First Mover Asia: Bitcoin, Ether Continue Their Rapid Descent in Volatility

ood morning. Here’s what’s happening:

Prices: Bitcoin holds steady at $16,800 amid ongoing concerns about the economy and central bank hawkishness.

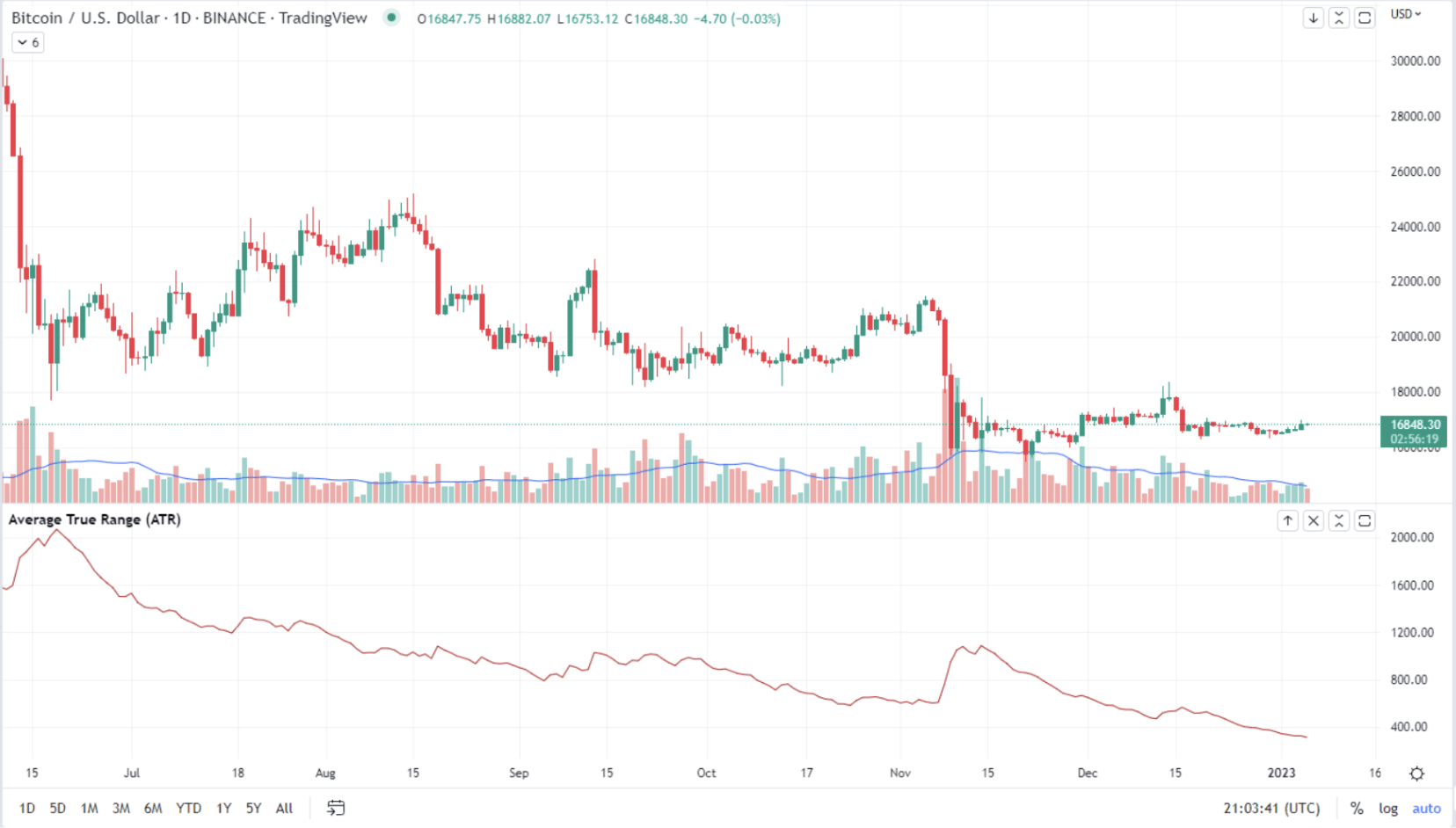

Insights: Bitcoin and Ethereum’s Average True Range has declined by more than 80% since 2022.

Prices

CoinDesk Market Index (CMI)

806.34

−0.2 ▼ 0.0%

Bitcoin (BTC)

$16,845

+4.2 ▲ 0.0%

Ethereum (ETH)

$1,254

−1.3 ▼ 0.1%

S&P 500 daily close

3,808.10

−44.9 ▼ 1.2%

Gold

$1,837

+2.5 ▲ 0.1%

Treasury Yield 10 Years

3.72%

▲ 0.0

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Bitcoin Continues Its 2022 Nostalgia Tour

By James Rubin

Bitcoin and ether continued their 2022 nostalgia tours, with the two largest cryptos by market capitalization holding almost precisely where they stood for the last two weeks of December.

BTC was recently trading at about $16,850, flat over the last 24 hours as investors mulled early 2023 economic indicators that seemed at odds and ongoing U.S. central bank resolve to raise interest rates for at least the first part of 2023. Ether followed a similar pattern to trade at just above $1,200, its perch on Wednesday, same time. Other major cryptos also spent much of Wednesday hovering within their most recent ranges.

ADA, the token of the Cardano blockchain, was recently up 1.8%. The CoinDesk Market Index (CDI), an index measuring cryptos’ performance, recently inched down 0.19%.

In an interview with CoinDesk TV’s First Mover program, Katie Stockton, managing partner of research group Fairlead Strategies, noted the «downtrend» in bitcoin and altcoins. «Since May or so we’ve seen them stair step lower,» Stockton said. «Right now, we’ve seen a bit of a plateau. They seem to end with a few days of downside volatility. And then we get into another consolidation phase, the likes of which we’ve seen over the past seven to eight weeks.»

She added: «Now, within that context, with the consolidation phase underway within the downtrend, we’ve obviously not seen any kind of breakouts above resistance.»

On the third trading day of the new year, equity markets slumped with the tech-focused Nasdaq falling 1.5% and the S&P 500 and Dow Jones Industrial Average (DJIA) dropping 1.2% and 1%, respectively – reaction to a surprisingly strong report by human resources software and services provider ADP showing employers adding $235,000 jobs in December. The monthly measure of employment markets rekindled fears that the economy was not slowing as much as U.S. central bankers had hoped and undercut hopes stirred by a U.S. Labor Department report showing a slight downturn in overall, available jobs.

Job cuts highlighted crypto news on Thursday. Crypto bank Silvergate Capital (SI) cut 40% of its staff, or about 200 employees, the company said in a filing with the U.S. Securities and Exchange Commission, and beleaguered Genesis Global trading, a subsidiary of crypto conglomerate Digital Currency Group (CoinDesk’s parent company) eliminated about 30% of its workers, taking it down to 145 employees, according to a person familiar with the matter.

Fairlead’s Stockton said warily that her group’s research strongly suggested that the current consolidation in crypto markets would «resolve to the downside.»

«We’re not advocating counter trend positions, given the risks inherent to bear market cycle(s),» Stockton said, adding: «We’re out there kind of with you looking for signs of a long-term bottom as sort of a major low, and we actually do think that this year will capture a major low, but we just don’t have it indications of it quite yet.»

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | +2.4% | Entertainment |

| Cardano | ADA | +2.1% | Smart Contract Platform |

| Solana | SOL | +0.6% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Avalanche | AVAX | −2.8% | Smart Contract Platform |

| XRP | XRP | −2.4% | Currency |

| Chainlink | LINK | −2.3% | Computing |

Insights

Bitcoin and Ethereum’s Decreased Volatility

By Glenn Williams Jr.

Bitcoin continued its sharp decline in volatility.

Bitcoin’s Average True Range (ATR), a proxy for measuring volatility in asset prices, has fallen to its lowest point since July 2020.

An asset’s “true range” incorporates its open, high, low, and “closing” price, with the range of the asset representing the absolute value of the largest move between components. A moving average is then calculated over a prescribed time (often 14 days) to determine the ATR.

Bitcoin’s ATR has declined by 88% from its 2022 peak of 2,569, and more than 95% from its all-time peak.

Ether volatility has responded similarly, with its 2022 ATR falling by 84%.

Bitcoin/U.S Dollar Daily Chart (TradingView)

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur