Crypto Markets Analysis: Bitcoin ‘Whale’ Deposits on Exchanges Surpass Withdrawals

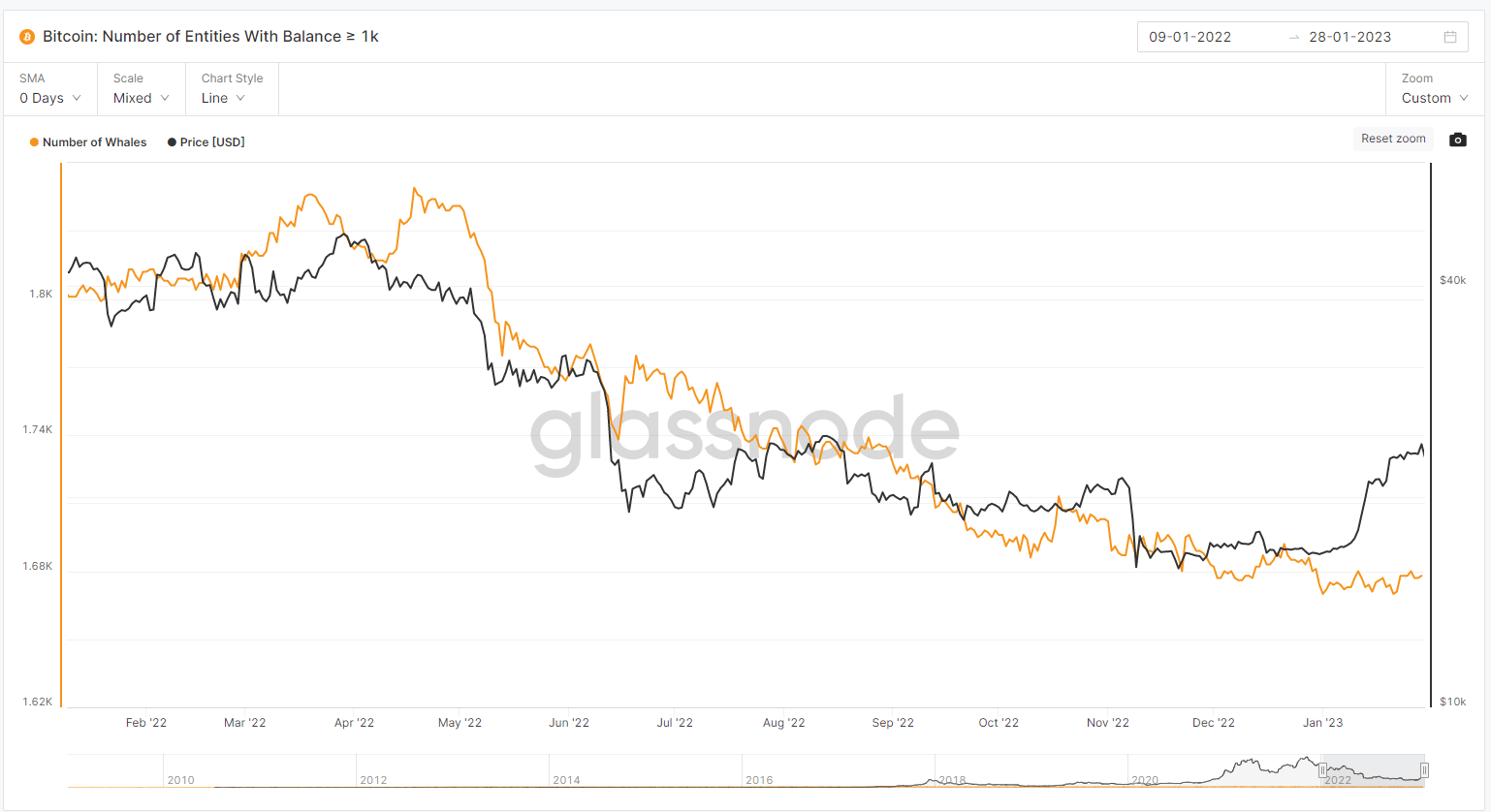

«Whale» investors have recently been depositing bitcoin to exchanges faster than they’ve been withdrawing the asset, a possible sign of near-term profit taking that could send prices lower.

But this resulting price movement is unlikely to upset markets significantly.

Whales are investors holding at least 1,000 bitcoin. Because whales control large amounts of BTC, their purchases and sales can have an outsized impact on markets. Tracking their activity can offer insights into potential price direction.

Per on-chain intelligence firm Glassnode, the net volume of BTC from wallets to exchanges has been increasing since Jan. 22. The movement of coins onto exchanges is often a bearish signal reflecting investors intent to sell assets.

To be sure, the number of whale deposits to exchanges has declined in recent weeks, which in isolation is bullish. But the volume of deposits to exchanges exceeds the number of withdrawals on a relative basis, which is not. The withdrawal of assets from exchanges is generally a bullish signal.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur