First Mover Asia: Bitcoin Falls on Inflation Fears but Continues Its Ride Above $17K

Good morning. Here’s what’s happening:

Prices: Bitcoin and other crypto prices fall along with other riskier assets amid concerns the U.S. economy isn’t slowing enough.

Insights: Is Taiwan’s technology manufacturer HTC betting too much on the success of the Metaverse? The company is reportedly looking to take its virtual headset unit public in the U.S.

Prices

CoinDesk Market Index (CMI)

867.00

−10.4 ▼ 1.2%

Bitcoin (BTC)

$17,026

−188.9 ▼ 1.1%

Ethereum (ETH)

$1,265

−28.1 ▼ 2.2%

S&P 500 daily close

3,998.84

−72.9 ▼ 1.8%

Gold

$1,787

+19.2 ▲ 1.1%

Treasury Yield 10 Years

3.6%

▲ 0.1

BTC/ETH prices per CoinDesk Indices; gold is COMEX spot price. Prices as of about 4 p.m. ET

Bitcoin Has a Sinking Feeling

By James Rubin

Crypto markets didn’t like the sound of good economic news, sending prices downward on Monday.

Bitcoin was recently trading down 1.1% over the past 24 hours, although it clung above its $17,000 support of the last six days. The largest cryptocurrency by market capitalization has seemed recovered from a mid November swoon following the implosion of crypto exchange FTX, although it remains subject to more minor winds that have had it dipping and rising in smallish increments on larger macroeconomic events.

On Monday, the Institute of Supply Management’s unexpectedly strong November services index fueled fears anew that the U.S. economy would require the U.S. central bank to administer a longer-term dosage of harsh interest rate hikes than had been hoped in mid November when the Consumer Price Index fell. The ISM services report followed just three days after a hot jobs report raised concerns that the economy was not contracting enough and that inflation would remain problematic. In recent months, inflationary worries have often dictated the performance of asset markets.

«Bitcoin’s earlier gains evaporated after a hot ISM services report fueled bets that the Fed could tighten much more than markets are currently pricing,» wrote Edward Moya, senior market analyst at foreign exchange market maker Oanda.

Ether was recently changing hands above $1,260, down more than 2% from Sunday, same time. Other major cryptos spent much of the day in the red with CRO, the token of the Cryto.com exchange off more than 4% and DOT, the cryptocurrency of blockchain interoperability protocol Polkadot, sinking more than 3%. AXS, the token of gaming platform Axie Infinity, was up nearly 20% to trade at more than $8.40.

Crypto prices largely tracked equity markets, which sank amid interest rate concerns fueled by the ISM report. The tech heavy Nasdaq and S&P 500, which has a strong technology component, dropped 1.9% and 1.8%, respectively. A Wall Street Journal report that food and beverage giant PepsiCo’s would be laying off hundreds of workers in North America amid company worries about shrinking volume.

Meanwhile, the recent decline in U.S. consumer savings rates to their second lowest level in 60 years suggest that crypto markets are likely to remain calm for at least the near future, wrote CoinDesk analyst Glenn Williams on Monday. «As retail investors comprise a sizable portion of crypto investors, the continued erosion of buying power will likely weigh upon bitcoin and ether prices.,» Williams wrote. «We face a cocktail of higher interest rates, decreased buying power and increased levels of debt.»

And Katie Talati, head of research at crypto investment firm Arca, noted with cautious optimism on CoinDesk TV’s First Mover program that crypto prices have likely bottomed out. «I don’t make price predictions, but I think we probably saw the bottom in terms of market prices and sentiment in the last few weeks,» Talati said.

Biggest Gainers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Gala | GALA | +3.3% | Entertainment |

| Decentraland | MANA | +2.2% | Entertainment |

| Solana | SOL | +1.3% | Smart Contract Platform |

Biggest Losers

| Asset | Ticker | Returns | DACS Sector |

|---|---|---|---|

| Chainlink | LINK | −3.6% | Computing |

| Avalanche | AVAX | −3.5% | Smart Contract Platform |

| Polkadot | DOT | −3.3% | Smart Contract Platform |

Insights

By Sam Reynolds

Taipei-based technology manufacturer HTC is reportedly looking to take its virtual headset business public in the United States, Taiwanese media report, as part of a larger quest to play a pioneering role in the metaverse.

But in IPOing its VR business, the company might be making a mistake it made years ago with its electric scooter arm called Gogoro. There are plenty of parallels between the two: What began as a niche product suddenly became more mainstream – and the market didn’t appreciate this. Fundamental questions have also arisen about the future of the metaverse.

VR, an HTC bright spot

Virtual reality has been a bright spot for HTC, a company that has otherwise seen its balance sheet effectively dissolve during the last decade. At the start of the Obama administration, HTC was a mobile phone giant, helping pioneer the Android ecosystem, peaking at a market share of 10% in 2011 and overtaking Nokia in market value, which at the time benefited from financial backing and a partnership with Microsoft.

But it has been in free-fall since, hitting 2% of the smartphone market share in 2015, and now it is too small to have its shipments tracked by research houses like IDC and Statcounter.

Looking to turn the company around, HTC launched the Vive VR headset in 2016 to mixed reviews. It was still a medium in development, with the hardware and software technology languishing behind consumer expectations.

Facebook, which acquired Vive-rival Oculus in 2014 for $2 billion, was in a similar conundrum. CNBC said in 2017 that its bet on VR was one of “Zuckerberg’s rare mistakes.” This wasn’t going anywhere as “nobody wants to be social in VR” and there was no compelling game for it.

Meanwhile, HTC’s balance sheet was still a sinking ship, and in 2017, Google came to the rescue with a $1.1 billion investment in HTC’s mobile phone manufacturing division so that Google would have a manufacturing partner for its Pixel phones.

VR continued to languish for the next few years. Reviewers still saw it as a niche product, with obvious enterprise and commercial applications, but no “killer app” for gamers and retail users that would make a headset a must-have.

“The VR revolution is alive and well, it’s just not ready for you,” Gizmodo’s Sam Rutherford wrote in 2019. “It’s [going] to take a bit longer to become mainstream than people initially thought. Be patient, your VR dreams are still alive and well.”

Mobile headsets and metaverse

VR got its first boost in consumer interest with the release of the stand-alone Oculus Quest headset in 2019, as analysts pointed to the lower price point and its untethered nature as piquing the interests of consumers.

As stand-alone devices powered by the same chips that went into smartphones, they couldn’t push out realistic graphics like PC-tethered headsets, but they were cheap and fun with games finally arriving, which is what consumers wanted.

By mid-2021 there was a mini-boom in standalone headsets like the Oculus Quest 2 and Vive Focus. HTC was still a money-losing entity, but its balance sheet was improving.

And then came Facebook’s headfirst dive into the metaverse and VR.

Quality concerns about Facebook’s VR and metaverse platforms aside, at first, investors were intrigued.

In Taiwan, HTC’s stock became a proxy for the metaverse, gaining nearly 130% during the last quarter of 2021. VR headset shipments were growing at a rate not seen since 2016, but HTC faced a competitive market from its rivals.

Even as the metaverse bubble popped, and Meta’s stock, along with the metaverse major tokens began their year-long plunge, HTC hasn’t performed that badly.

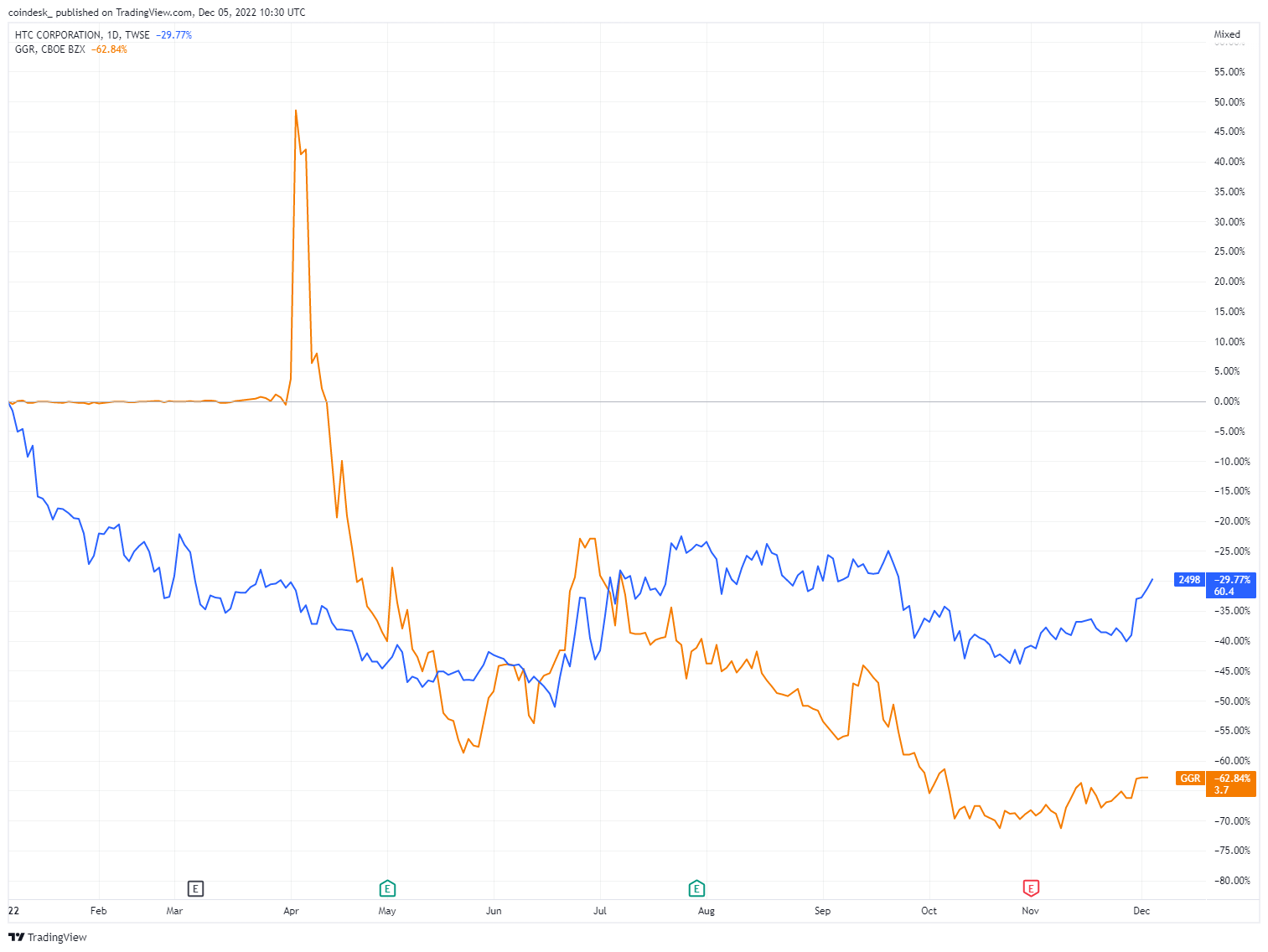

Year-to-date, the company has posted losses of 62%, compared to HTC’s 30%. While Gogoro does have solid cash flow, and licensing agreements for its battery-swapping technology, it isn’t profitable, only posting net income during the last quarter because of a favorable charge on warrants on the books.

Certainly, if Vive were to be spun off into an IPO there would be similar results. We don’t know how much Vive accounts for revenue at HTC, as it is bundled together with smartphones and other electronic equipment. But it’s likely not profitable.

Gogoro was pushed early into an IPO because its backers, like HTC’s Cher Wang, needed a quick buck (HTC is a money-losing entity, after all). Wang probably regrets not buying a more significant stake of Gogoro as an investor and bringing it closer into the HTC fold, as it would undoubtedly be a success story for the company – and a more proven product than VR.

Despite the advancements of the last four years, VR still needs more time for incubation. Vive’s performance on the stock market will be predictable, and likely just track the ups and downs of Meta. But HTC needs the cash infusion, and there’s no obvious private buyer available.

The company is hoping the metaverse finds a firm foothold.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Lisk

Lisk  Decred

Decred  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Status

Status  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD