Markets could not get enough of crypto in March, pushing CEX trading volumes to 6 month high

The U.S. banking crisis that began with the collapse of Silicon Valley Bank seemingly did little to curb interest in crypto trading.

According to a recent report from CCData, the total trading volume across centralized exchanges increased by over 25% in March, showing that crypto trading flourishes in highly volatile markets.

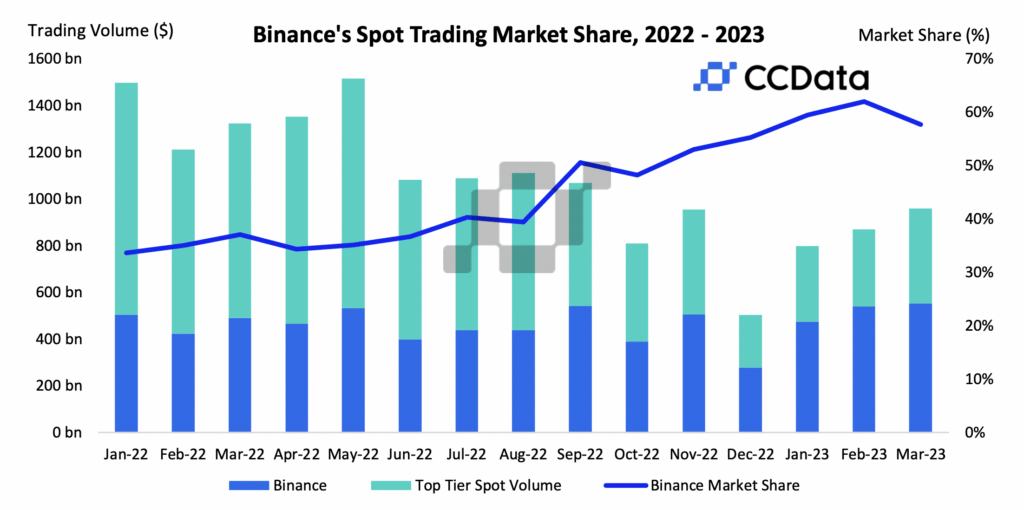

The attention USDC got for losing its peg quickly focused on Binance, whose regulatory struggles cost it a significant chunk of its market dominance.

The exchange’s spot market share across top-tier exchanges fell for the first time in five months, decreasing from 62% in February to 57.7% in March. Despite its spot trading volume increasing by 2.54%, it lost market dominance as competitors OKX and Coinbase saw a 29.7% and 23.5% increase.

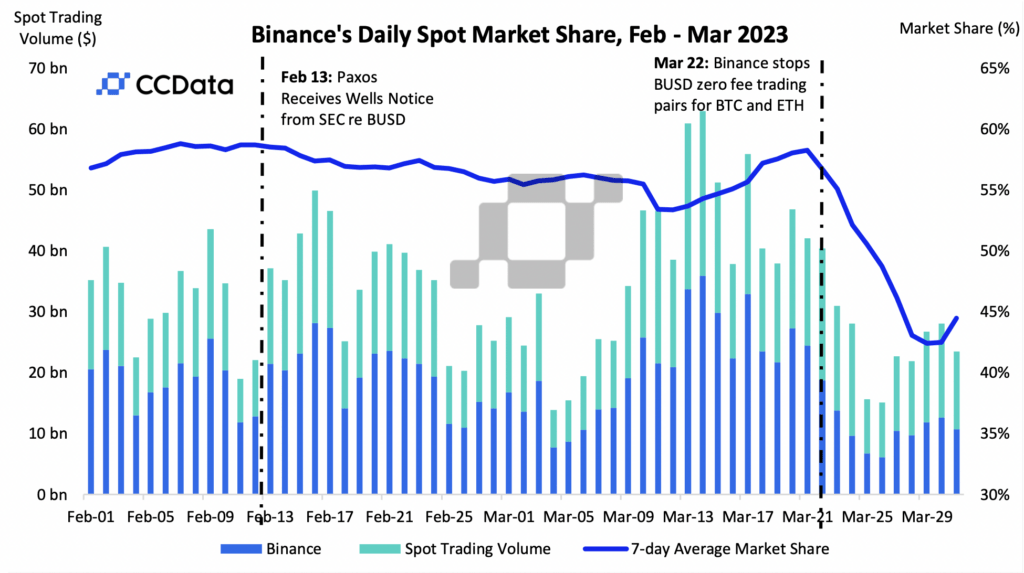

Binance’s decreasing spot volume dominance is most likely due to the exchange’s decision to halt zero-fee trading for BTC/BUSD and ETH/BUSD pairs, contributing to a large chunk of its trading volume. The regulatory issues BinanceUS faces certainly contributed.

The seven-day average market share shows a much steeper decline, with Biannce’s daily spot trading volume market share at just 44.5% at the end of March.

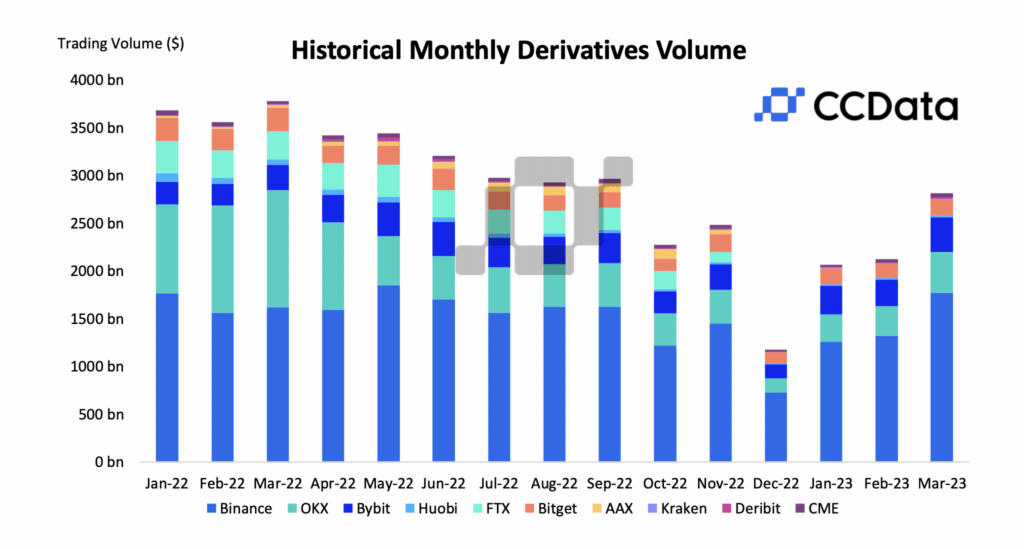

Nonetheless, the exchange saw a significant increase in derivatives trading volume on its platform. Derivatives trading volume increased by 32.6% across all centralized exchanges, pushing Binance’s derivatives market share to an all-time high of 64%.

As of April 2023, derivatives accounted for 72.7% of the total crypto trading volume across centralized exchanges. CCData notes that the increase could result from increased speculation after the USDC contagion caused multiple stablecoins to de-peg.

The total derivatives volume reached $2.77 trillion in March, with the intra-month high of $170 billion recorded on March 14. According to the report, it was the highest monthly trading volume since September 2022. The daily high of March 14 is a 47.3% increase from February’s intra-month high of $116 billion.

“This is an all-time high for the market share of derivatives, highlighting the increase in usage of leverage as the narrative for bitcoin and crypto assets gets stronger under the current turmoil in the banking sector,” CCData noted.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Holo

Holo  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD