FTT, CRV, AR, APT and HT Suffer the Biggest Price Drops in an Already Bearish Crypto Market

BeInCrypto takes a look at five projects that underperformed relative to the crypto market last week, more specifically from Nov. 4 to Nov. 11.

These digital assets have performed even worse than the rest of the crypto market, taking the crypto news spotlight:

- FTX Token (FTT) price decreased by 86%.

- Curve DAO Token (CRV) price decreased by 32.13%

- Arweave (AR) price decreased by 31.98%

- Aptos (APT) price decreased by 30.28%

- Huobi Token (HT) price decreased by 30.28%

FTT Price Leads Crypto Market Breakdown

On Nov. 8, the FTT price broke down from the $24 support area. Previously, the area had been in place since June 2021.

The breakdown was rapid and led to a low of $2.01 after three days. Afterward the price bounced at its final support area at $2.20. Despite the bounce, technical indicators are bearish. The RSI is decreasing, is below 50 and is in oversold territory.

So far, the FTT price has decreased by 86%.

A breakdown below the $2.20 support area would take the FTT price to a new all-time low price. Conversely, if the bounce continues, there would be resistance at $9.

FTT/USDT Chart By TradingView

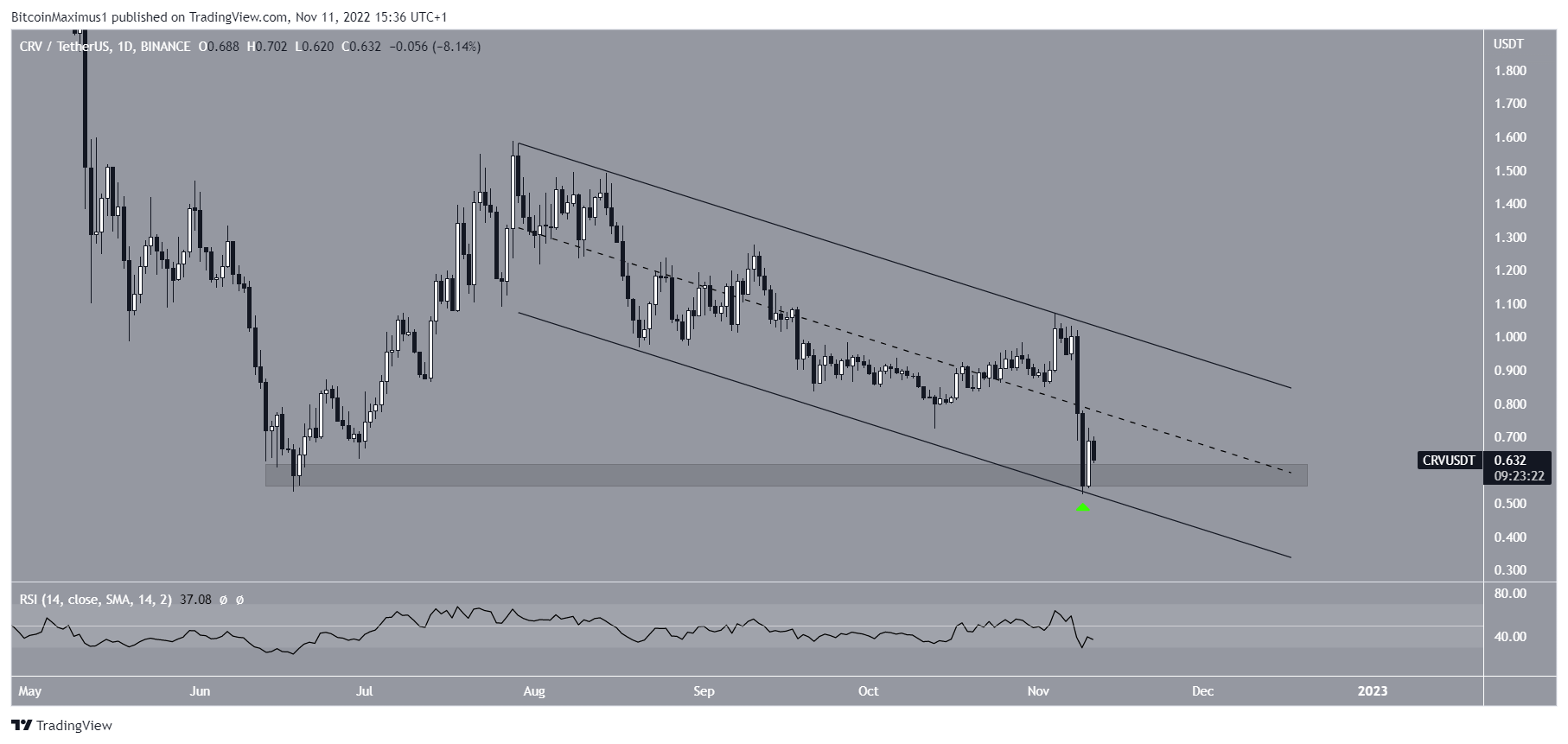

CRV Price Creates Double Bottom Pattern

CRV has been decreasing inside a descending parallel channel since July 28. The downward movement led to a low of $0.52 on Nov. 9. The low served to validate the $0.42 horizontal support area and the support lien of the channel.

Additionally, it is possible that the CRV price created a double bottom, considered a bullish pattern. As a result, it is possible that the area will initiate a bounce.

However, the daily RSI is decreasing and below 50, casting some doubt on the possibility of an upward movement and breakout from the channel.

So, whether the CRV price breaks out from the channel or breaks down below the $0.42 area will determine the direction of the future trend.

CRV/USDT Chart By TradingView

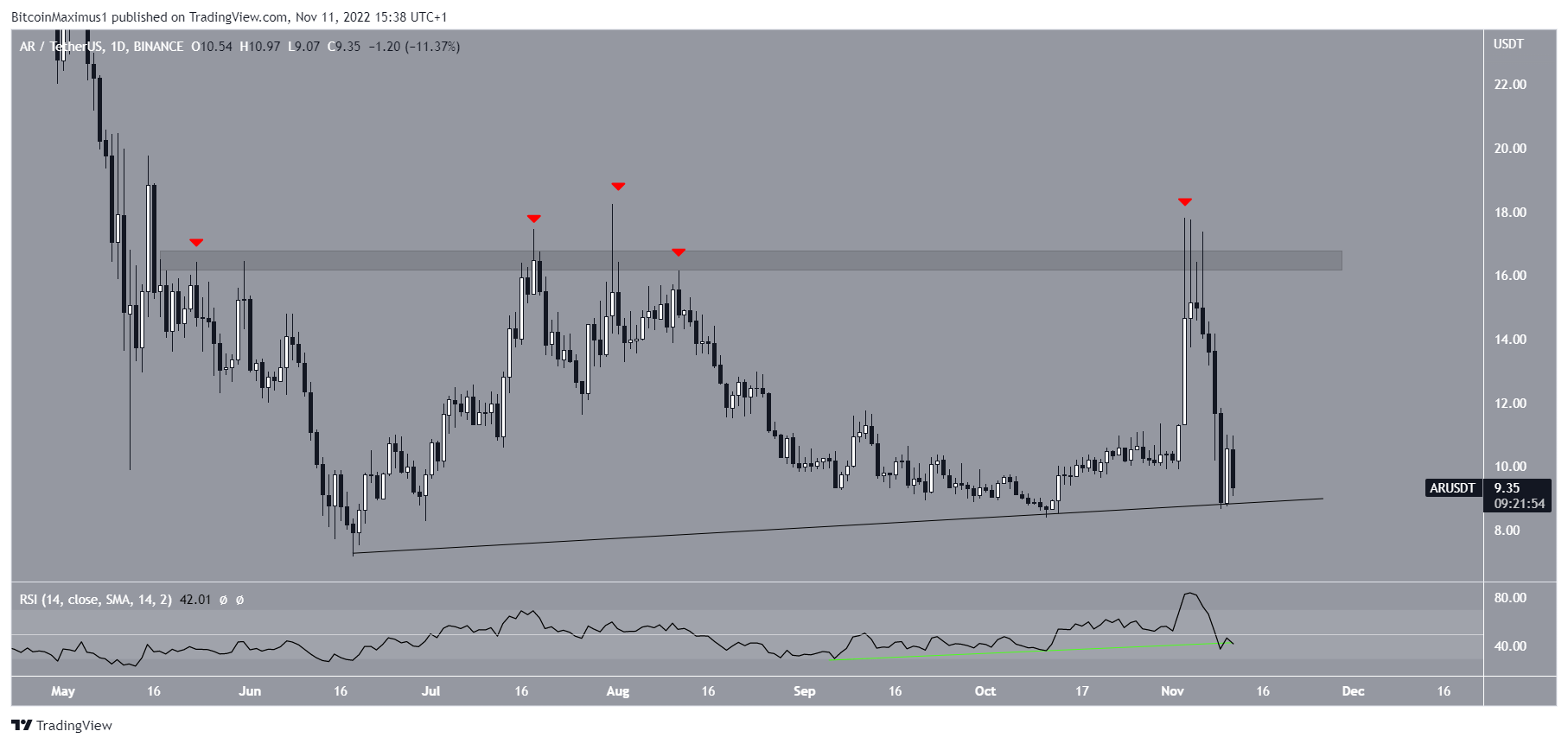

AR Price Bounces at Diagonal Support

The AR price has been following an ascending support line since June 18. During this time, the $16.50 area acted as resistance, causing five rejections (red icons).

On Nov. 10, AR reached the support line and initiated a slight bounce over the past 24 hours. However, the daily RSI is at risk of breaking down from its bullish divergence trendline.

If the daily RSI breaks down from its bullish divergence trend line (green line), a breakdown from the support area would be expected.

AR/USDT Chart By TradingView

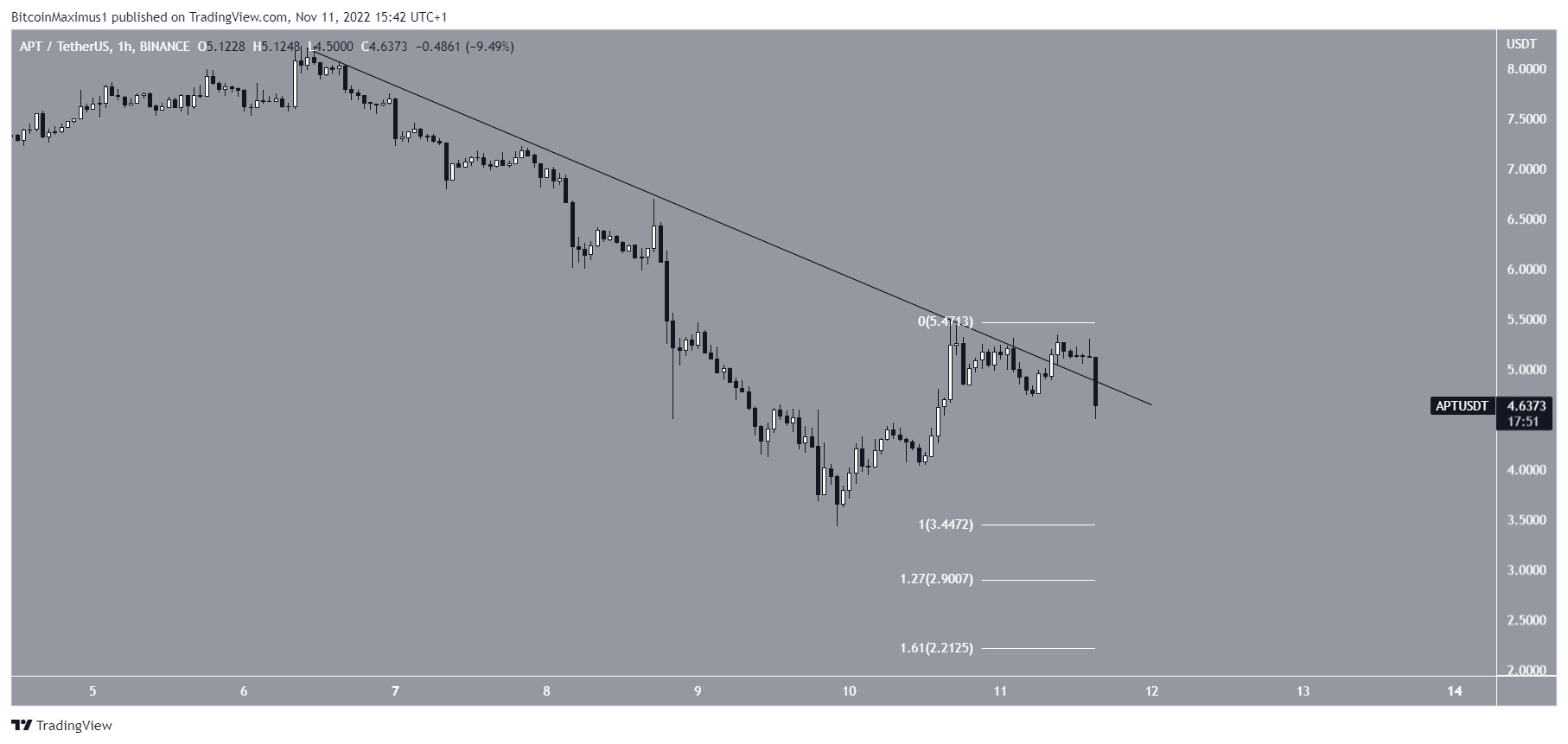

APT Price Fails to Break Out

On Nov. 11, APT seemingly broke out from a descending resistance line that had been in place since Nov. 6. However, it failed to sustain its upward movement and fell below the line shortly afterward.

Such deviations are often followed by significant downward movements.

If the downward movement continues, the closest support levels would be at $2.90 and $2.21, created by the 1.27 and 1.61 external Fib retracement support levels (white).

Conversely, a reclaim of the line would be a bullish indicator.

APT/USDT Chart By TradingView

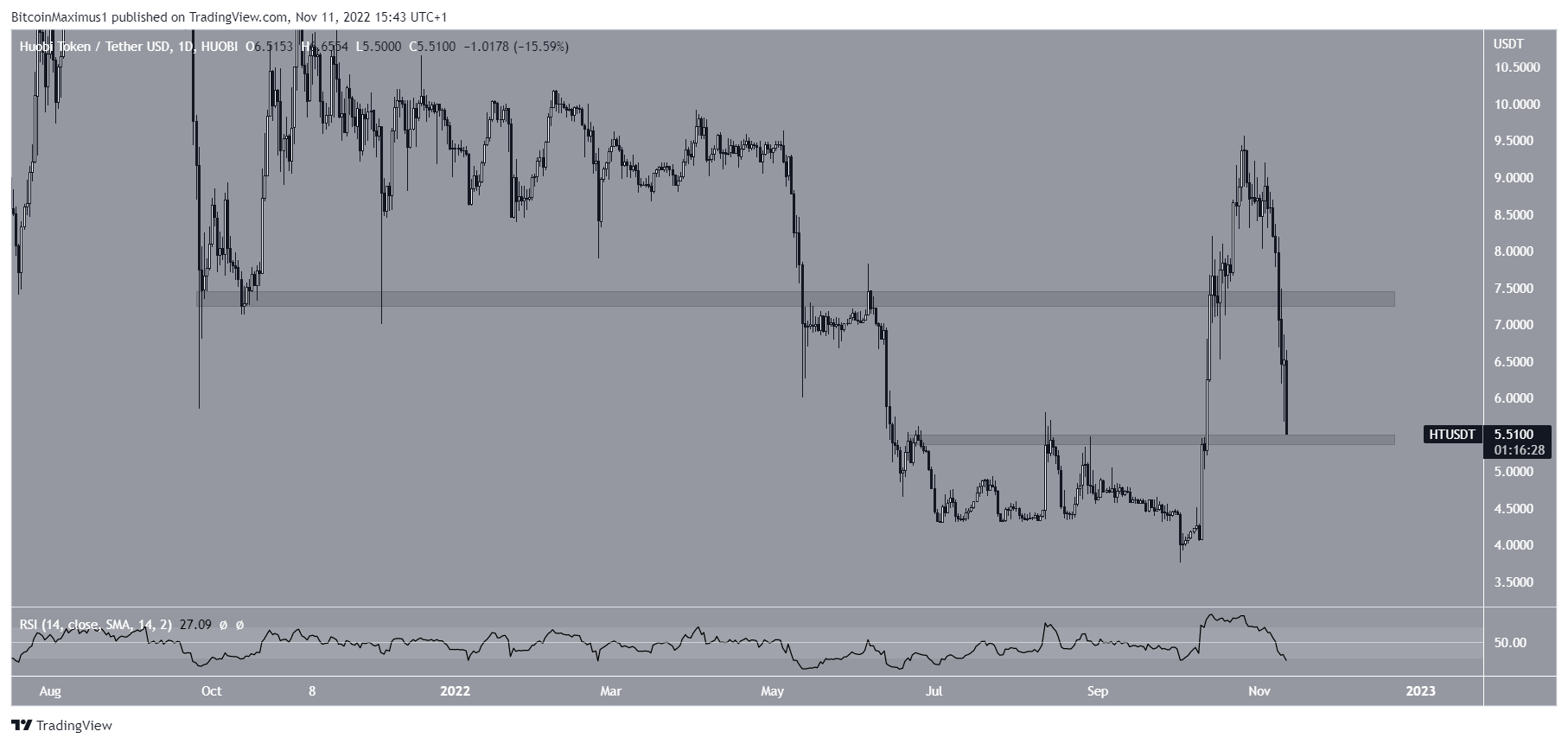

HT Price Falls Alongside Crypto Market

HT has been decreasing since reaching a high of $9.57 on Oct. 26. The downward movement led to a low of $5.50 on Nov. 11. Furthermore, it caused a breakdown below the $7.40 area, which is now expected to act as resistance.

The closest support area is at $5.50. Therefore, the most likely scenario suggests that HT will create a range between these two levels.

HT/USDT Chart By TradingView

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decision.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur