FTM Technical Analysis: Despite Recent Bull, Fantom Fails to Reach $0.025

The FTM technical analysis displays a sideways uptrend after a bullish breakout with 200-day EMA far below the price line. Fantom (FTM) has delivered a tremendous growth of 29.5% over the last 14 days following a market crash due to the FTX controversy when FTM plunged to the low of $0.16. Since then the token has been in recovery mode. With a spike of 13.7%, the token’s market cap rose by 11.83% to $560.82 in the last 24 hours. The jump of 11.38% in the trading volume to $160.30 million complemented by the price rise, reflects substantial demand in the market.

Key Points

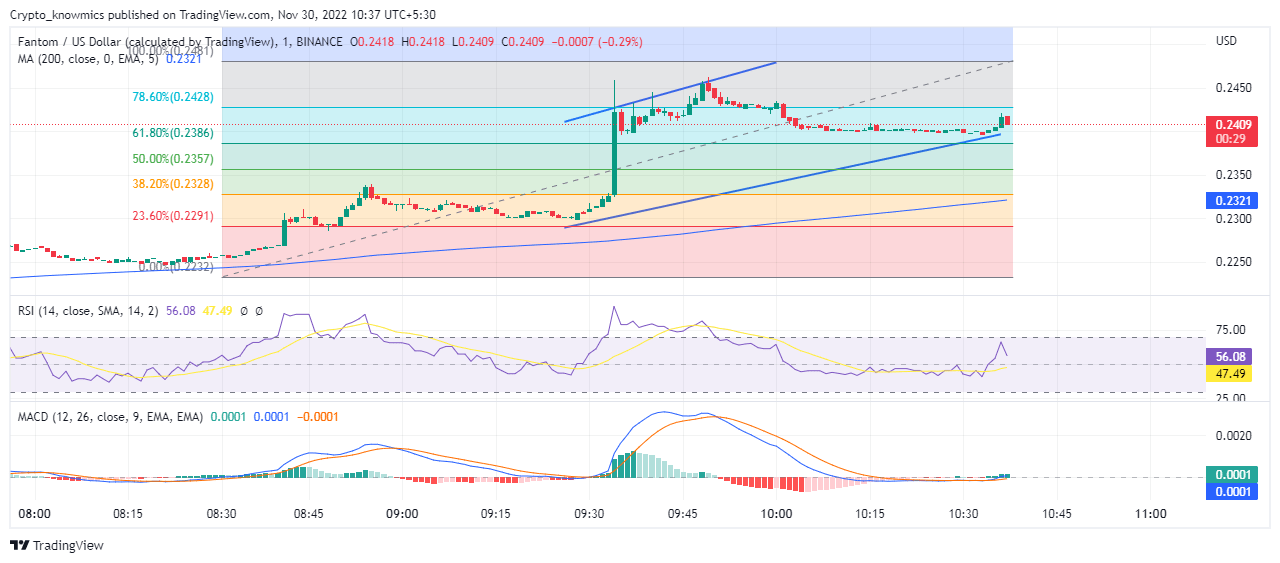

- The FTM price action shows sideways upward momentum after the recent bull cycle

- The price line moving above the 200-day EMA still shows bullish in the market

- The intraday trading volume in FTM is $160.30 million

Source: Tradingview

FTM Technical Analysis

After FTM plunged to the low of $0.16, the token has been at the forefront to recover from the recent crash. With a remarkable rise of 37.8%, the coin has recovered steadily in the last 7 days, with a high of touching $0.24. The daily chart shows that after a recent slash the token has again taken the path of bullish reversal while challenging the 200-day EMA. Although the recent bull has cooled down, the movement of the price above 61.80% on the Fibonacci retracement level shows positive signs. If FTM manages to prolong the recovery rally, every rally price can break above $0.25, whereas if the reversal rally fails the token can again plunge beyond $0.17. Sidelined traders can still make an option to book the profits if prices show some stability.

Technical Indicators

The RSI after diving from the overbought zone moves sideways along the halfway line showing the balance between demand and supply, diving down despite giving a bullish divergence. Bottom-out MACD and the signal line are choppy on the bullish histogram signaling another round of upswing. The technical indicators display a slowdown in the bullish momentum due to low buying pressure in the market despite MACD showing some relief.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Zcash

Zcash  LEO Token

LEO Token  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Stacks

Stacks  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Status

Status  Enjin Coin

Enjin Coin  Ontology

Ontology  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Ren

Ren