Here’s why Linear Finance’s LINA token price is surging

LINA price has defied gravity in the past few days as its rally gains steam. Linear Finance token soared to a high of $0.02623, the highest level since April 24th of this year. In all, the token has jumped by more than 365% from the lowest point this year.

Why is Linear Finance token soaring?

LINA is the native token for Linear Finance, a small DEFI platform that offers a cross-chain platform to trade digital assets. The platform offers several features, including Linear Buildr, Linear Exchange, Linear Swap, and Linear Vault. Acording to DeFi Llama, Linear Finance has over $17 million in total value locked.

It is unclear why LINA price has surged in the past few days.A likely reason is that the volume of trades in the ecosystem is doing well, with the TVL surging to over $13 million. It was about $5 million at its lowest level in 2022.

The other reason is that the token is gaining traction in social media. As shown below, data compiled by LunaCrush shows that it is one of the most actively mentioned project on social media. Historically, cryptocurrencies that are mentioned in platforms like Twitter, Reddit, and StockTwits tend to do well.

With leading combined social + market activity, $LINA has hit the No.1 LunarCrush AltRank™ again.

Linear one-week activity:

Social mentions: +1.71K%

Social contributors: +2.33K%

Social engagements: +350.6%➡️https://t.co/INARSI0JB4 pic.twitter.com/xmVqJZz9SK

— LunarCrush (@LunarCrush) May 30, 2023

The same is happening in CoinMarketCap, one of the biggest crypto websites in the industry. As shown below, together with $TOMO, $OXBT, $HEX, and $BIAO, it is one of the top trending coins in the platform.

These Trending Projects are on ? over at #CMCCommunity.

? Come feel the heat: https://t.co/vHI1wrzF17 pic.twitter.com/vCURsb1pgn

— CoinMarketCap (@CoinMarketCap) May 30, 2023

LINA price prediction

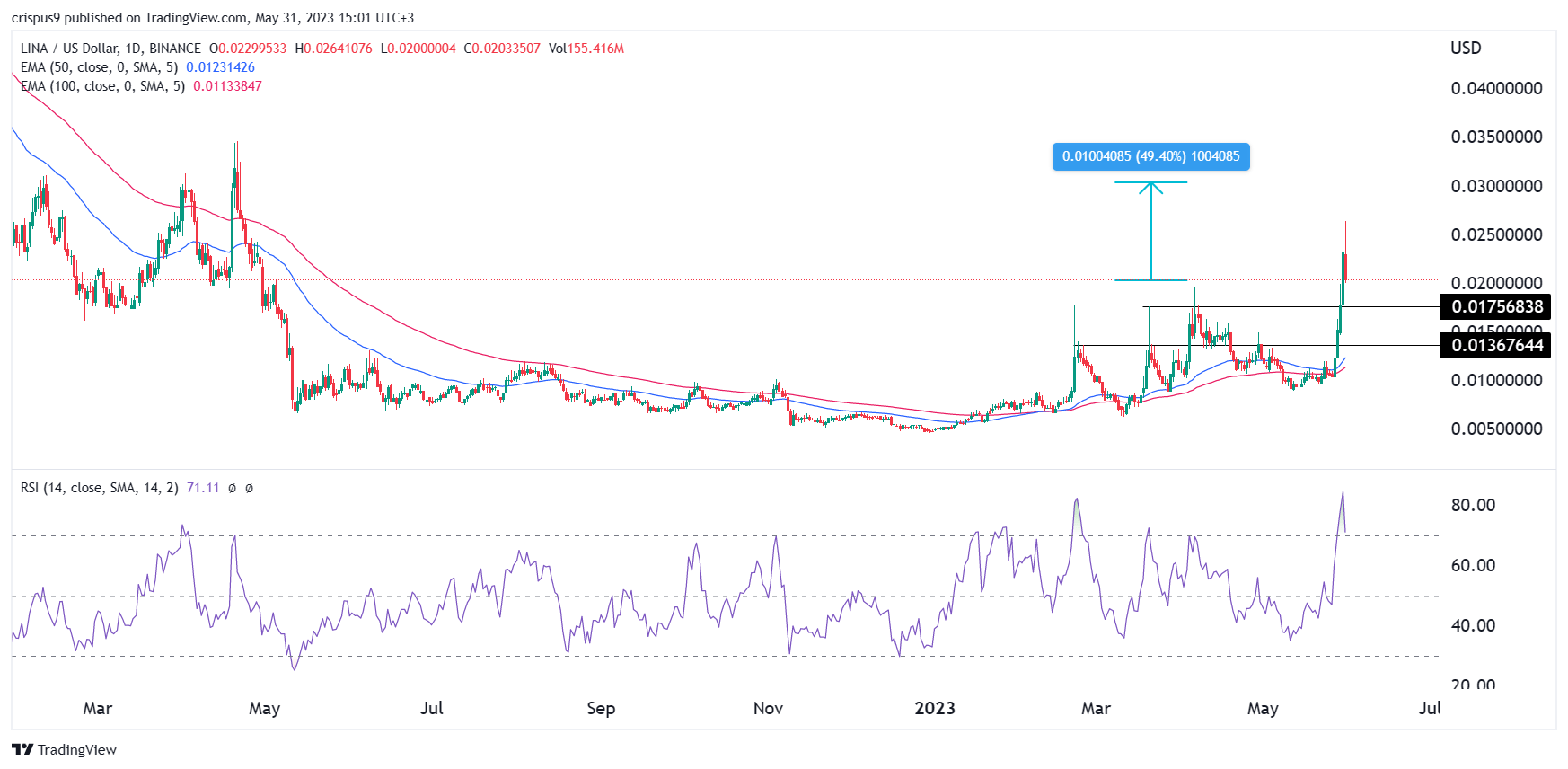

The daily chart shows that LINA crypto price has been in a strong bullish trend in the past few months. This week, the token managed to move above the important resistance point at $0.0194, the highest point on April 6.

LINA has jumped above the 50-day and 25-day exponential moving averages (EMA) while its volume is drifting upwards. At the same time, the Relative Strength Index (RSI) jumped above the overbought level at 80.

Therefore, there is a likelihood that the token will retest the key support at $0.175 and then resume the bullish trend. If this happens, the next level to watch will be at $0.030, which is ~50% above the current level. A drop below $0.017 will invalidate the bullish view.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur