Key Highlights From FOMC Minutes, Bitcoin And Ethereum Bull Run Coming?

The crypto market rebound witnessed in the first few days of 2023 turned muted after the release of FOMC minutes. The total crypto market volume decreased by 2.08% over the last 24 hours. Bitcoin and Ethereum prices hold near the $16.8K and $1,250 levels, respectively.

Will the hawkish Federal Reserve‘s restrictive interest rate hike to curb inflation in the coming months impact the anticipated Bitcoin and Ethereum bullish rally in 2023?

Highlights From the FOMC Minutes

Key points from the minutes of the Federal Reserve’s December FOMC meeting released on January 4 paint an interesting picture for the crypto market in 2023.

- Decision to step down to a 50 bps hike after four consecutive 75 bps rate hikes do not indicate slowing inflation.

- Strong commitment to continue rate hikes in 2023 as the FOMC “would continue to make decisions meeting by meeting” and returning inflation to the 2% target.

- Restrictive monetary policy stance is expected to lift the unemployment rate to 4.6% by the end of the year and the fight to reduce prices will continue.

- Fed staff suggests considering the possibility of a recession in 2023 for continuing restrictive rate hikes.

- Fed warns financial markets not to underestimate the central bank’s bringing down inflation as an effort to restore price stability

The CME FedWatch Tool indicates a 64.2% possibility of a 25 bps rate hike and a 35.8% possibility of a 50 bps hike in February. The possibility of a 50 bps rate hike increased after the FOMC minutes release.

Moreover, the U.S. dollar index (DXY) remained above the 104 level on Thursday. The futures tied to stock market indexes trade marginally higher as FOMC minutes induced mixed reactions in the markets.

Bitcoin and Ethereum Price in 2023

Wall Street banks anticipate a Fed pivot in 2023 as the central bank wants to continue interest rate hikes this year. Experts predicted the change in the monetary and economic policy cycles in mid-2023.

Bitcoin price is currently trading near the $16.8K level, above the 50-EMA at $16,714. The BTC price will show low volatility due to the Bollinger Band Squeeze. After the FOMC minutes release, the trading volume dived lower. Thus, it indicates that the price will continue to make range movement.

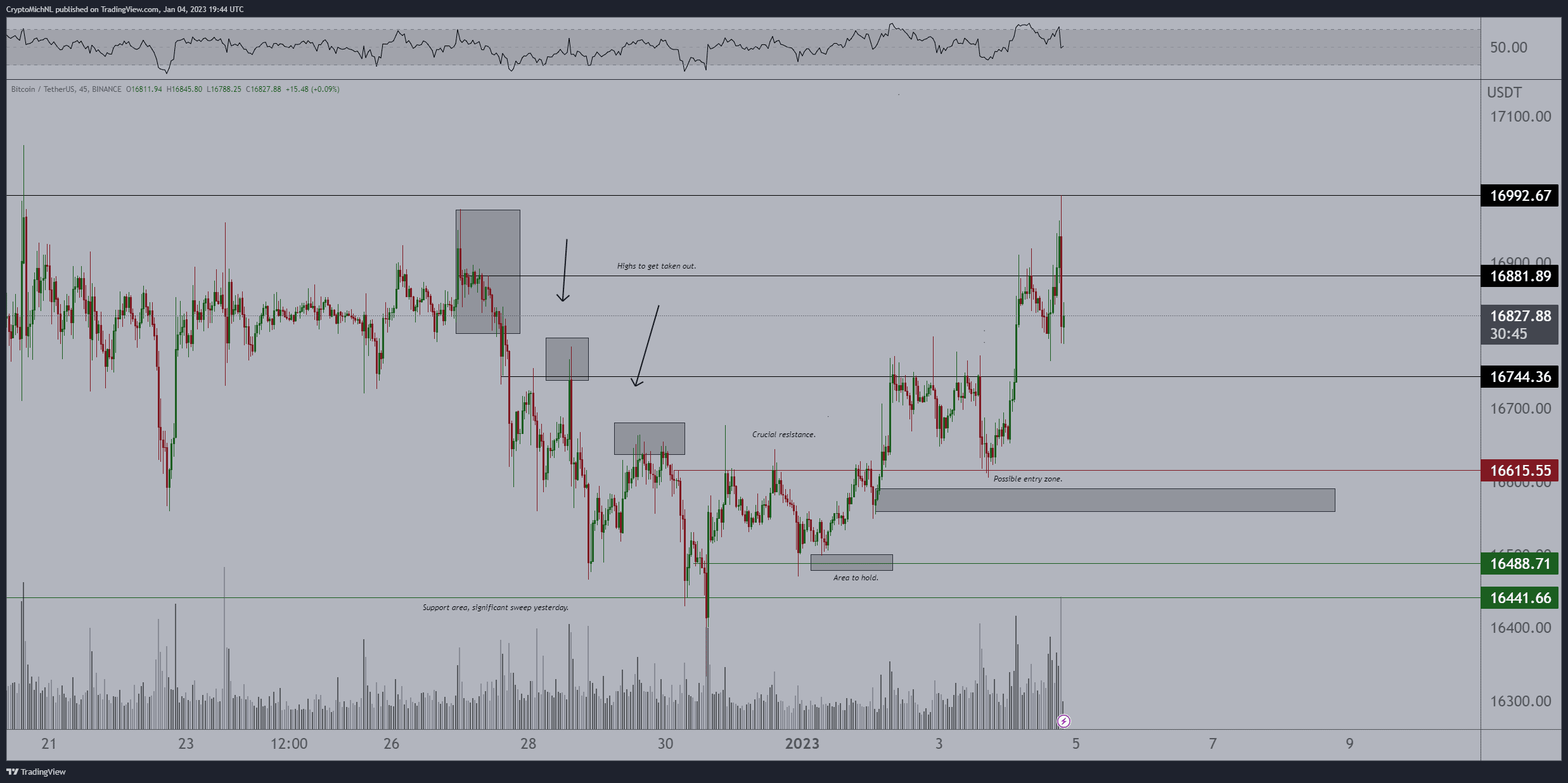

Crypto analyst Michael van de Poppe predicts Bitcoin is poised to run up to $17K before the next FOMC rate hike decision on February 1. However, the BTC price could witness a correction after the meeting. People looking for longs could go around $16.5-16.6K.

Bitcoin Price at 4Hr Timeframe. Source: Michael van de Poppe

Meanwhile, Ethereum price can also have a better upside move before a correction near the FOMC meeting. Ethereum is currently trading at $1,252, moving sideways with low trading volume.

The recent price jump in ETH is due to the renewed whale activity in Ethereum. In the last 24 hours, over 600 ETH transactions worth more than $100K have taken place on the Ethereum blockchain, as per Santiment.

Michael van de Poppe earlier suggested investors to go long on Ethereum near $1,170 as it is the crucial support level for Ethereum.

Also Read: Shiba Inu’s Official Shibarium Account Shares Update On Beta Launch

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD