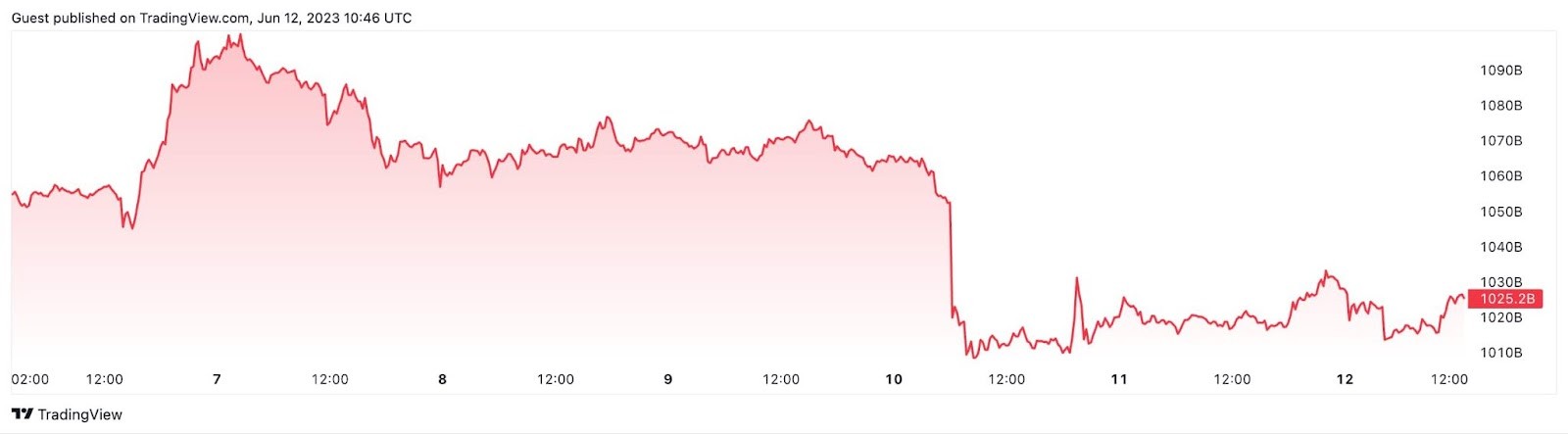

Crypto market cap on the brink of catastrophic crash below $1 trillion

The total market capitalization of cryptocurrencies has experienced a notable decline in recent days as investors jumped ship amid the increasing regulatory scrutiny faced by the digital asset industry, particularly from the United States Securities and Exchange Commission (SEC).

On Monday, June 12, Michaël van de Poppe, a widely-followed crypto expert, weighed in on this matter, pointing out a critical threshold the global crypto market cap must recover to avoid further slumps.

“Mayday, mayday. Total market capitalization is beneath the 200-Week MA and EMA. Needs to get back above $1.04T during this week to avoid further downwards momentum for Crypto.”

– van the Poppe wrote in a tweet.

Market analysts regularly monitor the 200-week moving average (MA) and exponential moving average (EMA) levels due to their significance in assessing long-term trends and market sentiment.

The 200-week MA is a long-term indicator that smoothes out price fluctuations over a span of approximately four years, providing a clear view of the overall trend. Crossing above or below the 200-week MA can signal a major shift in market direction, influencing investor sentiment and triggering significant buying or selling activity.

Global crypto market cap analysis

At press time, the global crypto market cap slightly stood at $1.02 trillion, seeing a slight recovery of 0.24% in the past 24 hours. Over the past week, the markets lost 7.32%, or $52 billion.

As can be noticed from the chart, the sharpest decline occurred on June 10, a day after stock brokerage Robinhood announced it would delist Solana (SOL), Cardano (ADA), and Polygon (MATIC) from its online trading platform, due to “a cloud of uncertainty around these assets” amid the SEC crackdown.

Those three altcoins witnessed particular selling pressure in the past 7 days, plummeting 27.8%, 23.6%, and 27%, respectively.

Meanwhile, last week, the securities regulators filed lawsuits against the world’s two biggest crypto exchanges, Binance and Coinbase, citing a breach of federal securities laws, commingling of investor funds, and listings of unregistered crypto asset securities, among other accusations.

Disclaimer: The content on this site should not be considered investment advice. Investing is speculative. When investing, your capital is at risk.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur