Crypto Markets Analysis: Crypto Trades Lower as Regulatory Concerns Trump Encouraging Macro Signs

“Bad” job market news that financial markets have been craving arrived, but crypto markets had other concerns.

Initial jobless claims in the U.S. rose 7% week over week to 196,000, exceeding expectations of 189,000. The higher figure represents the first increase in jobless claims in six weeks.

Counterintuitively, investors consider higher unemployment a positive thing for risker assets – crypto and otherwise.

They see a cooler employment market as an antidote for hotter inflation. Jobs data so far this year has been surprisingly positive, suggesting the U.S. economy was still expanding and that stubbornly high prices would endure.

Traditional equity markets traded higher immediately following the latest job numbers, before moderating to close lower. The tech-heavy Nasdaq was off more than a percentage point and the S&P 500 fared nearly the same.

Crypto markets saw no such bounce, however. One explanation could be that regulatory concerns are taking precedence over macroeconomic ones. On Thursday, crypto exchange Kraken agreed to “immediately” end its crypto staking-as-a-service platform for U.S. customers and to pay $30 million to settle Securities and Exchange Commission (SEC) charges it offered unregistered securities.

The news followed a day after Coinbase CEO Brian Armstrong tweeted that he’d heard rumors the SEC would like to ban retail investors from engaging in cryptocurrency staking, the income-generating technique at the core of running blockchains including Ethereum.

«I hope that’s not the case as I believe it would be a terrible path for the U.S. if that was allowed to happen,» he tweeted Wednesday.

The banning of staking would remove a source of cash for certain crypto holders, removing a valued benefit in the crypto space. The threat of this occurring bit hard into digital asset prices.

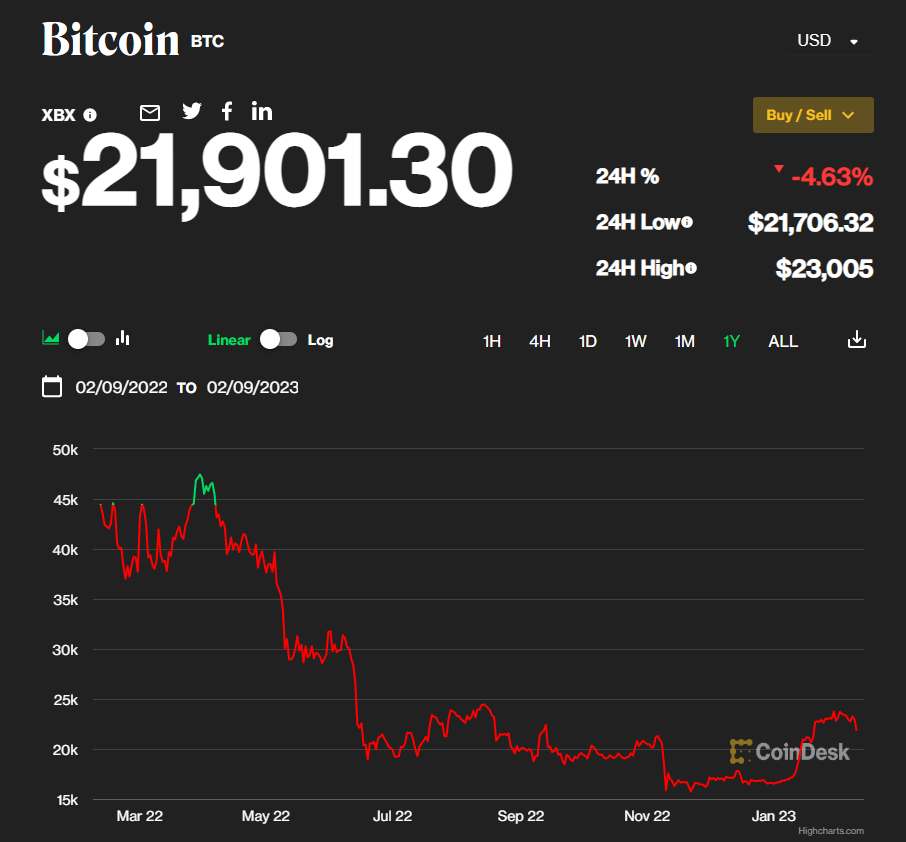

BTC’s chart has highlighted its decoupling from traditional assets so far this month, as its correlation with both the S&P 500 and Nasdaq fell from as high as 0.77 to a current level of .44 and .36. Equity markets embraced the encouraging jobs data but crypto prices seemed weighted down by concerns about potential, new staking regulation.

To be sure, a staking ban would apply to proof-of-stake blockchains, not a proof-of-work blockchain like Bitcoin. But the Armstrong tweet sent nearly all crypto assets plunging.

Now, it appears that crypto investors are taking more of a cautious stance than a panicked one. Trading volume remains below its 20-day moving average. The trends over the next few days will be interesting to watch.

(CoinDesk)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD