Crypto Markets Analysis: Fresh Look at Bitcoin Price Charts After Biggest Rally in 9 Months

This week’s sudden burst in crypto markets means it’s time to reassess key levels on bitcoin’s price charts.

Bitcoin (BTC) rose 12.5% over the most recent seven days, its best weekly performance since March, and ether (ETH) rose 12.15%, a welcome change from what had been persistently flat trading for most of the prior month.

Momentum grew in both assets all week; neither had a negative trading day. BTC in particular built to a crescendo on Thursday, as the largest cryptocurrency by market capitalization rose 5% following the release of the U.S. Consumer Price Index for December,showing inflation slowed during the month.

On a relative basis, bitcoin’s seven-day performance was eighth among the top 20 cryptocurrencies by market capitalization. ETH was not far behind, finishing 12th in the group for the second consecutive week.

Solana (SOL) completed a second consecutive week of strong performance, registering a 26% increase, on the heels of a 35% advance in the prior week. Avalanche (AVAX) led the way among the group, increasing 34%.

The laggards on the week were TONCOIN and LEO, falling -0.71% and 1.29% respectively.

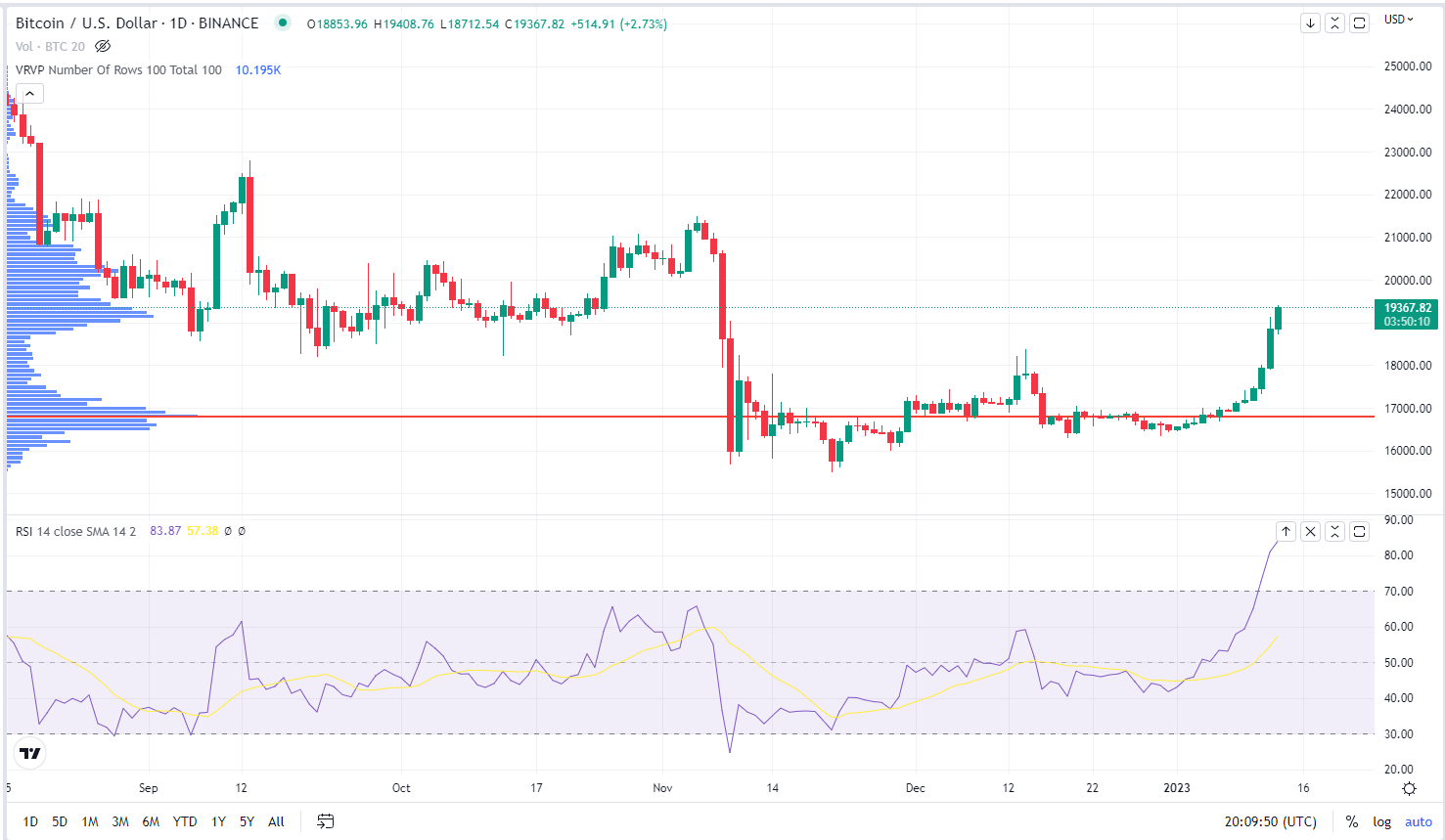

Point one can be seen using the Visible Range Volume Profile tool, which shows BTC moving from one high-volume node area near $16,700 to another high-volume node area near $19,200.

The significance is that areas of high volume imply areas of high price agreement. These areas often serve as levels of support and/or resistance, and helps explain why BTC prices were mired between $16,000 and $17,000 for so long

Point two is illustrated via the BTC’s current Relative Strength Index (RSI) reading of 84. The RSI is a momentum indicator ranging from 0 to 100. Readings of 30 and below imply that an asset is overpriced. By contrast, readings of 70 and above imply that an asset may be overpriced.

BTC’s current reading is its highest reading since Jan. 2021. Since 2018, BTC’s RSI has been higher than 84 just 25 times.

This isn’t to say that an asset can’t stay overbought for extended periods. The 91 RSI level reached on Jan 8. 2021 was followed by a 15% increase in price 30 days later. It should be monitored.

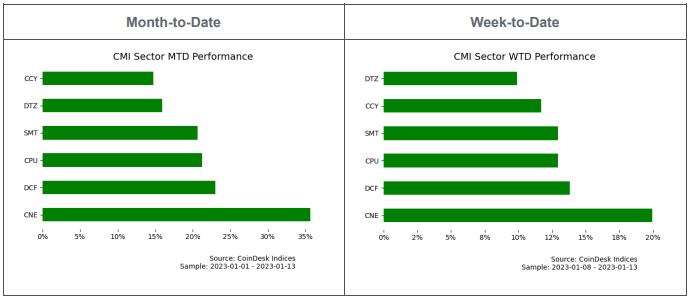

CoinDesk Market Index sector performance

CoinDesk’s CMI sector performance shows the CoinDesk Culture and Entertainment (CNE) sector continuing to lead the way on both a weekly and monthly basis.

The Coindesk Currency sector (CCY) trails the group on the month, while the CoinDesk Digitization sector (DTZ) has been the laggard for this week.

CoinDesk Market Index Performance

Learn more about Consensus 2023, CoinDesk’s longest-running and most influential event that brings together all sides of crypto, blockchain and Web3. Head to consensus.coindesk.com to register and buy your pass now.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur