MATIC Flashes Five Technical Signals That Led To Previous 10,000% Rally

MATIC, the native token to Polygon is up more than 6% intraday, but could be on the cusp of much more, according to a handful of technical signals.

The last time these five buy signals appeared, MATIC went on an incredible, 10,000% rally in a matter of only four months. Could these same conditions be foretelling of yet another explosive breakout?

Five Bullish MATIC Technical Signals

The recent rally in MATIC has moved the cryptocurrency past Dogecoin and into the number 9 rank by market capitalization. But the upside in the token might only be beginning.

Polygon is preparing to launch its zero-knowledge Ethereum Virtual Machine (zkEVM) beta mainnet on March 27 and has been tapped by major companies Meta, Disney, Adidas and Starbucks, giving it plenty of fundamental value.

From a purely technical perspective, MATIC could be ready to pop. Five potential bullish signals are triggering or close to it, that in the past when combined led to a 10,000% price increase.

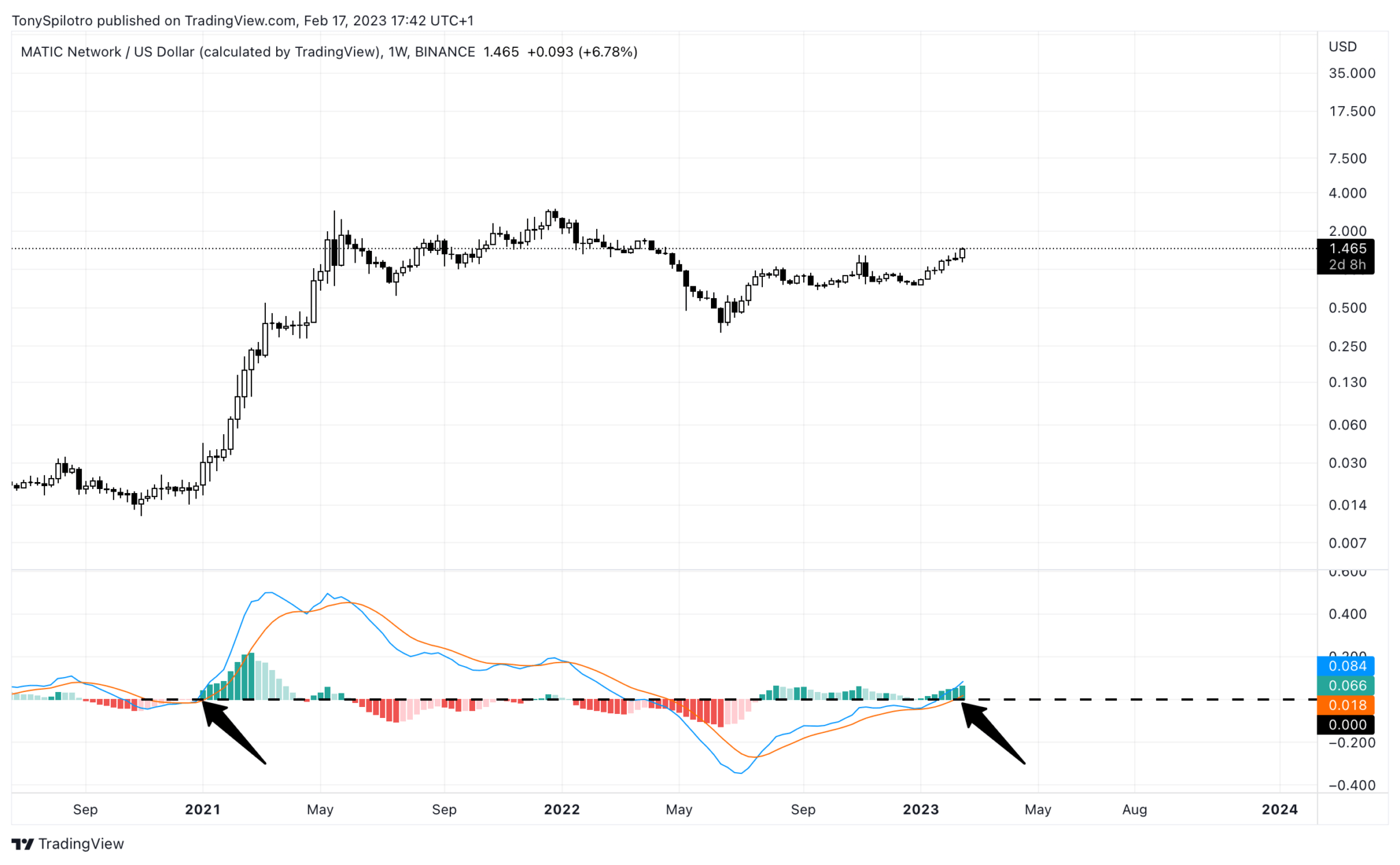

Momentum is increasing and flipped bullish | MATICUSD on TradingView.com

LMACD

It’s no surprise given the positive narrative in Polygon that the MATIC token is gaining momentum. That increase in momentum can be seen in the weekly Logarithmic Moving Average Convergence Divergence indicator, otherwise known as the LMACD.

Related Reading: Total Crypto Market Triggers Golden Cross, Despite “Deadly” Bitcoin Counterpart

The tool is crossing above the zero line on an already green histogram, while the MACD line has passed through the signal line from below.

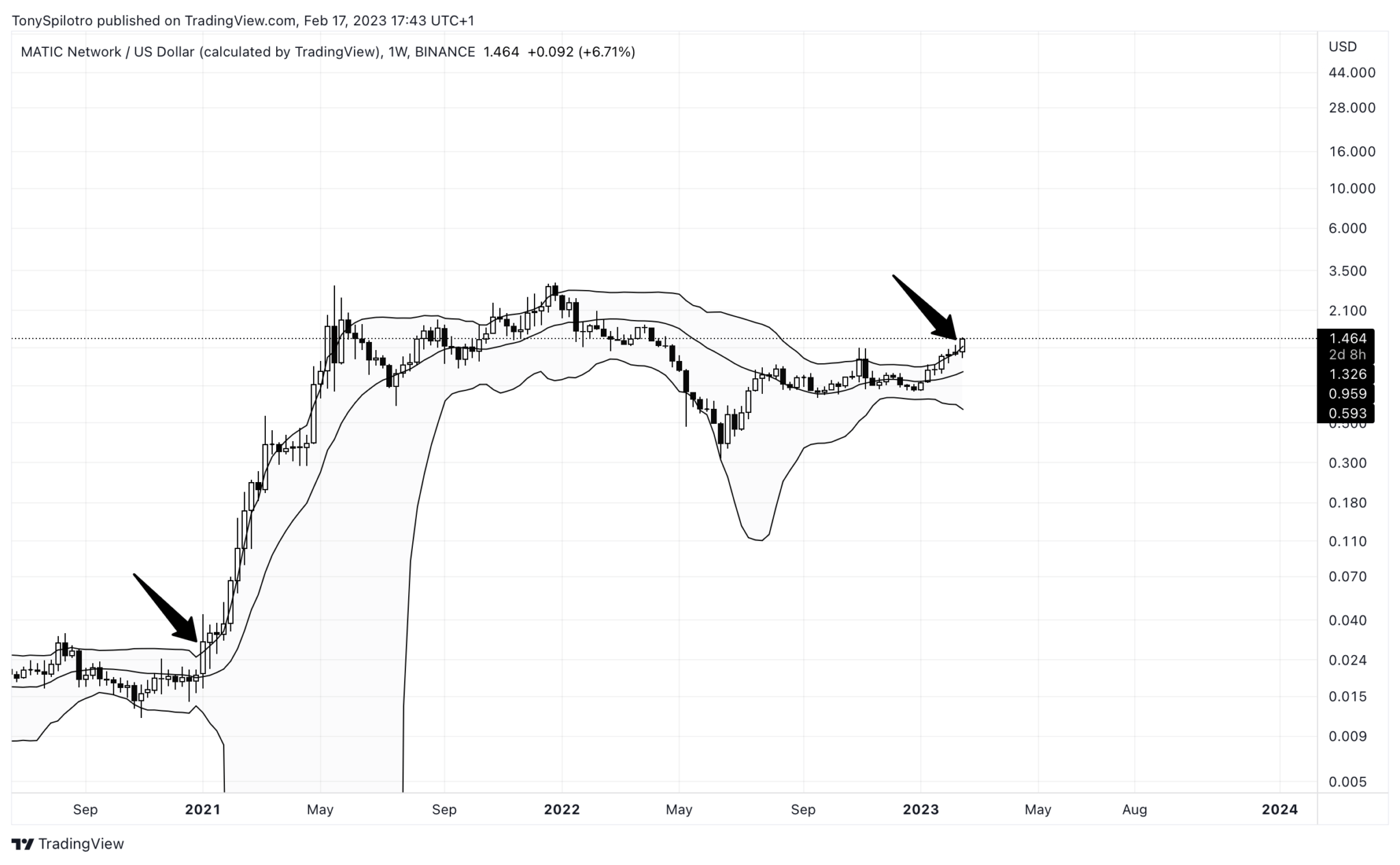

Will Polygon ride the Bollinger Bands? | MATICUSD on TradingView.com

Bollinger Bands

If MATIC can maintain current price levels or higher on the one-week timeframe, the token will have closed outside of the weekly Bollinger Bands. A close outside of the upper band is a buy signal and can suggest strong continuation if the bands begin to expand and price rides the upper band higher.

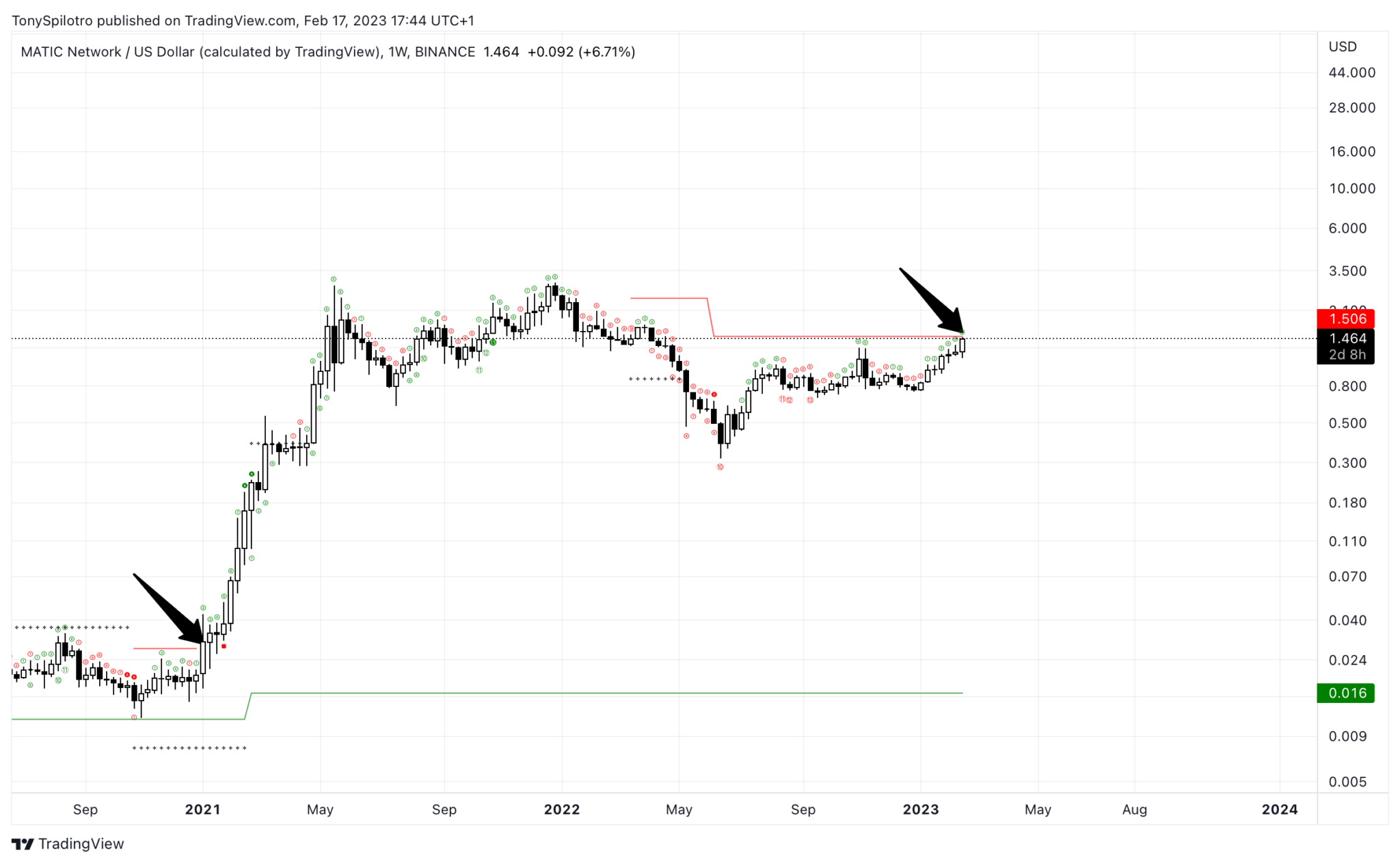

A confirmed buy signal from the SuperTrend | MATICUSD on TradingView.com

SuperTrend

At the very same level as the upper Bollinger Band, the SuperTrend has been tapped, triggering a buy signal. The signal actually appeared last week, and has since been confirmed.

Making it out of the cloud is critical for continuation | MATICUSD on TradingView.com

Ichimoku

Continuing to highlight the important confluence of indicator resistance potentially being broken at this very moment, MATICUSD 1W has pushed into the Ichimoku cloud and is nearly at the top of it. Once outside the cloud, it’s clear skies for higher prices.

Related Reading: Forget The Moon: Bitcoin Could Target The “Cloud” At $40K

The Tenkan-sen and Kijun-sen are also crossed bullish and price is above the two lines, which are rising to show a trending market. Very little Chikou span resistance is located above this level.

The red line is possibly the only resistance left | MATICUSD on TradingView.com

TD Sequential

Last but not least brings timing into play, with MATIC about to face off against TDST downtrend resistance, indicated by the red line created by the TD Sequential indicator. The token hasn’t made it through quite yet, but adds to the stacking signals appearing on the same weekly timeframe.

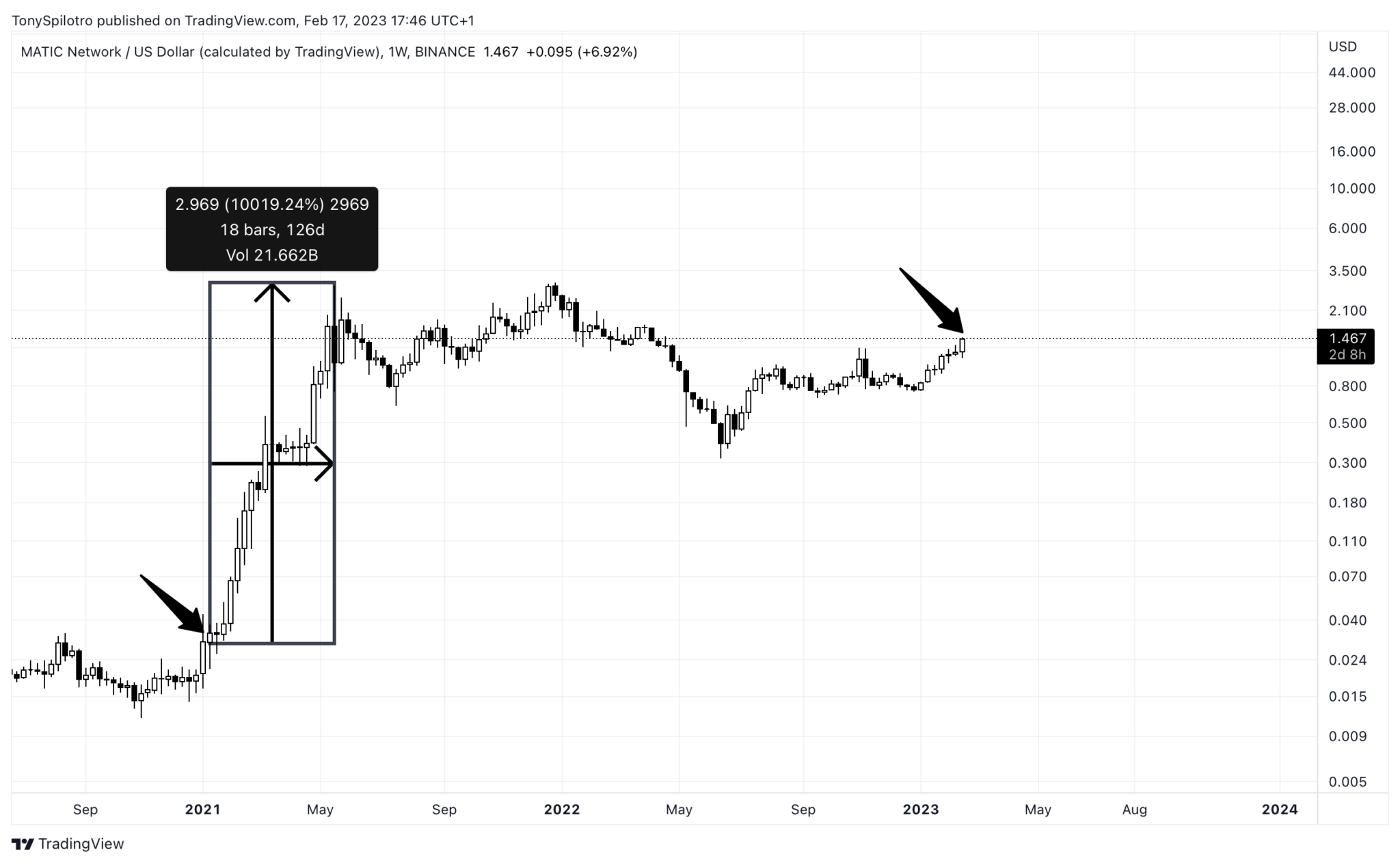

The last time these signals all appeared the token grew 10,000% | MATICUSD on TradingView.com

Another 10,000% Rally?

The last time all of these signals appeared simultaneously, MATICUSD climbed by 10,000% in only four months. Another 100x would take the cryptocurrency to over $140 a token. While another rally of that size is unlikely, a promising uptrend could be nearing a breakout. Considering the confluence of resistance at this level, failure would also be catastrophic and crush confidence further in the token.

Follow @TonyTheBullBTC on Twitter or join the TonyTradesBTC Telegram for exclusive daily market insights and technical analysis education. Please note: Content is educational and should not be considered investment advice. Featured image from iStockPhoto, Charts from TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur