First Mover Americas: Binance Dumps FTT Tokens

This article originally appeared in First Mover, CoinDesk’s daily newsletter putting the latest moves in crypto markets in context. Subscribe to get it in your inbox every day.

Latest Prices

CoinDesk Market Index (CMI)

1,037.62

−24.9 ▼ 2.3%

Bitcoin (BTC)

$20,758

−499.8 ▼ 2.4%

Ethereum (ETH)

$1,583

−39.2 ▼ 2.4%

S&P 500 futures

3,800.00

+20.5 ▲ 0.5%

FTSE 100

7,329.35

−5.4 ▼ 0.1%

Treasury Yield 10 Years

4.16%

▲ 0.0

BTC/ETH prices per CoinDesk Indices, as of 7 a.m. ET (11 a.m. UTC)

Top Stories

Binance CEO Changpeng «CZ» Zhao said the exchange plans to sell all of its FTT tokens after a CoinDesk report revealed the potentially parlous state of trading firm and FTX sister company Alameda Research. Zhao tweeted that Binance will sell all of the remaining FTT (FTX’s native token) that it received last year as part of its exit from FTX equity. Although Alameda CEO Caroline Ellison offered to buy back Binance’s entire FTT allocation, the token declined from over $25 to under $22 and is down 1.6% on the day.

Canadian bitcoin miner Hive Blockchain appears to be in better shape than many of its mining peers. The firm has 3,311 BTC worth $68.8 million, and, unlike several rivals, it has no debt-servicing payments related to digital assets or its mining equipment. The crypto market slump in recent months has hit mining firms hard, with share prices tanking and companies seeking means to manage liquidity and debt.

Stablecoin issuer Paxos is eyeing a major hiring push in Singapore, where it last week received a license to offer crypto products and services. The firm plans to add more than 130 employees to its current staff of 20 over the next three years, making the city-state its hub for growth outside its U.S. home. Paxos is one of the few crypto companies that are bucking the trend of the wider story in the digital-assets industry, which has been dominated by layoffs as a result of the market downturn.

Chart of the Day: Futures Volume Down

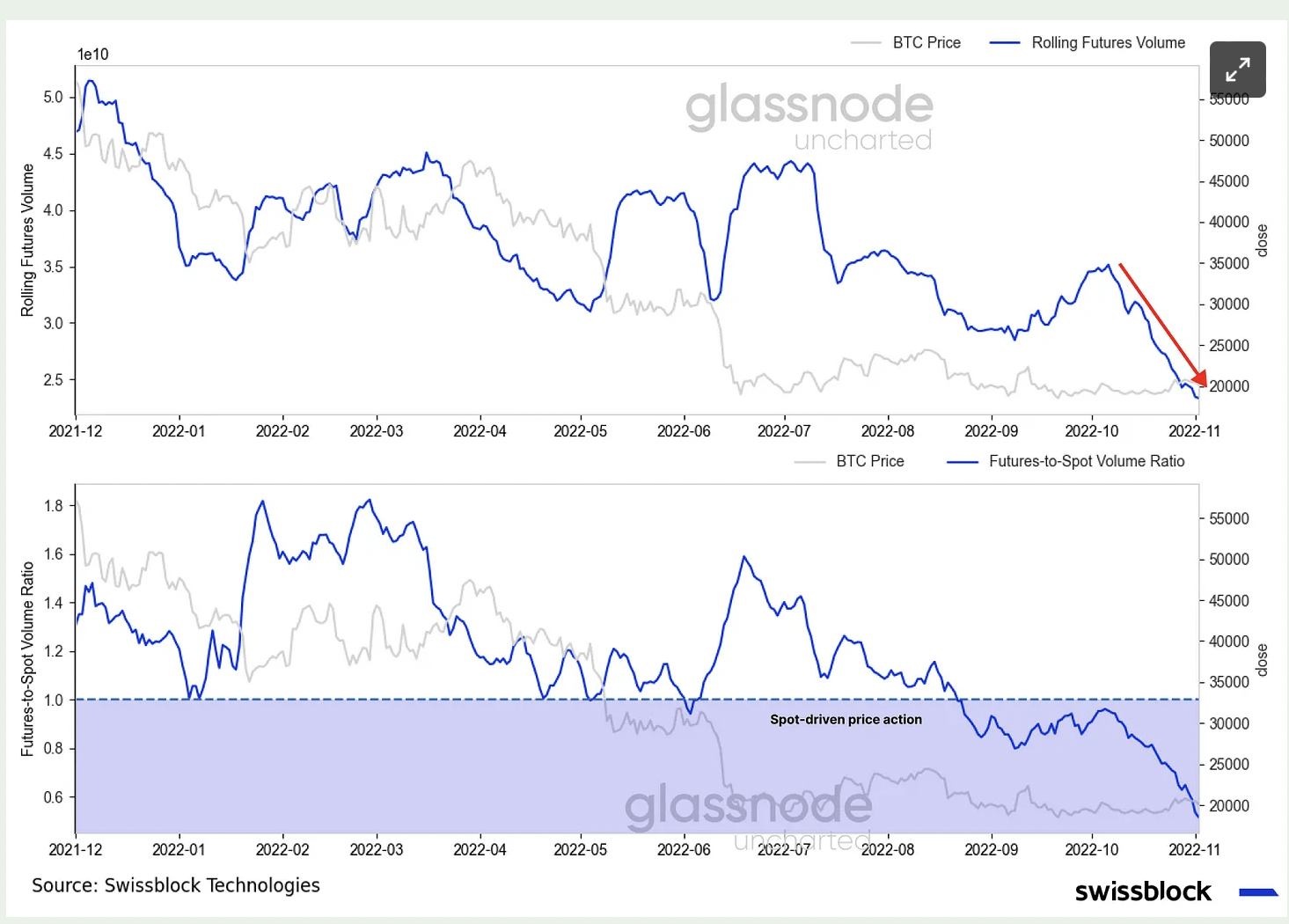

- The chart shows the bitcoin futures market volume and the cryptocurrency’s spot price since December 2021. Futures trading volume has dropped sharply in recent weeks, indicating a spot-driven market.

- «The reduced traded volume in the futures market reinforced the thesis of a lack of speculation to the up and downside as the spot market continued to drive the price action,» Glassnode’s co-founders Yann Allemann and Jan Happel wrote in the latest edition of their Uncharted newsletter.

- «Increased spot volume suggests an agreement that bitcoin is where it needs to be,» the newsletter added.

– Omkar Godbole

Trending Posts

- Bernstein Says Polygon Blockchain Is the Web3 King

- USDC Issuer Circle to Add Solana Support for Euro Coin in 2023

- Bitcoin (Magic Internet Money!) Again Proves Less Volatile Than Stocks

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur