Crypto Markets Analysis: Bitcoin’s Relative Strength Readings Are in Rare Territory

Crypto markets still appear to be operating within a “good economic news equals bad news for asset prices” landscape.

A 15,000 weekly decrease in the number of Americans filing for unemployment insurance points to a stubbornly tight labor market Fed officials want to see loosen. But signs of economic slowdown appeared in housing data, with building permits for December down 1.6% versus expectations for a 3.7% increase. Housing starts fell 1.4% to their lowest level in five months.

Cryptos responded in kind, testing lows but then recovering as investors chewed over the conflicting data. Bitcoin declined temporarily to $20,780 before finding its footing. The largest cryptocurrency by market capitalization was recently trading a little below $21,000. Ether’s price also dropped, to $1,513, before rising to near $1,550.

Unusual RSI readings

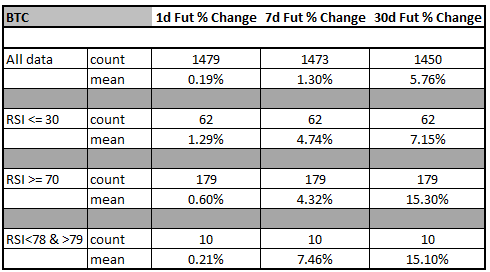

BTC’s recent 25% price surge came with a sharp uptick in momentum. A look at past data shows just how unusual the recent Relative Strength Index (RSI) readings are. RSI is a widely watched momentum indicator that looks to identify areas where an asset’s price is potentially overbought or oversold.

Within the last two weeks, BTC has registered three of the 10 highest RSI readings dating to 2019. Its reading of 89.3 on Jan. 14 ranked third, with its readings on Jan. 16 and 17 ranking eighth and ninth, respectively.

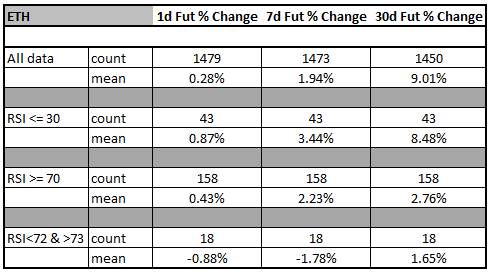

ETH RSI Data (CoinDesk)

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur