Crypto Markets Analysis: Bitcoin, Ether Hold Mid-Week Gains; Crypto Exchange Token OKB Outperforms

Despite a Thursday dip, bitcoin (BTC) added to its 2023 success story, rising 12.4% this week.

The largest cryptocurrency by market capitalization has now jumped in five of the last seven weeks.

Ether (ETH), the second-largest crypto in market value, has enjoyed a similar upbeat path, gaining 11.7% during the past seven days.

Liquidated short positions drove BTC prices skyward on Wednesday. Data from crypto information platform Coinglass showed approximately $65 million in BTC liquidations and $42 million in ETH liquidations on Tuesday. By contrast, only $16 million in BTC and $5 million in ETH liquidations occurred on Thursday.

The price increase coincided with higher-than-average volume, a bullish signal in its own regard. Equally high volume Thursday, however, pushed prices to the downside, although prices held most of the prior day’s gains, a sign of resiliency in both BTC and ETH.

Momentum in both has risen in line with performance, but has not yet reached technically overbought levels. BTC appears to be establishing support at $24K, while ETH appears to be settling in near $1,650.

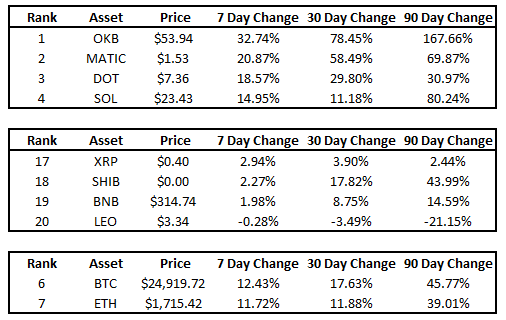

When looking at the top 20 coins by market capitalization, BTC and ETH finished near the middle of the pack, at sixth and seventh, respectively.

Crypto performance 2/17/23 (Messari)

OKB, the token for Malta-based crypto exchange OKEx, led gainers, rising nearly 33%, while LEO was the laggard, falling 0.28%.

OKB’s rise follows its launching of a new blockchain dubbed “OKBChain,” which is separate from OKXChain, its current EVM (Ethereum Virtual Machine)-compatible protocol.

According to OKX founder Star Xu, the new blockchain will focus on creating a decentralized ecosystem that allows users to access decentralized applications. OKB also released a proof-of-reserves report in January, announcing $7.5 billion in BTC, ETH and tether (USDT).

OKB is up 168% over the last 90 days and 99.2% year to date.

Crypto exchanges in general are likely to come under more scrutiny in 2023 amid SEC Chair Gary Gensler’s push for more aggressive oversight of the crypto industry. How this trend affects the market will be worth watching.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur