MATIC Technical Analysis: After a Major Downfall, Polygon Teases $1 Mark

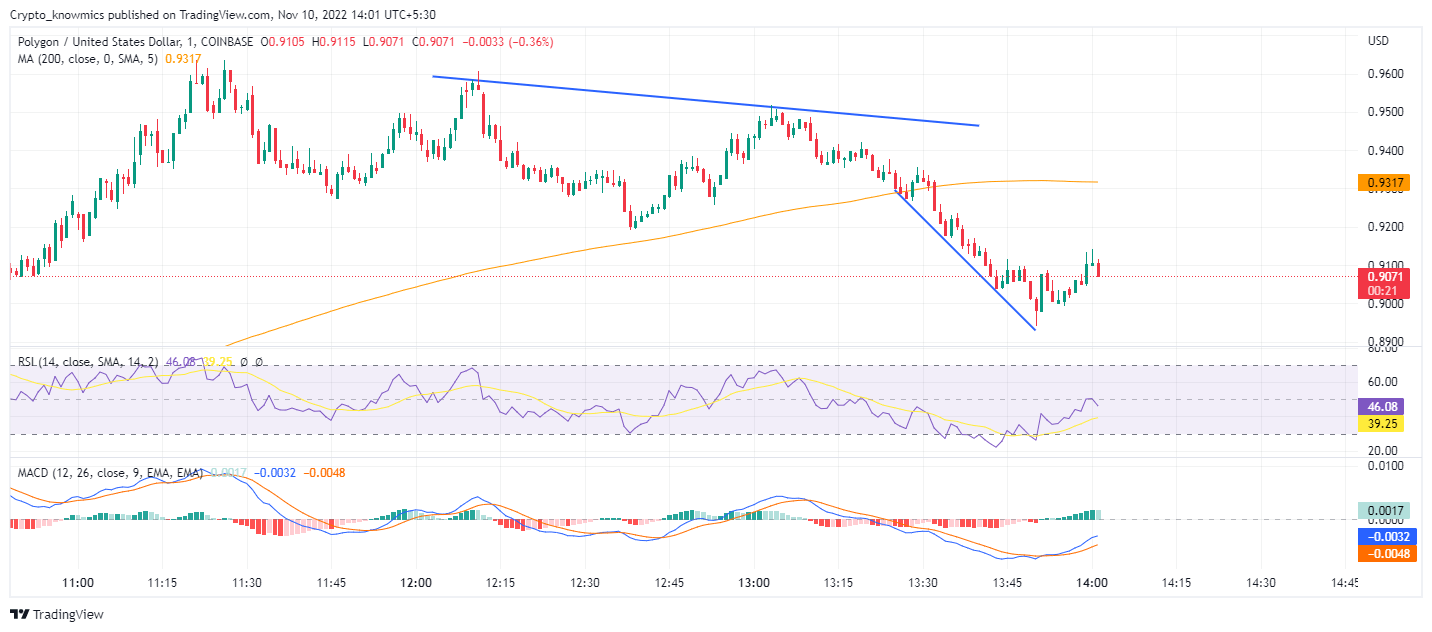

The technical analysis exhibit that MATIC is on the way to reversal, with the 200-day SMA moving above the price line and RSI moving away from the oversold zone. Will you consider buying the MATIC? MATIC also could not prevent itself from a current crypto crash in light of the Binance-FTX deal failure and rising fear of FTX collapse. As the MATIC broke below the $1 psychological mark, it witnessed a 3.69% drop in the last 24 hours and 3.59% in the last 7 days. In the last 24 hours, the MATIC price hit as low as $0.76246131 and as high as $0.97285028. Currently trading at $0.9315 as of writing, the price action showed some recovery signs by growing 0.19% in just the past hour. The price shows the continuation of the uptrend with 200-day SMA teases at the support level showing price recovery.

Key Points

- The MATIC price action shows a bullish reversal approaching the 200-day SMA

- The bullish crossover in the MACD indicator signals a bullish breakout

- The intraday trading volume in Polygon is $1.8 billion.

Source Tradingview

MATIC Technical Analysis

MATIC price breaks above the 50-day and 200-day SMAs approach a recovery rally teasing to reclaim the level of $1 with recent resistance fallout. With the possibility of an uptrend, traders can get multiple entry points at the current market price. The high price rejection in the daily candle showed a possibility of a bearish reversal. However, the sideline trader must wait for the daily candle to reach the $1 mark which may potentially give a bullish breakout.

Technical Indicators

RSI moves sideways in the oversold zone, making multiple bearish and bullish divergences, as it bounced back after touching the 50% level, with a 14-day SMA remaining below RSI, indicating buying opportunity. With a bullish histogram, followed by a bullish crossover the rising gap between MACD and signal lines signals an uptrend in the market, highlighting the right time to buy in the market. The technical indicators display buying pressure due to recovery in the MATIC as 200-day SMA indicates an uptrend, providing traders with multiple buying opportunities with every fallout.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Qtum

Qtum  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Waves

Waves  Lisk

Lisk  DigiByte

DigiByte  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur