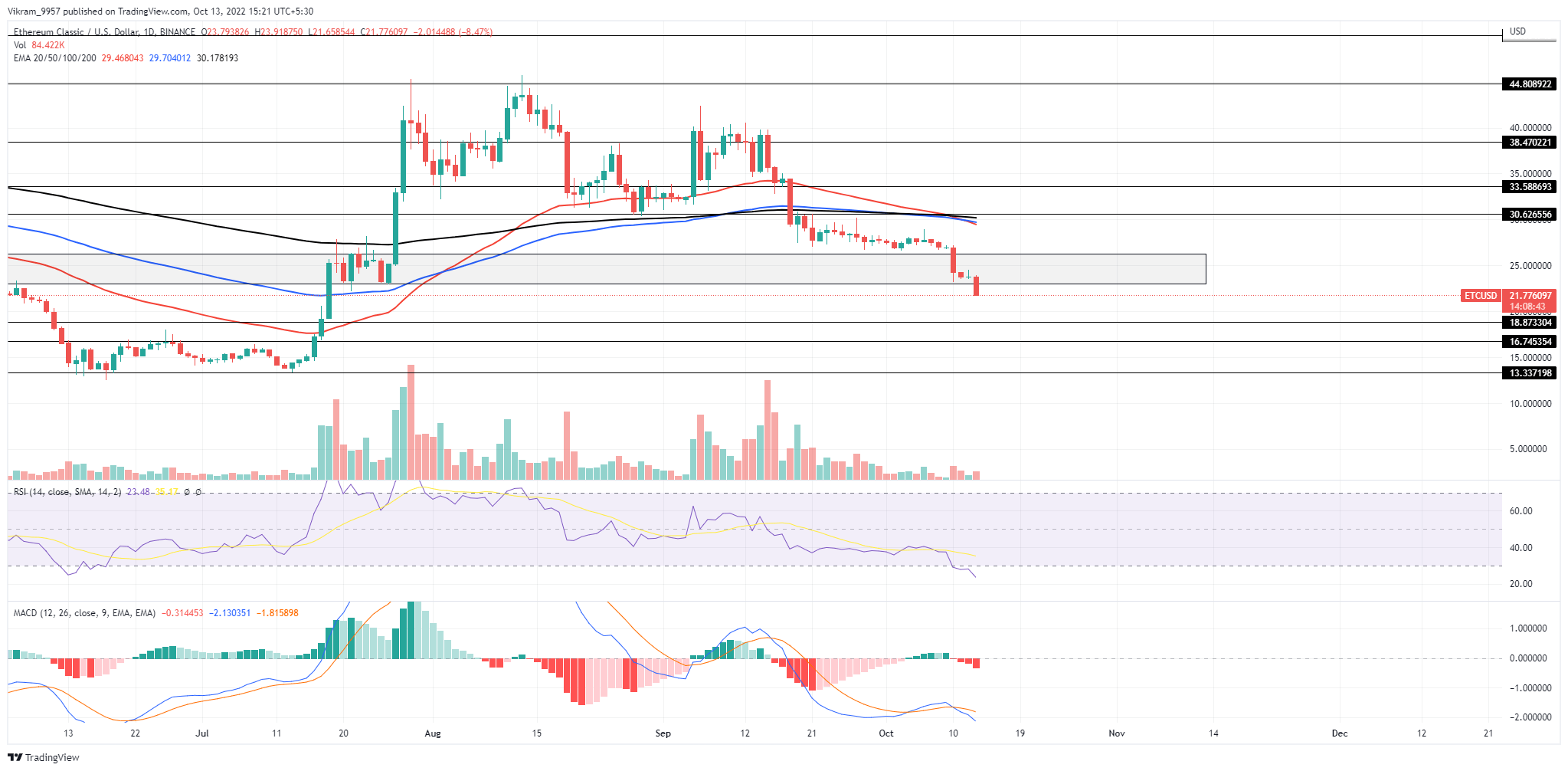

ETC Technical Analysis: Extreme Selling May Trigger $20 Downfall

The ETC technical analysis offers a selling opportunity as the downtrend continues at breakneck speed to reach the psychological mark of $20. The ETC price action has recently rebounded from $44 and is heading to $20. The altcoin currently trades at $21 with an intraday fall of 10%. With sustained selling, the prices will drop under $20 to hit the $18 support level.

Key Points:

- The increased selling pressure plunges the Ethereum Classic market value under the $22 support zone.

- The death cross in the daily chart signals an extension in the correction phase.

- The intraday trading volume in Ethereum Classic is $425 Million.

Source-Tradingview

ETC Technical Analysis

The ETC price action has faced constant bursts of selling sprees after reversing from the overhead resistance of $44. Moreover, the ongoing bearish sentiment in the market fueled this downfall and plunged the market value by 46% last month. Additionally, the falling trend breaks below the $22 support zone and approaches the crucial $20 mark. As for now, the daily candle shows an intraday fall of 10.49% and trades at the $21 spot.

Source- TradingView On deeper analysis, the ETC price action shows the breakout of a falling channel with the daily candle. Additionally, this will prolong the correction phase if the candle closes below $22. Therefore, the sideline traders can find a bearish entry if the candle closes with a minimum lower price rejection. In such a case, the downtrend will breach the $20 mark to take support at the $18 horizontal level. Conversely, a bullish reversal above $22 will offset the bearish thesis if the market sentiment improves. This development could push prices higher within the bearish channel to hit the $30 mark.

Technical Indicator

The RSI indicator shows a sharp drop into the oversold zone with a declining trend in the 14-day SMA. However, the oversold nature teases a retest phase before falling under $20. Moreover, the bearish crossovers between the fast and slow lines indicate increased selling by market participants, which prolongs the correction. Therefore, the ETC technical analysis suggests traders can take bearish positions as the selling spree continues. Resistance levels- $22 and $25 Support levels- $20, $18

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Augur

Augur  Energi

Energi