Lido DAO price has dangerous exit-liquidity levels near $1.60

- Lido DAO price lost 50% of its market value in November.

- LDO price has unmitigated orderblocks near $1.60.

- Invalidation of the bullish thesis is a breach below $1.10.

Lido DAO price appears to be moving north while the rest of the market succumbs to Bitcoin’s lacklustre recovery. As the market may be setting up for another downswing, a risky countertrend opportunity is displayed within the LDO technicals. Traders should apply extreme caution if they intend to engage with the LDO token.

Lido DAO price shows a dangerous play

LDO price could set up a risky bet in the coming hours. Since November 6, the digital currency has declined by 50%. Post-decline, the bulls have shown retaliation efforts worth keeping an eye on. An additional countertrend move should not be ruled off the table.

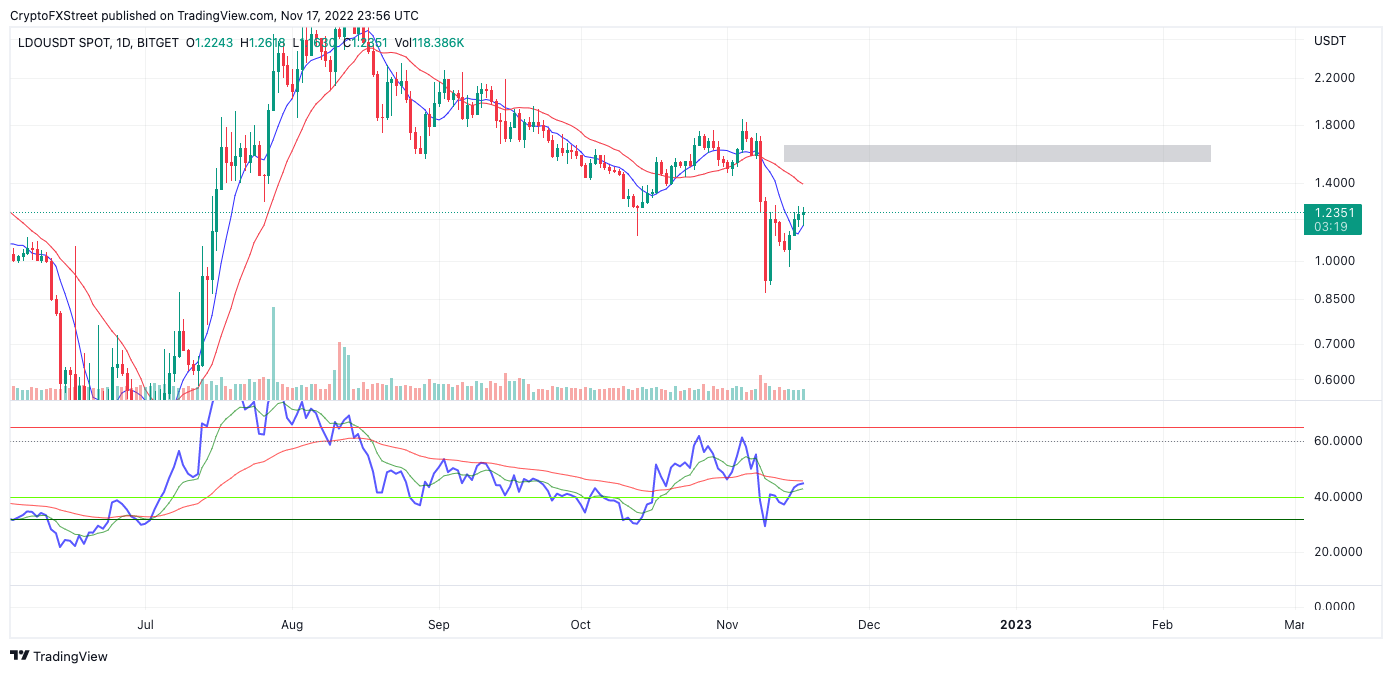

LDO price currently auctions at $1.23 as the bulls have managed to breach the 8-day exponential moving average (EMA). After two days of retests, the LDO price remains above the trend indicator, which compounds the idea that the bulls are poised to battle for last-minute gains. A daily order block has yet to be tagged at the $1.60 level. The bulls in the market may be aiming to mitigate the level for a quick 30% profit spike in the coming hours before an anticipated BTC crash occurs.

LDOUSDT 1-Day Chart

Still, traders looking to partake in the move must practice extraordinary precautions as Bitcoin’s pennant consolidation could resolve with a surging downtrend rally at any moment. The bullish invalidation is the 8-day EMA support at $1.10.

Should the bears tag the low, an additional dip toward the previous congestion zone at $0.61 could occur. Such a move would result in a 50% decline from the current market value.

Here’s how Bitcoin’s moves could affect LDO Classic price -FX Street Team

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur