DOT Technical Analysis: Downtrend Halts At 50-day EMA

The DOT price action shows a bearish breakout rally resting at the 50-day EMA, ready to gain momentum and test the $6.55 mark.

Key Technical Points:

- The Polkadot price has dropped by 13% in the last week.

- The price actions show a bearish breakout of a rising wedge pattern.

- With a market cap of $9.377 billion, the intraday trading volume of Polkadot has increased by 16% to reach $459 million.

Past Performance of DOT

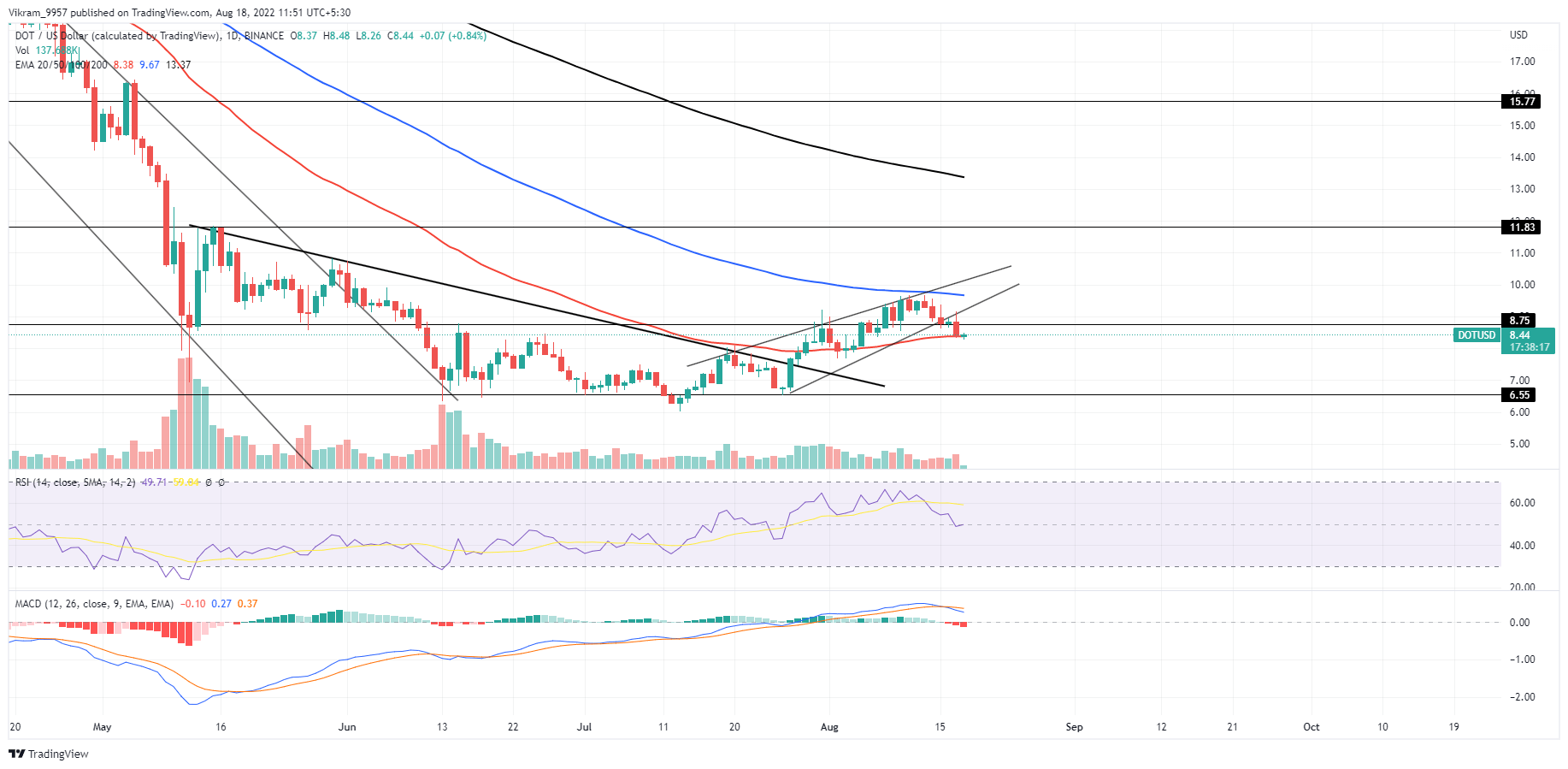

As we mentioned in our previous analysis, the DOT prices retest the $8.75 mark, but the downtrend continues instead of a bullish reversal. Currently, resting at the 50-day EMA, the prices sustain above $8, avoiding a drop to the $6.55 support level. Moreover, the higher price rejection in the daily candles retests the broken resistance trendline.

Source — Tradingview

DOT Technical Analysis

The DOT price action reflects an increase in the underlying bearishness as the selling pressure increases, evident by the spike in trading volume. Hence the possibility of a 50-day EMA breakout increases to test the bottom support at $6.55. After the recent sideways shift into EMAs, the downfall restarts the bearish influence over the EMA. The daily RSI slope drops below the 14-day average line and tests the halfway line support reflecting an increase in underlying bearishness. Moreover, the MACD indicator forecasts a downtrend continuation, with the recent bearish crossover of the fast and slow lines. Hence the technical indicators support the bearish price action analysis. In a nutshell, the DOT Technical Analysis displays a high possibility of a price drop below the 50-day EMA.

Upcoming Trend

DOT prices will decrease below the 50-day EMA to reach the $6.55 mark. On the contrary, a reversal from the 50-day EMA will test the 100-day EMA near the $9 mark. Resistance Levels: $9 and $10 Support Levels: $8 and $6.55

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Holo

Holo  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Status

Status  Enjin Coin

Enjin Coin  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur