Crypto Markets Analysis: Falling Inflation Expectations Might Signal Bullish Turn for Bitcoin

It’s not a law of science but an investment thesis: Any increases in digital-asset prices may be driven in part by decreases in physical asset prices.

Bitcoin (BTC) and ether (ETH) started the week in positive territory, up 1.5% and 4% respectively on higher than average volume.

The price increases occurred on a day in which the Federal Reserve Bank of New York announced U.S. consumer inflation expectations of 5% for December, versus expectations of 5.2%. The 5% reading marks the second consecutive month of declines, and the lowest reading since July of 2021. Bitcoin and ether prices continue to be impacted by Federal Reserve actions to slow inflation.

The reduction of inflation expectations is a welcome sign for crypto investors placing long bets on either asset.

The expected 5% increase in prices is fairly in line with top Fed officials’ expectations for 2023 interest rate levels.

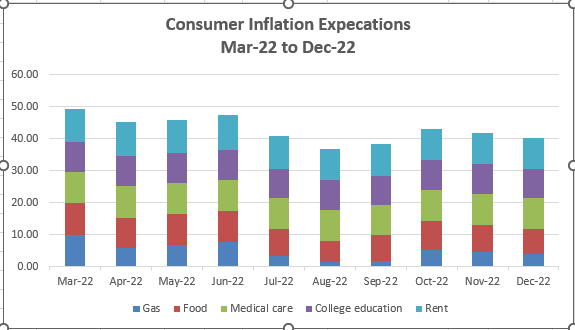

The largest decrease in expectations is attributable to gas, falling 5.9% over the prescribed time period. Food price expectations came in second, declining 2.2%

Ultimately, expectations for lower prices can lead to consumers delaying the purchase of goods, which can lead to lower prices, which could lead to increases in available capital to be invested in risk assets like bitcoin and ether.

Ether price trends

Ether has shown increased momentum over the most recent five days. Its Relative Strength Index (RSI) has risen near 70. The RSI is a momentum indicator that can be used to identify both trends, as well as potential overbought/oversold conditions.

It ranges between 0-100, with 30 implying that an asset may be oversold, and 70 indicating that an asset may be overbought. It has breached the upper range of its Bollinger Bands in four of the last six days. An asset reaches the upper range of Bollinger Bands, is often interpreted as a bullish signal.

Year to date, ether has outperformed bitcoin, rising 5.4% versus the asset.

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur