Lido DAO’s Bullish Momentum Strengthens Amid Positive Developments

After starting the day poorly, bulls in the Lido DAO market neutralized the bear trend that had lowered the price to a 24-hour low of $2.04. This optimistic awakening might be attributed to the Lido Node Operator Community Call #5, which reviewed the project’s future strategy and highlighted some expected future advancements.

We’re live ?https://t.co/ficdMC6ou8

— Lido (@LidoFinance) March 28, 2023

The latest developments include the Lido V2 testnet status and updates, a tour of the withdrawals procedure on Goeril, and an update on the Lido DVT Testnet #2.

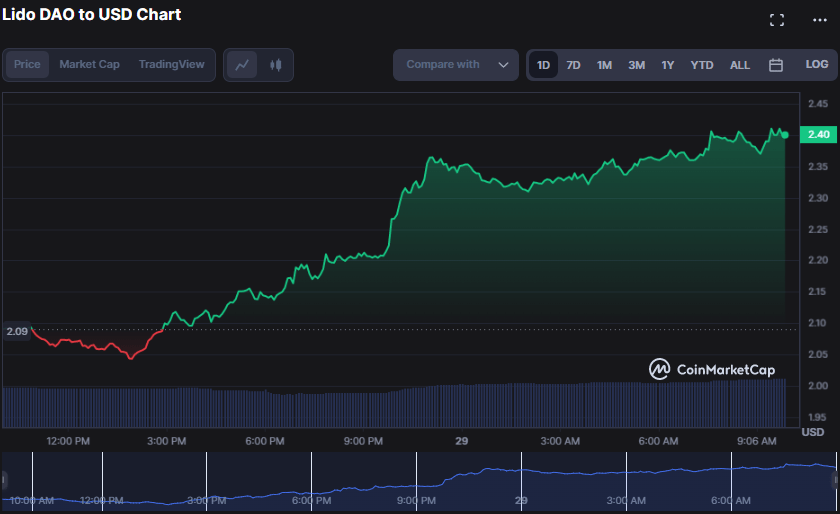

Due to the discussions, LDO bulls achieved a new 7-day high of $2.41 before hitting resistance and retreating to $2.40 as of press time, a 14.97% increase from the previous closing.

The market capitalization and 24-hour trading volume climbed by 14.92% and 22.00%, respectively, to $2,068,824,746 and $148,903,677, demonstrating increasing interest and engagement in DAO among investors and traders, which might be ascribed to favorable news and developments around the project.

LDO/USD 24-hour price chart (source: CoinMarketCap)

The MACD line on the LDO 4-hour price chart has recently crossed into positive territory, reading 0.039208131 and rising above its signal line. This MACD movement indicates the bullish momentum is strengthening, and traders may look for buying opportunities.

The movement of the histogram in the positive zone for the previous few hours confirms this bullish trend, indicating that purchasing pressure is building and the price may continue to increase in the short term, making it an excellent opportunity to initiate a long position.

With a reading of 0.31032473, the Bull Bear Power moves north and into positive territory, indicating that bullish strength dominates the market. This move implies a higher probability of further price appreciation, making it an appropriate time for traders to consider going long on LDO.

LDO/USD chart (source: TradingView)

The Relative Strength Index (RSI) movement northward, with a reading of 65.10, indicates that buying pressure is still present in the market, and the price may rise further. Traders should be cautious, however, because the RSI is approaching overbought territory.

However, overbought conditions do not always imply that the price will reverse if the bull’s momentum remains strong and there is no bearish divergence.

With a Chaikin Money Flow reading of 0.05, this bullish momentum is reinforced, indicating that there is still buying pressure in the market and that the price may rise further. However, if the Chaikin Money Flow reading falls below zero, it may indicate a shift in momentum and a possible reversal in price direction.

LDO/USD chart (source: TradingView)

In conclusion, Lido DAO’s recent developments have sparked a bullish trend, offering potential buying opportunities for traders.

Disclaimer: The views, opinions, and information shared in this price prediction are published in good faith. Readers must do their research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be liable for direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  NEM

NEM  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur