Has the U.S. Dollar Index (DXY) Completed Its Uptrend?

After months of upward movement, the U.S. dollar index (DXY) may have peaked and initiated a downtrend. In early August, the DXY broke down from its long-term, exponential upward curve, while yesterday it lost another support line that extends to March 2022.

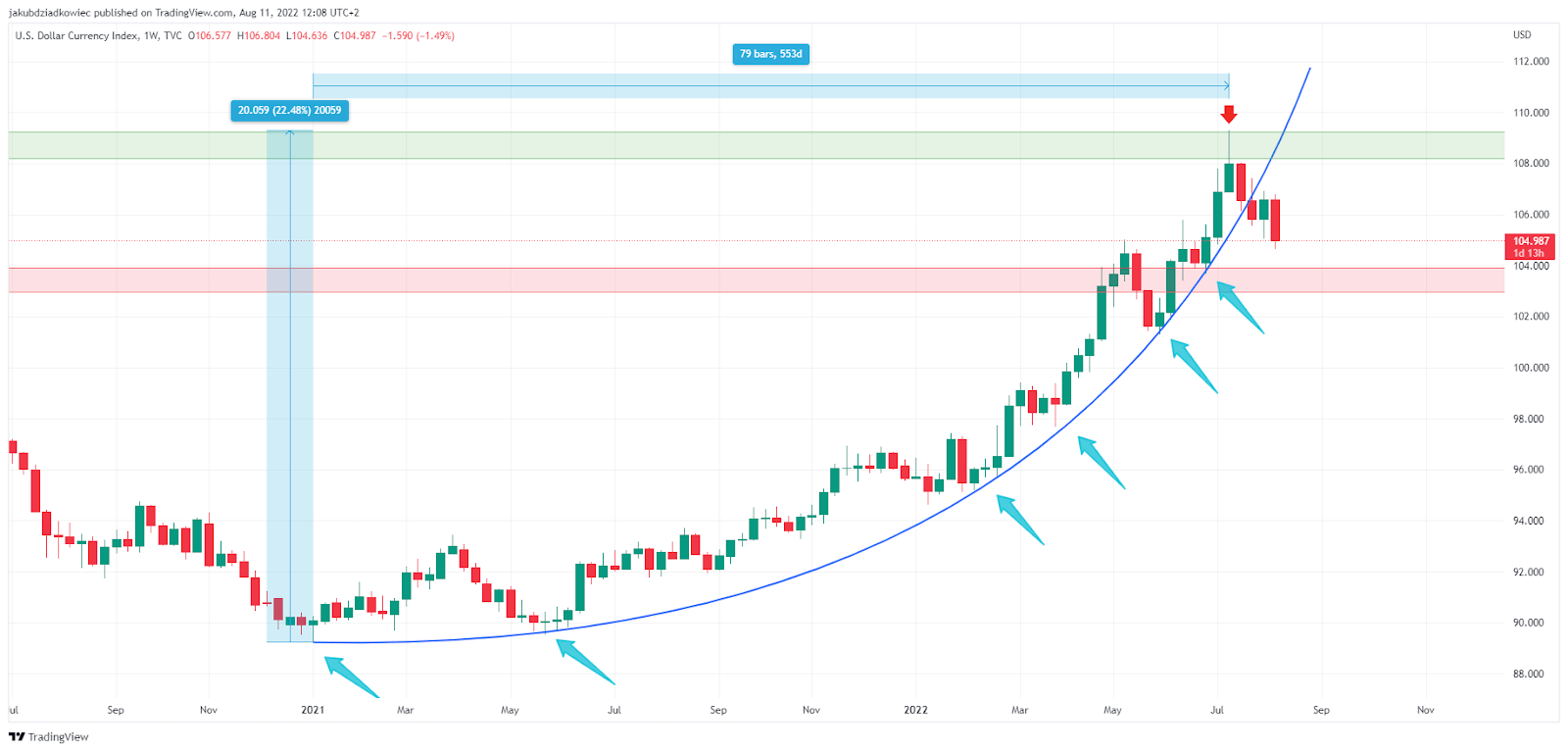

The U.S. dollar index bottomed at 89 on January 6, 2021. Since then, it has generated a bullish double-bottom pattern once again hitting the 89.5 level on May 25, 2021.

The DXY then initiated a long-term uptrend that took it to the 109 level on July 14, 2022. The upward movement lasted for 553 days and led to an increase of 22.5%. Moreover, it appears to have run along a parabolic uptrend line, which has been repeatedly validated (blue arrows).

Initially, it seemed that the parabola was broken back in May 2022, when the U.S. dollar index reached an important resistance level in the 103-104 range (red area). However, after a small correction, the DXY continued to rise, reaching another resistance area in the 108-109 range (green area).

The peak was reached with the formation of an inverted hammer candle (red arrow), which often signals a bearish trend reversal. Subsequent weeks led to declines and currently, the U.S. dollar index sits at 105. The break from the exponential uptrend line occurred in early August. If the declines cannot be stopped and a higher-order parabola will not be formed, it is possible that the DXY has already reached a long-term peak.

Chart by Tradingview

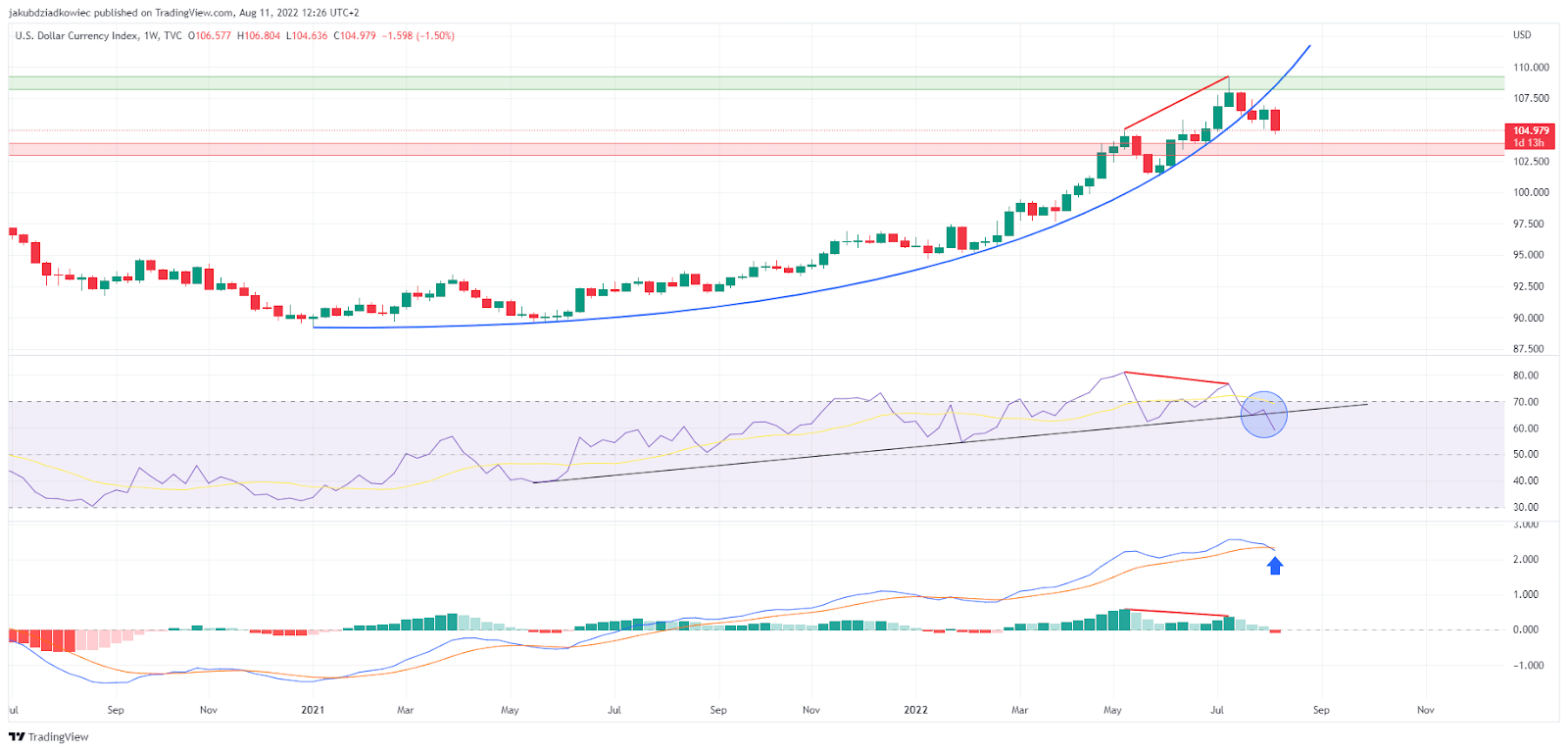

Technical indicators

Weekly technical indicators seem to confirm the possibility of the start of a downtrend. The RSI has broken down from a long-term support line (blue circle) that dates back to May 2021, when the U.S. dollar index began its uptrend.

Moreover, the RSI generated a clear bearish divergence between May-July 2022 (red line). Such divergence usually precedes a trend reversal, especially since it occurs on a high interval.

The same bearish divergence can also be seen on the MACD. In addition, this indicator is in the process of generating a bearish cross (blue arrow) and the first red momentum bar since February.

Chart by Tradingview

DXY loses yet another support line

Technical analyst @jclcapital published an 8-hour chart of the DXY yesterday, in which he drew another support line. This straight line goes back to the end of March 2022 and has provided support since then. However, it seems that yesterday the U.S. dollar index clearly collapsed below this line, thus losing another line of support.

Source: Twitter

One of the reasons the DXY has fallen so sharply over the past 24 hours is the moderately positive inflation data in the United States. According to the CPI report released yesterday, July’s CPI was lower than the month before, with inflation falling from 9.1% to 8.5%. This, in turn, lowers market expectations for interest rate increases and ultimately weakens the dollar.

Moreover, the U.S. dollar index has a long-term negative correlation with Bitcoin (BTC). Therefore, it can be expected that if the bullish trend of the DXY has come to an end, a recovery in the cryptocurrency market will soon follow.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Zcash

Zcash  Ontology

Ontology  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur