Liquity Price Prediction 2023-2032: Is LQTY a Good Investment?

Contents

1 Liquity Price Prediction 2023 – 2032

2 How much is LQTY worth?

3 Liquity Overview

3.1 What is Liquity Token?

4 Liquity Founders

5 Liquity Vision and Mission

6 Liquity Tokenomics

7 Where to buy Liquity Tokens

8 Liquity Key Features

8.1 Liquity’s Borrowing System and Stability Pool

8.2 Decentralized Frontend Operators

8.3 LQTY Rewards and Distribution

8.4 LQTY Staking

8.5 Recovery Mode

9 Liquity Road Map

10 Liquity Price History

11 Liquity Technical Analysis

12 Liquity Price Prediction by Cryptopolitan

12.1 Liquity Price Prediction 2023

12.2 Liquity Price Prediction 2024

12.3 Liquity Price Prediction 2025

12.4 Liquity Price Prediction 2026

12.5 Liquity Price Prediction 2027

12.6 Liquity Price Prediction 2028

12.7 Liquity Price Prediction 2029

12.8 Liquity Price Prediction 2030

12.9 Liquity Price Prediction 2031

12.10 Liquity Price Prediction 2032

12.11 Liquity Price Prediction by DigitalCoinPrice

12.12 Liquity Price Prediction by Technewsleader

12.13 Liquity Price Prediction by Coincodex

12.14 Liquity Price Prediction by Market Experts

13 Conclusion

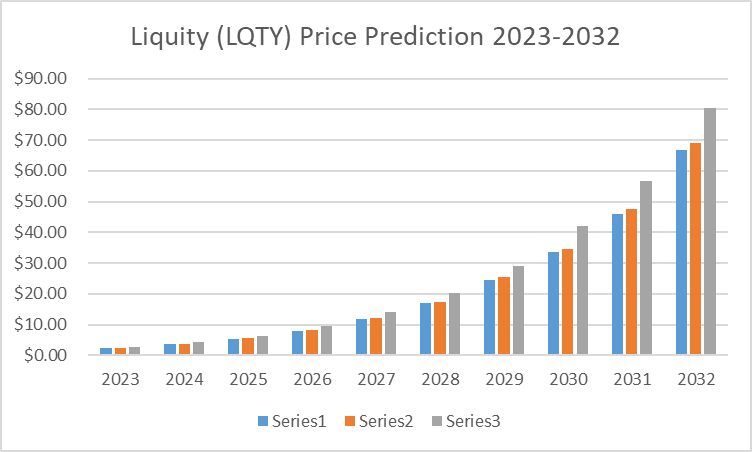

Liquity Price Prediction 2023 – 2032

- Liquity Price Prediction 2023 – up to $2.75

- Liquity Price Prediction 2026 – up to $9.57

- Liquity Price Prediction 2029 – up to $28.99

- Liquity Price Prediction 2032 – up to $80.60

Looking to invest in the future of decentralized finance? Then you won’t want to miss out on the excitement surrounding Liquity cryptocurrency and its potential for price growth. With its innovative approach to lending and borrowing, Liquity has quickly gained a loyal following among cryptocurrency enthusiasts and investors alike. What does the future hold for the value of Liquity? And is Liquity Price Prediction by experts reliable?

There are two different ways to generate revenue using Liquity: Deposit LUSD to the Stability Pool and earn liquidation gains (in ETH) and LQTY rewards. Is the profit guaranteed and risk-free? In the world of crypto as well as any investment instruments, there is nothing risk-free, might as well tell you that. But look at other aspects of the investment, which are guaranteed by the decentralized network.

Liquity’s key benefits include:

- 0% interest rate — as a borrower, there’s no need to worry about constantly accruing debt

- Minimum collateral ratio of 110% — more efficient usage of deposited ETH

- Governance free — all operations are algorithmic and fully automated, and protocol parameters are set at time of contract deployment

- Directly redeemable — LUSD can be redeemed at face value for the underlying collateral at any time

- Fully decentralized — Liquity contracts have no admin keys and will be accessible via multiple interfaces hosted by different Frontend Operators, making it censorship resistant

Binance announced that it will list LQTY in the innovation zone and open spot trading support from 11:00 UTC on Feb. 28. As expected, the LQTY price has increased to a local high of $1.8, recording a 32% gain over the next 24 hours after the announcement. In the last thirty days, LQTY has increased by over 103%, pushing its total market cap to $167 million.

How much is LQTY worth?

Today’s Liquity price is $1.84 with a 24-hour trading volume of $23,735,853. Liquity is up 1.51% in the last 24 hours. The current CoinMarketCap ranking is #171, with a live market cap of $168,871,958 . Ias a circulating supply of 91,821,344 LQTY coins and a max. supply of 100,000,000 LQTY coins.

Liquity Overview

Liquity is a decentralized lending and borrowing platform that operates on the Ethereum blockchain. Its main goal is to provide a more efficient and sustainable alternative to traditional lending systems. Liquity uses a unique stability mechanism called the Stability Pool, which ensures that the price of its native token, LQTY, remains stable even during periods of high volatility.

The Liquity protocol has been gaining popularity in the DeFi space due to its low transaction fees, fast transaction times, and the ability for users to borrow without needing to provide collateral. Liquity has also been recognized for its innovative use of smart contracts and its ability to provide liquidity to users without relying on intermediaries.

As with any cryptocurrency, predicting the price of Liquity can be challenging due to the volatility of the crypto market. However, many experts in the industry believe that the potential for Liquity’s growth is significant. Some analysts predict that LQTY could reach anywhere from $30 to $100 by 2023, and up to $500 or more by 2032.

Investors looking for high-growth investment opportunities are turning towards the cryptocurrency market, which has gained significant popularity in recent times. Two cryptocurrencies that have caught the attention of investors are Liquity (LQTY) and Uwerx, both of which are currently in their presale phase. These tokens are predicted to provide lucrative returns of up to 20x, making them an attractive option for investors.

The Liquity (LQTY) and Uwerx tokens have unique use cases and benefits that make them stand out in the market. Liquity operates as a decentralized lending and borrowing platform that uses a Stability Pool to keep the value of its native token stable, even in times of high volatility. Uwerx, on the other hand, is a social commerce platform that enables users to buy and sell products through social media, thus eliminating the need for a centralized marketplace.

Liquity (LQTY) is a decentralized finance (DeFi) protocol built on the Ethereum blockchain that offers interest-free loans denominated in the LUSD stablecoin. To obtain a loan, users must collateralize it with assets whose value is at least 110% of the amount borrowed. Liquity’s stability pool backs these loans and is funded by users who contribute to it. These contributors earn a share of liquidated collateral as an incentive.

What is Liquity Token?

Liquity’s native cryptocurrency, LQTY, is used to reward stability providers and liquidity providers on the Uniswap LUSD/ETH trading pair. Currently, the liquidity balance of the LUSD/ETH trading pair is $20,733. Third-party frontend developers are also incentivized with LQTY to build applications that provide access to the Liquity protocol.

Staking LQTY tokens enables users to receive stake rewards, which are funded by the revenue generated by issuance and redemption fees. Liquity’s approach to DeFi lending offers an alternative to traditional lending mechanisms, and its use of LQTY tokens as incentives is a novel way to incentivize participation in the protocol.

In addition to its use as an incentive for stability providers, liquidity providers, and third-party developers, LQTY also serves as a governance token for the Liquity protocol. Holders of LQTY have the ability to propose and vote on changes to the protocol, including changes to the issuance and redemption fees, changes to the stability parameters, and the addition of new collateral types.

The Liquity protocol is designed to maintain the stability of its stablecoin, LUSD, by using a collateralization ratio of 110%. This means that for every 1 LUSD issued, there must be at least 1.1 ETH of collateral deposited in the system. If the value of the collateral falls below this threshold, the protocol will automatically liquidate the position and sell the collateral to maintain the stability of LUSD.

LQTY tokens also play a role in the governance of the stability parameters, including the target collateralization ratio, the stability fee, and the liquidation penalty. These parameters are set by the Liquity DAO, which is controlled by LQTY holders.

Dune Analytics reports that Liquity, a decentralized finance (DeFi) protocol, has generated more than $28.6 million in revenue so far. Additionally, the average annual percentage yield (APY) for staking LQTY tokens over a seven-day period is 35.94%. As of today, the total value locked (TVL) in Liquity is over $463 million, which has decreased from its peak of over $1.84 billion on January 2, 2022.

Liquity Founders

The Liquity protocol was founded by Robert Lauko, a former software engineer at Google, in 2019. Lauko, who has a background in computer science and finance, was inspired to create a new type of DeFi lending protocol that could offer an alternative to the traditional lending mechanisms used by centralized finance (CeFi) institutions.

Liquity was officially launched in April 2021, after several months of testing and development. The protocol was designed to be a decentralized lending platform that could offer low-interest loans with no liquidation risk. To achieve this, Liquity uses a unique approach to collateralization that requires a higher collateralization ratio than other DeFi lending protocols.

Liquity’s native cryptocurrency, LQTY, was created as a way to incentivize participation in the protocol and to provide a means of governance for the platform. The LQTY token is used to reward stability providers and liquidity providers, and it also serves as a governance token for the Liquity DAO.

Since its launch, Liquity has gained significant attention in the DeFi community for its unique approach to lending and its focus on stability. The protocol has been successful in attracting liquidity and users, and it has recently expanded to include new collateral types, such as Wrapped Bitcoin (WBTC).

As of April 2023, the Liquity protocol has a total value locked (TVL) of over $1.5 billion, and the LQTY token has a market capitalization of over $300 million. The team behind Liquity continues to work on improving the protocol and expanding its use cases, and the future looks bright for this promising DeFi lending platform.

Liquity Vision and Mission

Liquity’s goal is to provide interest-free and low-cost loans to crypto users while incentivizing stability providers with LQTY tokens. The protocol also aims to create a self-sustaining system by eliminating governance.

Liquity uses LUSD, a USD-pegged stablecoin, as its primary network token, and LQTY as its secondary token, which is given out as a reward to stability providers. To access the system, borrowers deposit Ethereum into a Trove, against which they can borrow LUSD. The minimum debt is set at 2,000 LUSD to prevent spamming, and 200 LUSD is reserved for gas fees in the event that the account is closed before the debt is repaid.

Liquity Tokenomics

Liquity’s token system operates based on a minimum collateral ratio of 110% to 150%. Borrowers are required to maintain this ratio to ensure the stability of the system. The protocol’s algorithm-based and self-sustaining design eliminates the need for governance, allowing it to function autonomously. Liquity’s founders developed the system to provide a decentralized, USD-pegged stablecoin as an alternative to centralized stablecoins used by other borrowing platforms.

The primary network token, LUSD, is used for loans, while LQTY is given out as rewards to stability providers. The system is designed to incentivize stability providers and eliminate the need for governance, making it more efficient and cost-effective for users. Overall, Liquity offers a user-friendly borrowing platform that provides low-cost, interest-free loans to crypto users while ensuring the stability of the system.

Where to buy Liquity Tokens

LQTY tokens, the secondary network token of the Liquity borrowing system, can be purchased from a variety of centralized and decentralized cryptocurrency exchanges. Some of the popular exchanges where LQTY tokens can be bought include Binance, Coinbase, KuCoin, Gate.io, Huobi, Crypto.com Exchange, Poloniex, Balancer, and Uniswap.

These exchanges offer users the ability to buy and sell LQTY tokens easily, providing liquidity to the market and making it easier for people to get involved with the Liquity protocol. It is important to note that the availability of LQTY tokens may vary based on the exchange and geographical location of the user, and that buying and selling cryptocurrency involves risks that should be carefully considered before making any transactions.

Liquity Key Features

Liquity is a decentralized finance (DeFi) protocol that offers interest-free loans to users against their ETH collateral. The platform operates on a minimum collateral ratio of 110% and has a governance-free, fully automated system. Liquity offers direct redeemability of LUSD at any time for the underlying collateral at face value, making it a censorship-resistant platform with no control by any entity or individual. The platform charges a one-time borrowing fee as low as 0.5%, making it cost-effective for users.

Liquity offers a unique borrowing system where users can borrow LUSD interest-free against their ETH collateral with no recurring costs. The system has no variable interest rates that accrue over the loan’s duration, making it more predictable for borrowers. Liquity captures revenue from borrowing and redemption fees and pays out pro-rata to LQTY token stakers, who can freely stake and unstake their tokens with no minimum lockup period.

Liquity’s Borrowing System and Stability Pool

Liquity also has a Stability Pool, which ensures the platform’s stability and operates to cover the debts incurred by liquidated accounts. Liquidations occur only when a Trove falls below the minimum collateral ratio or when the system is in Recovery Mode. Liquity’s unique feature is the direct redeemability of LUSD for Ethereum at face value, making it possible to maintain LUSD’s soft peg between $1 and $1.10 without resorting to hard pegging.

LQTY tokens are the native tokens of the Liquity protocol and are used to participate in the Stability Pool, provide liquidity on decentralized exchanges or lending platforms, and earn rewards for helping to maintain the system’s stability. Liquity offers a straightforward staking mechanism for LQTY tokens, making it more accessible for users compared to other DeFi protocols.

Decentralized Frontend Operators

To ensure decentralization and eliminate censorship, Liquity relies on third-party operators to provide interfaces for users to borrow. This approach allows anyone to receive loans and ensures that the platform remains open and accessible to all.

LQTY Rewards and Distribution

Liquity rewards stability and liquidity providers with LQTY tokens. The more LUSD they have in the pool, the higher the amount of LQTY they’ll receive. Providers can stake their LQTY rewards to earn a share of the protocol’s fees. LQTY tokens can be freely staked and unstaked with no minimum lockup period, making them accessible to users.

LQTY Staking

Users can stake LQTY tokens and receive a share of the loan issuance and redemption fees charged by the system. The staking process is simple and can be done by adding coins to the Liquity staking contract. Users will receive a proportional share of the fees based on their total staked LQTY.

Recovery Mode

Liquity’s system enters Recovery Mode when the total supply of Ethereum collateral falls below 150% of the network debt. In Recovery Mode, all Troves with below 150% collateral can be liquidated or removed from the system. Users can avoid Recovery Mode by ensuring their collateral ratio is always above 150%.

Liquity Road Map

Liquity aims to continue providing low-cost loans to crypto traders and increase its user base. As a self-governing, fully automated system, Liquity has no admin key or governance, ensuring that the protocol remains unchanged. The platform’s future goal is to provide more rewards to its stakers and stability pool providers while maintaining its fully automated smart contract delivery system.

Liquity Price History

By analyzing Liquity’s price history chart, we can gain insights into the cryptocurrency’s potential and anticipate upcoming trends. Comparing the Open price of LQTY on the first day (March 27, 2023) and the last day (April 26, 2023) of the 1-month period, it’s clear that the price decreased by 14.63%, starting at $2.08 and ending at $1.78.

When we examine the High prices of Liquity during the 1-month timeframe, we see a 14.29% decline from March 27, 2023, to April 26, 2023. The highest price on March 27 was $2.15, and on April 26, it was $1.84. In terms of the lowest prices, March 27 had the lowest price of $2.04, while April 26 had the lowest price of $1.70. This comparison reveals a decline of 17.00% in the lowest LQTY price between the first and last days of the chosen period.

The comparison of LQTY’s Close price on March 27, 2023, ($2.14) and April 26, 2023, ($1.84) shows a decrease of 13.90% in the cryptocurrency’s closing price. Moreover, when we examine the trading volume of Liquity, we see that $12,159,388 worth of LQTY was traded on the first day of the 1-month period, while the last day’s volume ($9,522,455) saw a 21.69% drop.

Finally, comparing Liquity’s Market Cap during the 1-month timeframe, we observe a decrease of 13.59%. The Market Cap started at $195,351,078 and ended at $168,802,665. Analyzing these data points can help us understand Liquity’s price trends and potential future movements.

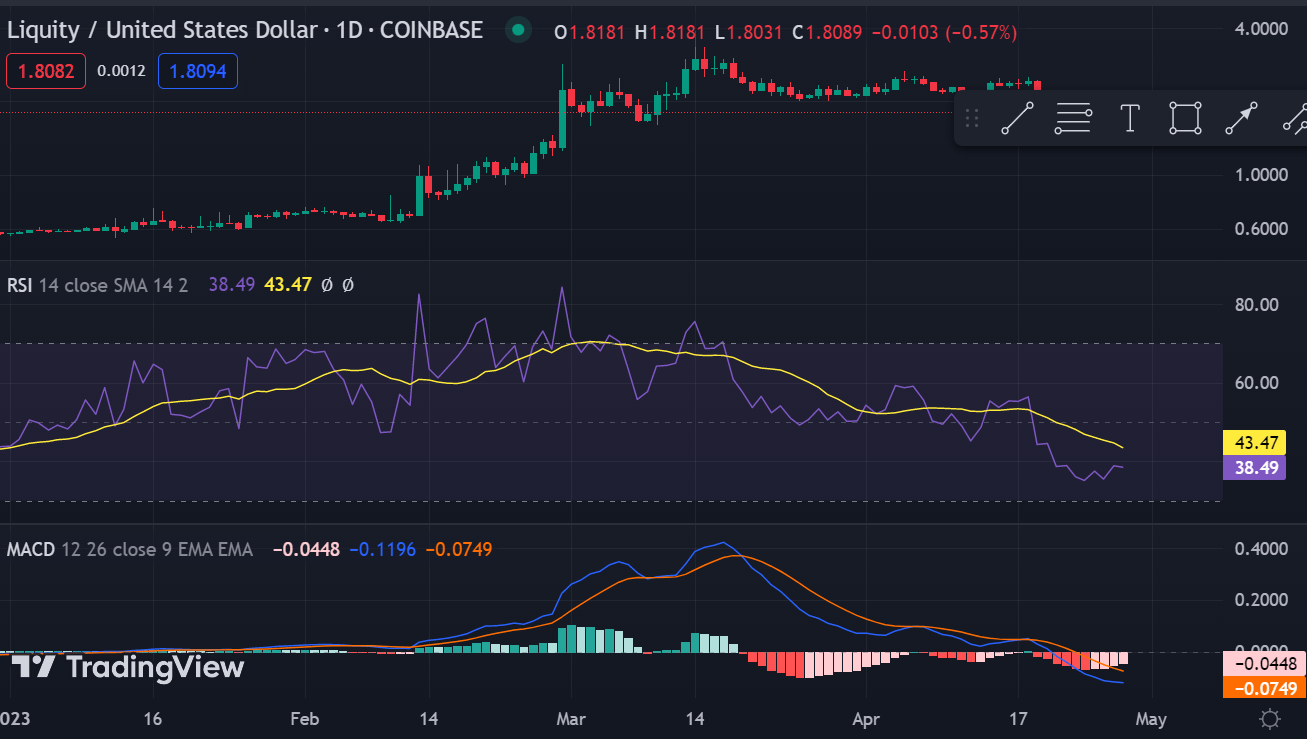

Liquity Technical Analysis

Liquity price analysis shows the altcoin has been trading in a descending triangle after a bounce off the support at $1.67. The lower trendline has been tested multiple times and a break below it would likely result in further downside. The Liquity token’s price has been fluctuating between $1.67 to $2.64 since mid-April.

The Liquity token is trading at $1.83 at the moment of writing, up by 6.90% in the last 24 hours while in the past week, LQTY is down 10%. The altcoin has been making higher highs and higher lows since mid-April but has been unable to break the resistance at $2.64.

The technical indicators are also giving bearish signals. The MACD shows a bearish crossover as the signal line is now above the histogram. The RSI also indicates that it is in an oversold region while the 50 EMA (exponential moving average) acts as a resistance and indicates the bearish trend.

The Simple Moving Average (SMA) is also indicating a bearish crossover as the 50 SMA is now below the 200 SMA. When the 50 SMA is below the 200 SMA, it indicates the bearish trend could continue in the long term.

The technical outlook is giving bearish signals as the weekly and monthly Relative Strength Index is residing below 30. This indicates that there may be a chance for further downside in the token’s price if it does not break the resistance of $2.64 soon.

The Chaikin Money Flow is also pointing downwards, indicating a bearish sentiment in the market. The altcoin will have to break the resistance at $2.64 for any chance of an uptrend. Bullish signals could arise if the CMF moves above 0.2 and the RSI breaches the 70 level.

Overall,Liquity price analysis indicates the altcoin is bullish for today while in the past 30 days, the token has been bearish. For any chance of a sustained uptrend, it will need to break the resistance at $2.64 soon. If it does not, further downside is expected near the Fibonacci Retracement level of 0.618 at $1.67. The token has strong support levels at $1.67 and $2.64, with any break below the former indicating further downside in price.

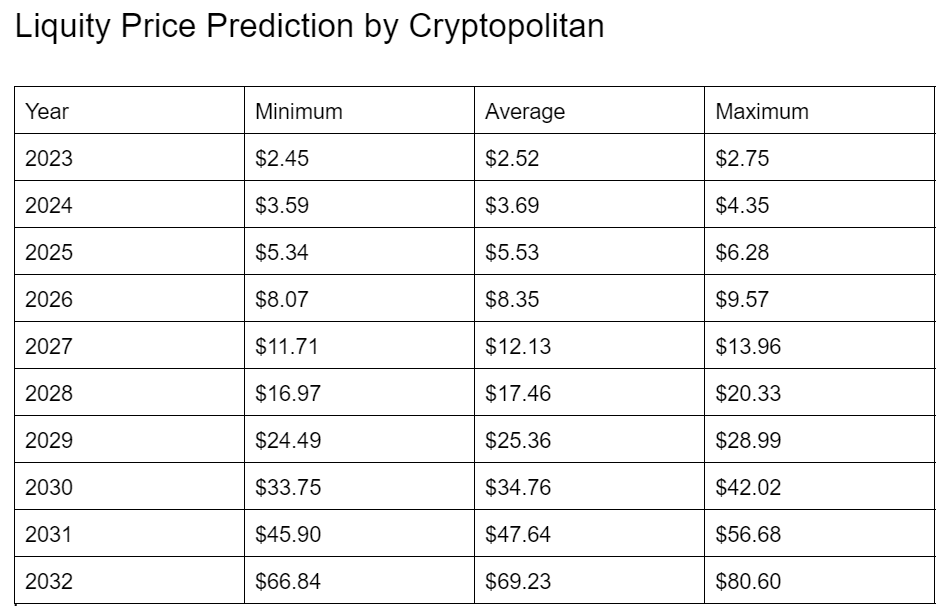

Liquity Price Prediction by Cryptopolitan

Liquity Price Prediction 2023

The Liquity LQTY price prediction for 2023 is a maximum price of $2.75 and an average trading price of $2.52.The least expected price of the Liquity token is $2.45.

Liquity Price Prediction 2024

Our Liquity price prediction for 2024 estimates LQTY to trade at a minimum price level of $3.59 and an average forecast price of $3.69.The LQTY token might potentially trade at $4.35,the highest possible price.

Liquity Price Prediction 2025

For Liquity token in the year 2025, Our Liquity price prediction estimates the LQTY token to trade at an average of$5.53 with a minimum price level of $5.34 and a maximum potential of up to $6.28.

Liquity Price Prediction 2026

Our Liquity price prediction for 2026 suggests that the LQTY token could reach a maximum trading price of $9.57 with an average forecast price of $8.35 and a minimum price level of $8.07.

Liquity Price Prediction 2027

The Liquity price prediction for 2027 is estimated to hit a maximum of $13.96, with an average forecast trading price of $12.13, and a minimum possible price level of $13.96.

Liquity Price Prediction 2028

Our Liquity price prediction for 2028 suggests that the LQTY token could reach a maximum trading price of $20.33 with an average price level of $17.46 and a minimum price level of $20.33.

Liquity Price Prediction 2029

In 2029, the Liquity price forecast for 2029 is LQTY cryptocurrency to trade at a maximum price of $28.99 and an average price of $25.36, with a minimum forecast price of $24.49.

Liquity Price Prediction 2030

Our Liquity price prediction for 2030 suggests that the LQTY token could reach a maximum trading price of $36.54 with an average trading value of $31.26 and a minimum possible price level of $30.77.

Liquity Price Prediction 2031

According to our Liquity price prediction for 2031, the LQTY token might reach a maximum trading price of $45.12 with an average forecast price of $39.01, and a minimum value of $45.90.

Liquity Price Prediction 2032

The Liquity price prediction for 2032 suggests the altcoin could potentially trade at a minimum level of $66.84 and an average price of $69.23, with a maximum price value of $80.60.

Liquity Price Prediction by DigitalCoinPrice

DigitalCoinPrice has a relatively bullish LQTY price forecast for the short term and long term. The one-year forecast implies that the price will hit $1.13 by the end of December. By December 2023, 2024, Liquity’s short-term 50-Day SMA shows a $2.24.

DigitalCoinPrice estimates LQTY to trade at a minimum price value of $7.01, an average value of $8.23, and a maximum price of $8.37 in 2026.DigitalCoinPrice suggests Liquity price will continue growing and could attain a maximum level of $26.23 while by 2032, it’s expected to reach a maximum price of $35.54.

Liquity Price Prediction by Technewsleader

Technewsleader has a bullish Liquity price forecast for the next ten years, predicting that the coin will reach a maximum value of $50.36 by 2029. The prediction is based on a number of factors, including Liquity’s potential to become one of the most popular crypto assets in the world and its track record for steady growth over the past year.

The team at Technewsleader believes that liquity prices could range between a minimum average price of $10.68 and a maximum average price of $12.38 in 2027, with a price target of $10.98 in 5 years. Technewsleader LQTY forecasts the price of LQTY to trade at $13.75 at the end of 2023 and to reach a price target of $12.38 by 2025. The team expects Liquity’s price to reach a peak of $27.29 in 2029.

Liquity Price Prediction by Coincodex

Coincodex uses technical analysis of various market indicators to provide an accurate Liquity price prediction. According to the LQTY forecast and technical analysis, the current Liquity price value is set to rise by 6.51% and reach $ 1.938869 by May 2, 2023. Coincodex suggests the current sentiment is neutral, with 19 technical analysis indicators signaling bullish signals, and 9 signaling bearish signals. Coincodex’s long-term liquidity price prediction is $ 22.06 if it follows Facebook’s growth. In case Liquity would follow Internet growth the prediction for 2026 would be $ 2.53.

Liquity Price Prediction by Market Experts

Various market experts and crypto analysts have been extremely bullish on Liquity (LQTY) in recent weeks. Prominent investors and traders have suggested that the coin could reach its all-time high of $3 soon, if not higher. A recent tweet from a popular crypto analyst has also mentioned LQTY as a “gem” and has fans believing that the coin might reach its highest price yet. Another popular market analyst based on Youtube ”Cilinix Crypto” has given a technical analysis and predicts that LQTY could reach a maximum price level of $4.5 within the next few months.

Conclusion

Liquity (LQTY) is a decentralized lending protocol that operates on the Ethereum blockchain, providing a stable and efficient borrowing experience. The platform’s innovative stability mechanism enables borrowers to obtain loans without requiring over-collateralization, making it an attractive option for those who want to borrow without liquidating their assets.

In addition, Liquity (LQTY) offers low transaction fees, fast transaction times, and a user-friendly interface, which has made it a popular choice among DeFi enthusiasts. Binance announced on February 28th that it will list Liquity (LQTY) tokens in its innovation zone and make them available as a borrowable asset in its isolated margin account.

The listing of Liquity (LQTY) on Binance is a major milestone for the decentralized finance (DeFi) sector, as it will open up access to this asset class to a larger pool of users. This move by Binance could bring in more liquidity and drive up prices, potentially leading to further gains in value. Looking ahead,Liquity cryptocurrency has positioned itself to become a major player in the DeFi space, as it continues to expand its offerings and grow its user base.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi