How Will Cryptocurrencies Change as Silvergate Bank Faces Liquidation?

Across the past week, the cryptocurrency market has been struck once again by crypto winter, with red candlesticks emerging across a majority of the top 100 – with very few having any protection from this bearishness. As a result, losses of up to 22% have been commonplace this week, with the likes of Solana and Litecoin shedding just over 20% respectively this past week. In line with this bearish sentiment, the US Treasury has posed a new 30% excise tax on crypto mining firms. Similarly, KuCoin has come under fire in the past week, with the New York Attorney General suing the firm over the alleged sale of securities and commodities – with ETH now being pinned as a security in court. Following on from this bearish note, crypto banking giant, Silvergate, has liquidated as the market landscape continues to darken.

US Treasury Floats 30% Tax On Crypto Miners

With US President, Joe Biden, unveiling his 2023 budget proposal on Thursday, the US Treasury Department has proposed a 30% excise tax on the cost of electricity used to power crypto mining facilities. In a provision of the department’s ‘Greenbook’, there has been the proposal of a tax based on the costs of electricity used in mining processes or referred to as ‘using computing resources’ to mine any cryptocurrency.

As a result, crypto mining companies in the US could be required to report their electricity use and the type of power used. In addition, this tax is set to be phased in the next three years, with a ten percent increase per annum. This taxation is intended to potentially ‘lower the overall number of mining machines in the US’ due to growing environmental concerns.

A Riot (A Leading US-Based Crypto Mining Firm) Branch (Image Courtesy of Bloomberg)

KuCoin Sued As Attorneys Allege ETH Is A Security

The New York state Attorney General, Letitia James, has revealed that she has filed a suit against the crypto exchange giant, KuCoin, after she was able to transact cryptocurrencies via the exchange. While this may appear as business as usual on the exchange’s behalf, due to cryptocurrency not being registered in New York, this has set off alarm bells for James. Filed on the 9th of March in the Supreme Court of the State Of New York County, the complaint alleges that KuCoin has violated state securities laws, remarking that this occurred when they facilitated the transaction of cryptocurrencies that are ‘commodities and securities’.

As a result, her office stated that ‘this action is one of the first times a regulator is claiming in court that ETH, one of the largest cryptocurrencies available, is a security.’. However, James’ claims that ETH is a security comes in light of both federal and state authorities stating that ETH, amongst LUNA and UST are commodities.

Silvergate Collapses Amidst Advancing Crypto Winter

Joining the multitude of crypto businesses to tank, Silvergate Bank, a huge crypto lending conglomerate that was known to lend to the infamous FTX, has announced its imminent liquidation as internal concerns regarding the longevity of the crypto market have sprung up. Having established a reputation as the go-to US crypto bank, with a reported $14 billion in customer deposits, Silvergate’s crash is reflective of the wider bearish crypto market in light of the FTX crash.

FTX’s collapse resulted in a detrimental decline in Silvergate’s customer deposits and share price, which unraveled into the company’s liquidation.

Current Crypto Project Trends

Based on data provided by CoinMarketCap, the top-gaining project across the past week was focused on creating a fully integrated user-friendly platform and service that strives to connect as many blockchain novices as possible with a plethora of market-leading products in DeFi, GameFi, and P2E. This asset is called Supreme Finance, and has increased by a staggering 179.98% in a single day, leading it to reach $0.002072.

The Current BTC Price Trend

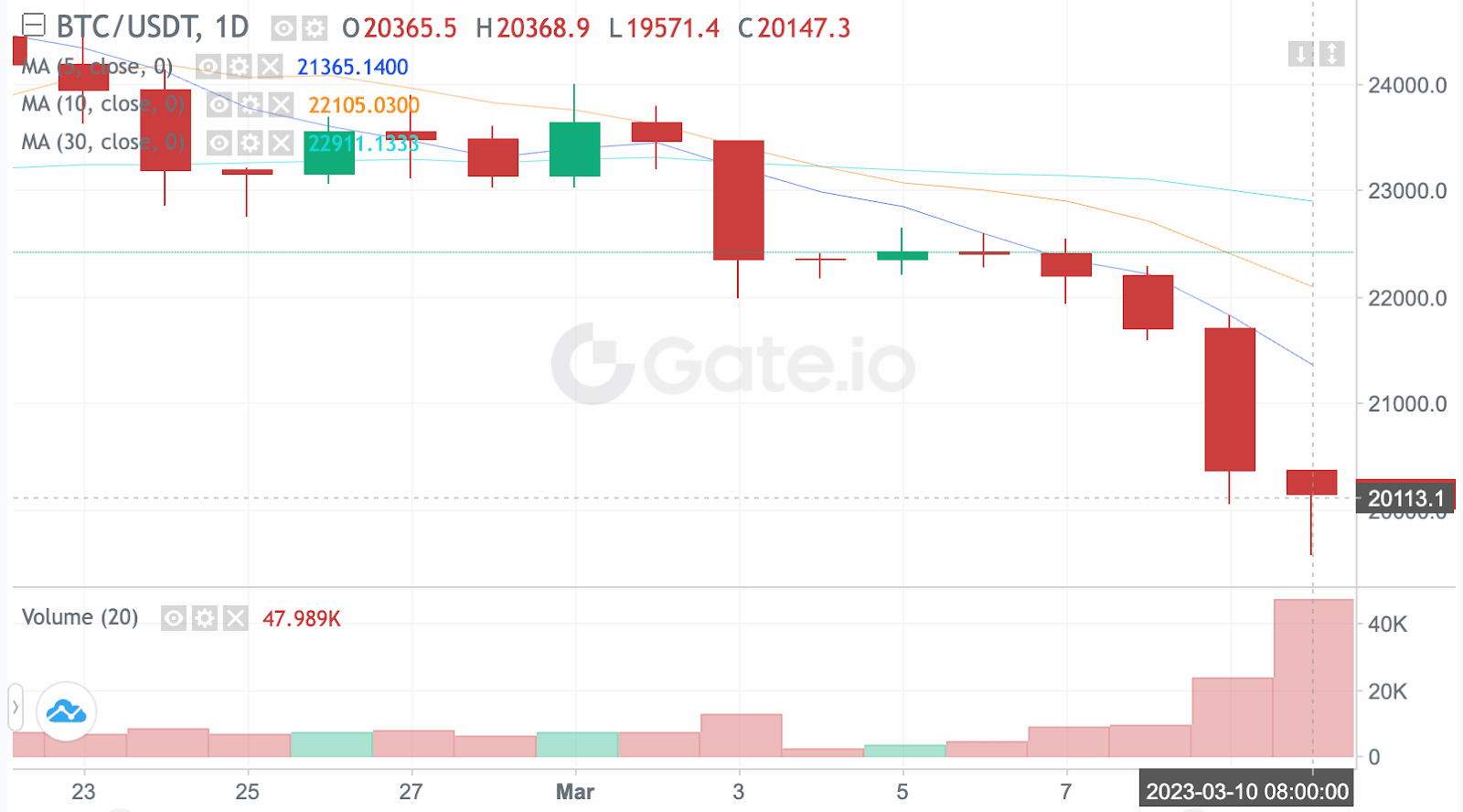

Weekly BTC price Data (Data Courtesy of Gate.io)

Across the past week, Bitcoin remained in a horizontal trading trajectory for the earlier portion of the week. BTC price trading at an average of $22.33k could be checked on Gate.io crypto exchange, and it remained relatively consistently above its 7-day SMA until the 8th when it began to decline below this threshold and teeter above $22k progressively. However, the 9th led the trajectory to unravel into a sharp decline, with led BTC to a multi-month low of $20.1k.

However, in spite of this rapid price degradation, analysts are speculating that the spike in negative sentiment may preclude a short-term rebound in valuation. Due to the influx of market ‘FUD’, analytics firm, Santiment, suggested that this increases the ‘probabilities’ of contrarian price bounces. However, the Fear and Greed Index slipped to two-month lows of 44, but remains firmly above the historic bounce levels of 10 to 25 – meaning that any price rebound is likely to be short-lived at best.

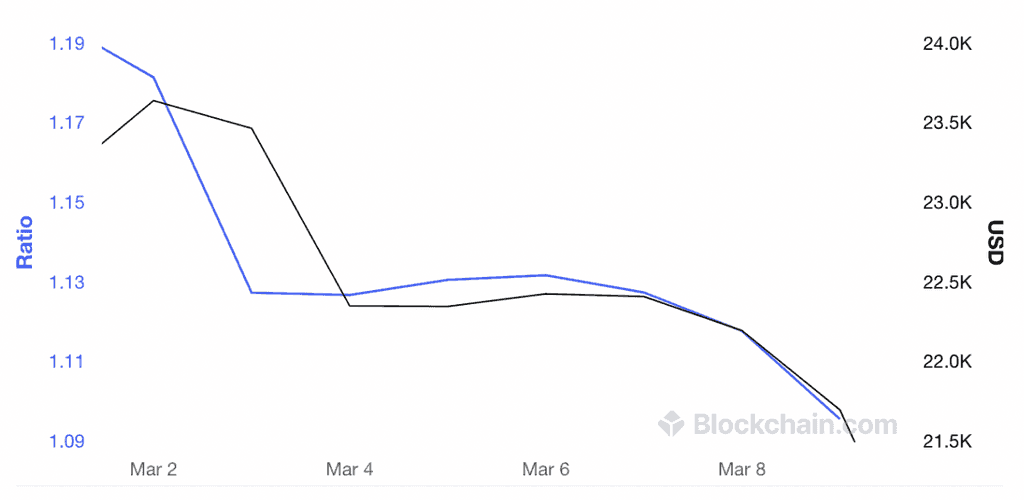

In light of this, Bitcoin’s MVRV (market value to realized value) tanked at the start of the week, before stagnating and entering a slow-moving downward trend. Entering the week at 1.18, BTC’s MVRV fell to a weekly low of 1.096 on the 2nd. As a result, BTC’s value appears to be inching back toward the ‘undersold’ territory.

7-Day BTC MVRV Data (Data Courtesy of Blockchain.com)

The Situation of ETH Staking

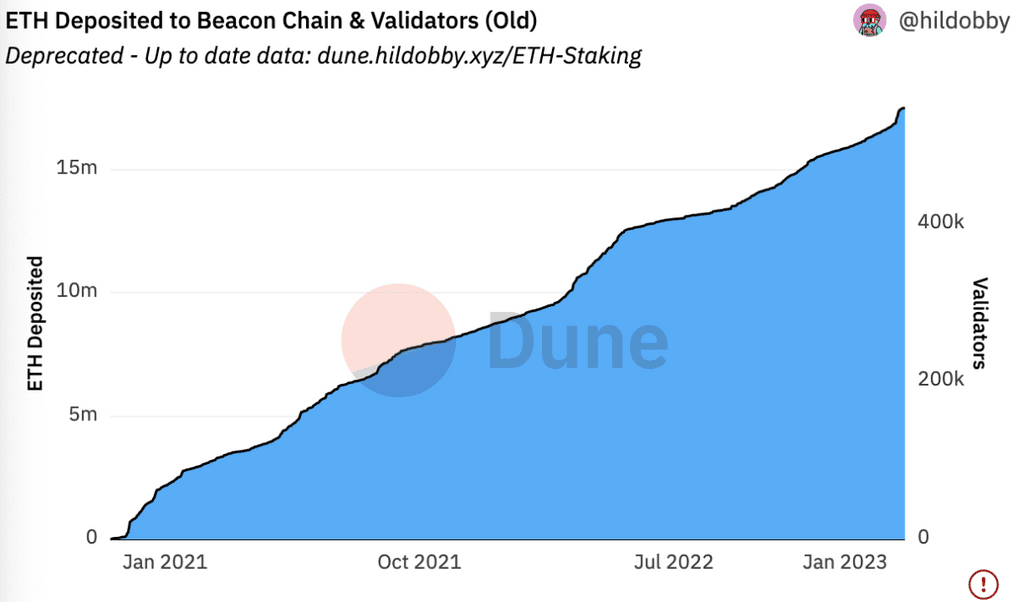

As of the 10th of March, the state of Ethereum staking remains relatively positive, likely due to the upcoming deployment of the Ethereum Shanghai upgrade, which will allow all validators who have staked Ethereum to progressively unlock their tokens and subsequent yield earnt.

In addition, the volume of Ethereum deposited to the Beacon Chain has continued to grow at a relatively steep rate since the start of 2023, with this beginning to see a sharp uptick in March. At the same time, it can be viewed on Gate.io that Ethereum’s price has grown by 137.7% in the first three months, which is also a significant increase.

(Data Courtesy of Dune)

Here are some key figures from across the past week to consolidate this:

Total validators: 512,657

Depositor Addresses: 90,200

Total ETH Deposited: 16,353,927

Liquid Staking Percentage: 35.39%

Staked Share Of ETH Supply: 14.60%

The Current Macro Situation

China Sets Lowest Economic Growth Target In Three Decades

For the second year in a row, Chinese Premier, Li Keqiang, has announced that China has set its lowest annual economic growth target since 1991, with the growth forecast capped at a potential 5%. As a result, Optimism surrounding the strengthening of the economy has begun to erode.

With similar forecasts last year, the Chinese economy only grew by 3%, following a year of abandoned growth targets due to the height of the COVID-19 pandemic in 2020. However, with pandemic restrictions having eased, many analysts have hypothesized that the growth target may increase throughout this year as Li told the legislative session that it is ‘essential to prioritize economic stability’ in the year ahead.

What Could Be Coming In The Week Ahead?

As crypto winter continues to seep its claws deeper and the market continues to bleed red, it is likely that the market will continue to bear the brunt of this bearish force in the coming week. With the market cap now at $935.84B after a shocking 6.15% decrease in the past 24 hours, it can be ascertained that the coming week will continue to thwart investors and propel negative sentiment surrounding the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Nano

Nano  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur