Enjin (ENJ) Price Prediction: ENJ token price tumble towards the demand zone

- ENJ token price triggered corrections from the overbought levels and formed a bearish candle

- ENJ crypto prices need minor correction or consolidation for the further upwards movement

Enjin Coin price is trading with mild bearish cues and bears are trying to drag the prices down towards the support zones but prices are likely to bounce back and continue the upward movement. According to Coinglass, In the last 12 hours, ENJ Long and Short ratio stands at 0.94 confirms the bearish sentiment in the derivative segment. Currently, The pair of ENJ/USDT is trading at $0.3377 with the intraday loss of 3.71 % and 24 hour volume to market cap ratio stood at 0.1228

Will ENJ be able to hold a 50 day EMA ?

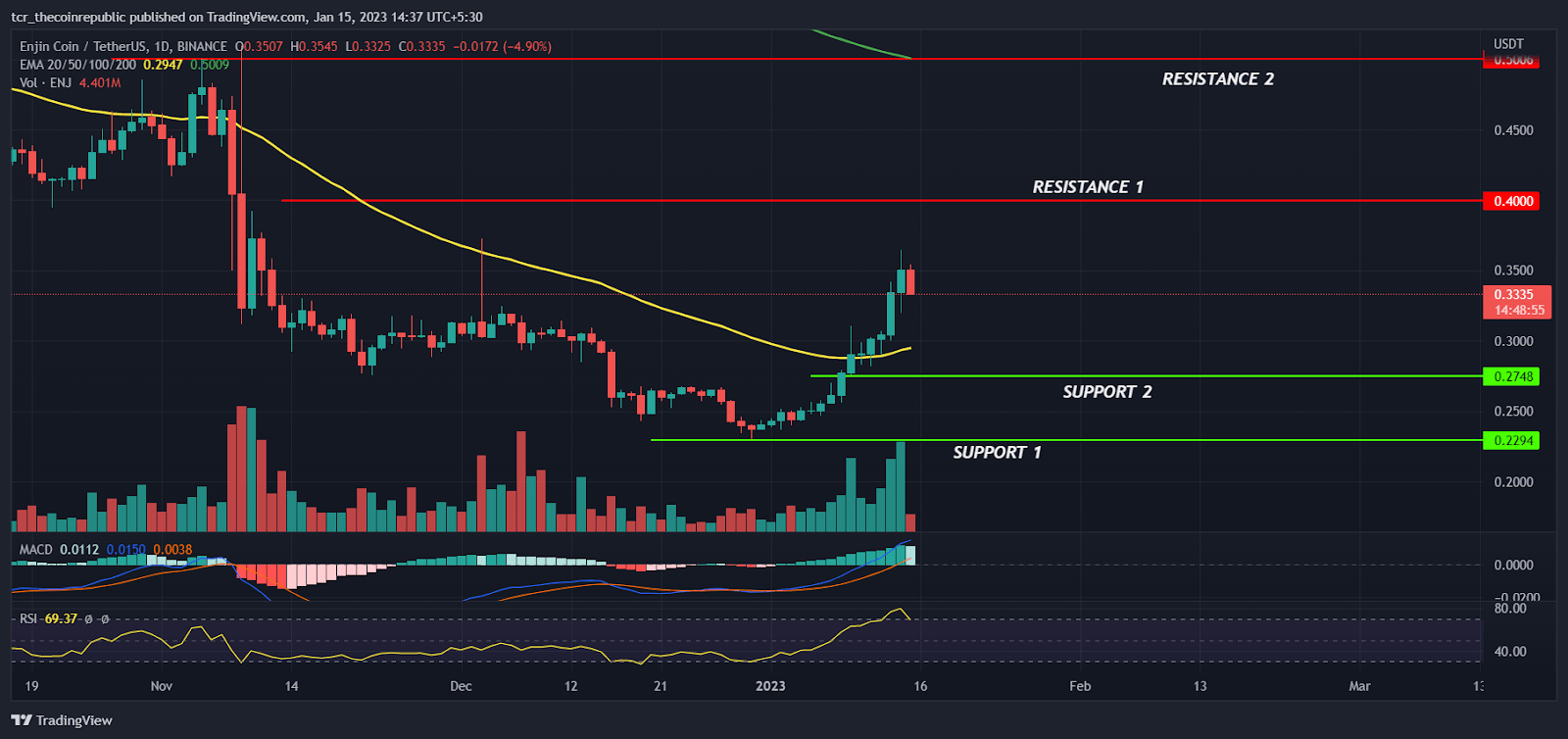

Source: ENJ/USDT daily chart by Tradingview

On a daily time frame, ENJ prices take a U-turn and reverse upwards with a positive momentum while forming higher high candles but prices seem to be overbought and needs minor corrections for further upward movement. From the past couple of months, prices have been stuck in the narrow range between $0.2500 to $0.3255 with bearish bias but surprisingly some aggressive buyers came forward and breakout the higher range with a giant bullish candle indicating the confidence of buyers at lower levels.

The ENJ prices are in a recovery mode and shot up by 53% approx from the recent lows at $0.2300 shows that some genuine buyers might be building long positions and expecting the positive movement to continue in coming days. However, $0.4000 will act as an immediate hurdle for bulls followed by the next hurdle at $0.5000 level.

The ENJ bulls have succeeded to hold the prices above 50 day EMA is the indication of short term trend reversal but if any minor correction triggers, $0.2748 and $0.2294 will be acting as demand zone for buyers.The MACD had generated positive crossover but it lacked momentum on the higher side indicates bears are active at supply zones and the RSI reversing down from the overbought levels denotes mild bearishness.

Summary

ENJ crypto prices had shown surprising recovery to its investors and buyers succeeded to reverse the short term trend in the favor of bulls. The technical analysis suggests prices are near to overbought levels and minor correction may trigger in coming days. According to price action, till the prices are sustaining above 50 day EMA, buyers may take the retracement as a buying opportunity and aim for the target of $0.4000 and above levels by keeping $0.2500 as SL. On the other hand, if prices drop below $0.2294, then bears could take control to push it down towards $0.1500 or below levels.

Technical levels

Resistance levels : $0.4000 and $0.5000

Support levels : $0.2748 and $0.2294

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur