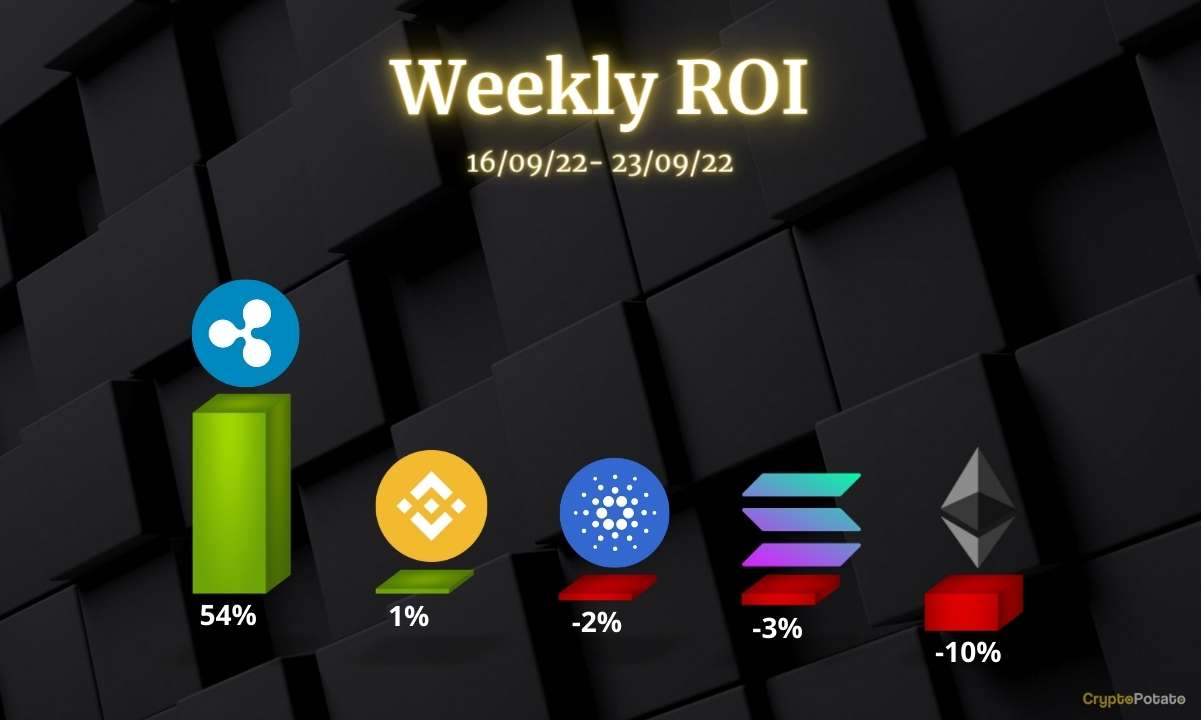

Crypto Price Analysis September-23: Ethereum, Ripple, Cardano, Solana, and Binance Coin

This week, we take a closer look at Ethereum, Ripple, Cardano, Solana, and Binance Coin.

Ethereum (ETH)

Despite the bullish fundamentals of Ethereum’s merge, the price of the second largest cryptocurrency has continued its downtrend and registered a 10% loss in the past seven days. At the time of this post, ETH managed to find some support at $1,250, but this level remains fragile.

The resistance is not far away at $1,400, and bears will likely come in strong if the price manages to rally to that level. Unfortunately for the bulls, the buy volume is just not there to push the price higher. With the weekend around the corner, the volume will likely drop further, and it’s likely that we will have to wait for Monday for any significant volatility.

Looking ahead, ETH seems more likely to remain in a downtrend. Only a clean break above $1,400 could reverse this negative bias. The indicators on the daily timeframe also give a bearish signal, and this is unlikely to change any time soon.

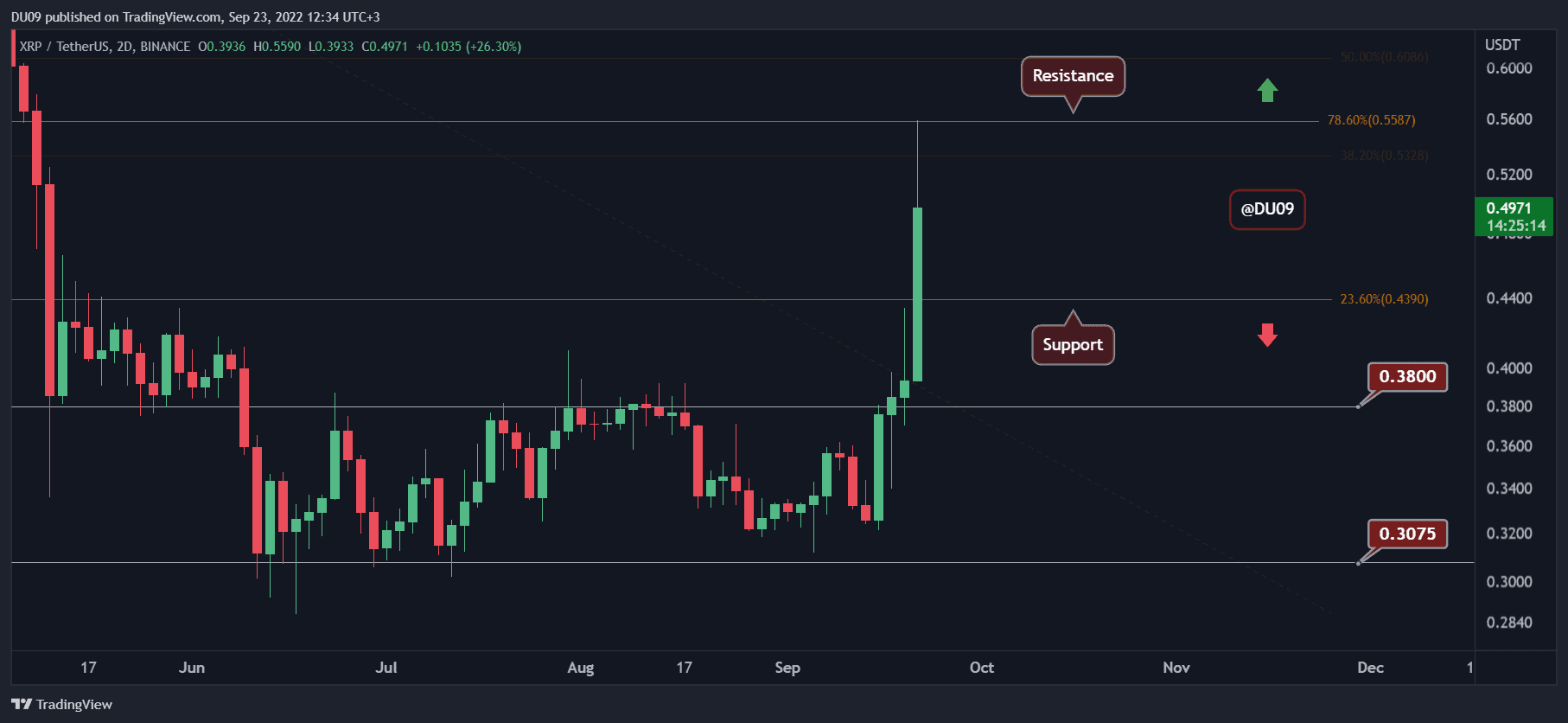

Ripple (XRP)

Ripple has been one of the strongest performers in a market that has otherwise seen only red in the past week. With an increase of 54% in the last seven days, XRP is back in the spotlight, fueling rumors of what could have caused this surge.

This most recent rally came to a halt when the price hit the resistance at $0.55. XRP is currently taking a break after such a significant move and is consolidating under this key resistance. The support is found at $0.44 and may not be tested if buyers remain interested.

This move from XRP has surprised the market, considering both BTC and ETH have made lower lows this past week. The biggest question is if buyers will manage to sustain this rally and protect these most recent gains. XRP is known for its sharp increases in price, only to be followed by a gradual correction back to previous price levels.

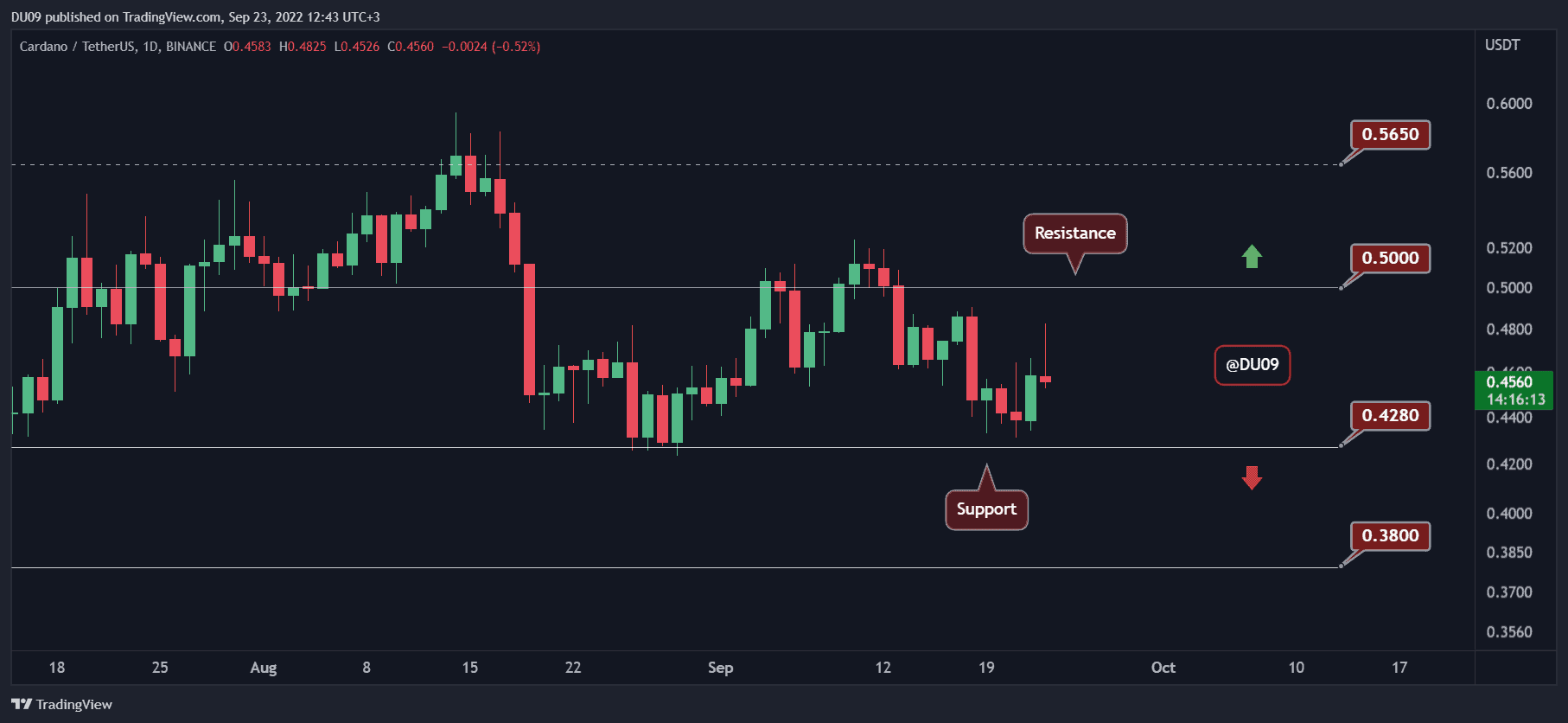

Cardano (ADA)

With the Vasil upgrade going live, Cardano had a good attempt at rallying, but the volume was simply not there to make it count. For this reason, ADA’s price registered a 2% loss in the past seven days. The support is at $0.43, and this key level has managed to stop the downtrend in the past.

To turn ADA’s price around and move into an uptrend, buyers will have to break the $0.50 level. Otherwise, the cryptocurrency will continue to move sideways between these key levels as before. The indicators are also rather flat, indicating a consolidation period.

Looking ahead, ADA appears to be taking its time before making any significant move. The bias is neutral. The best thing that can happen to Cardano at this time is a break of the key resistance at $0.50.

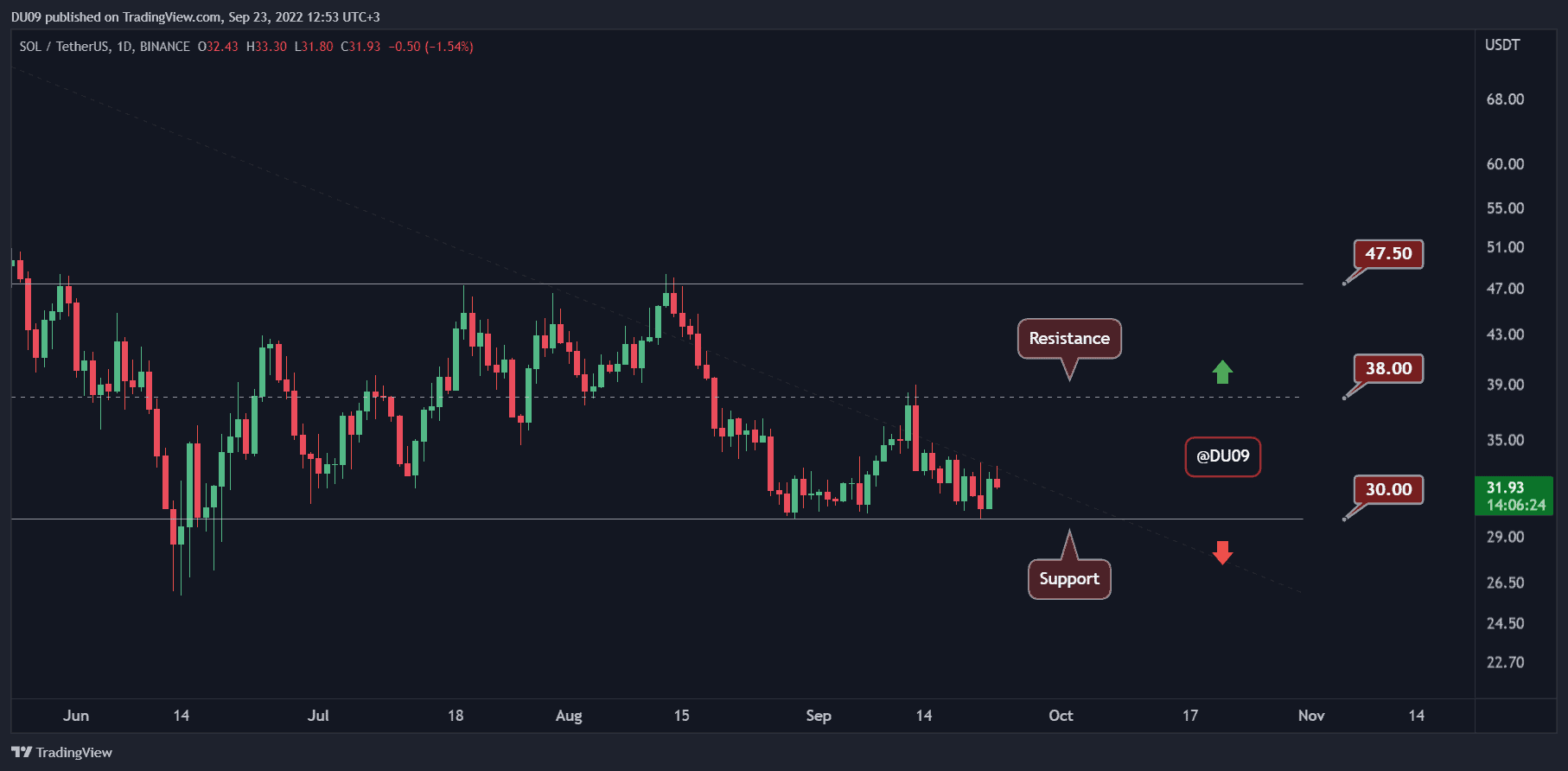

Solana (SOL)

The most recent rejection at the $38 resistance has pushed Solana’s price into a downtrend which lost 3% of its valuation in the past seven days. Now, SOL is found at critical support with the price hovering just above $30.

Buyers will have to do all that they can to protect the keysupport, because otherwise, Solana will enter a very dangerous area that could lead the price towards a significant drop. In August and September, buyers were successful to defend the $30 support, but the current market does not favor them.

The indicators do not give any clear hits on where Solana could go next and are rather neutral. This shows market participants are hesitating. Usually, this type of price action precedes a major move one way or the other. Therefore, best to be prepared for that.

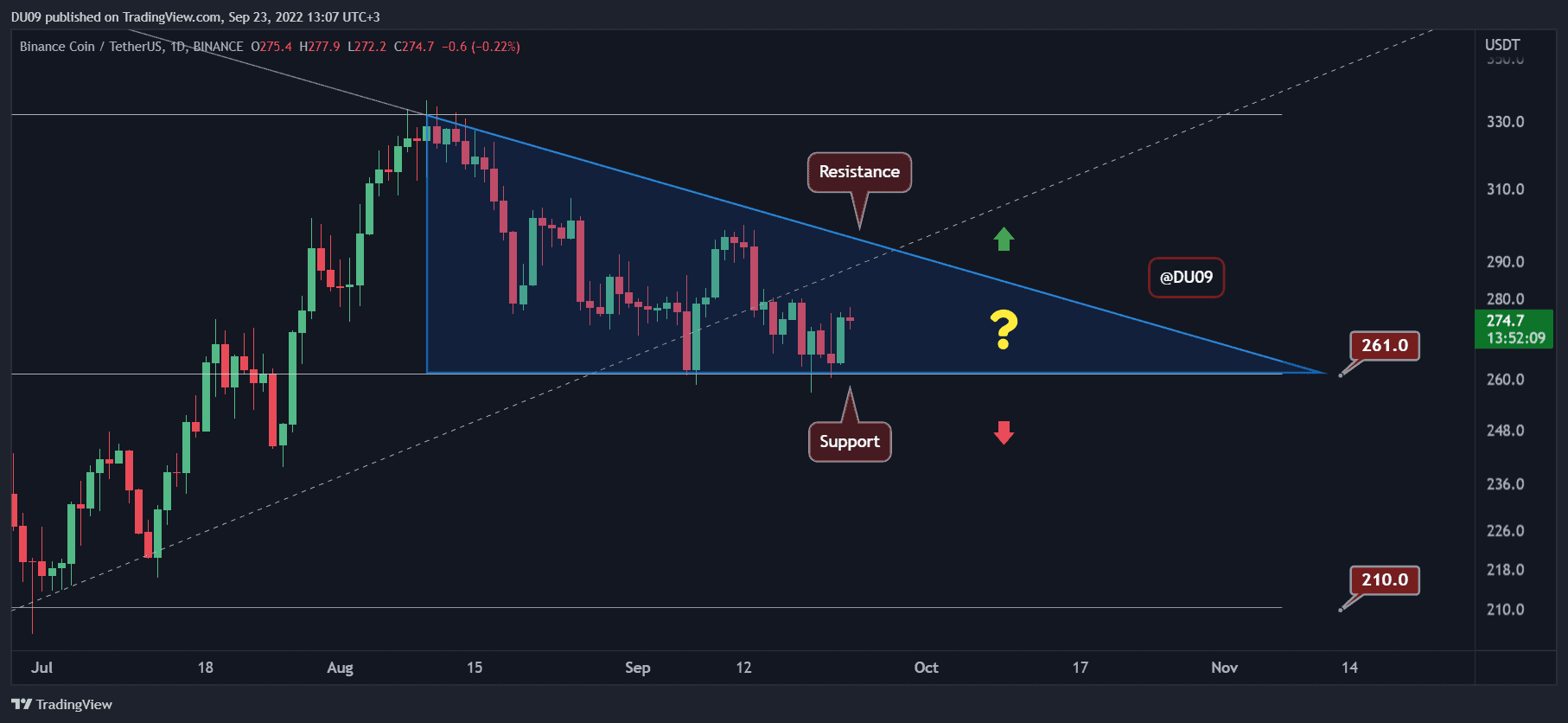

Binance Coin (BNB)

Binance Coin has lost the uptrend established in March 2020. This may spell trouble in the future as its price could enter a significant correction. For now, the cryptocurrency is consolidating in a descending triangle, represented in blue on the chart. For this reason, BNB only increased by 1% compared to seven days acritical

The key support is found at $261, and the resistance at $300. This descending triangle will likely be resolved by mid,-October at which point we will know where Binance Coin is headed next. Should the price fall below the triangle, then bears will likely dominate the price action and aim for $200.

Despite this bearish outlook, the fundamentals for BNB remain strong, and any significant decrease in price could be followed by a speedy recovery. This is contingent on the overall crypto market recovering since that will bring back demand for BNB on the largest crypto, exchange which is behind this coin.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur