May Forecast for Shiba Inu (SHIB) Price: Hold or Sell?

The Shiba Inu (SHIB) price has nearly reached the support line of a long-term pattern. Whether it bounces there or breaks down can be crucial for the future trend.

A breakdown will mean that the entire structure in place for nearly a year is now invalid, and a new bearish trend has begun. On the other hand, a bounce will likely lead to continued consolidation inside the pattern.

Shiba Inu Price Reaches Support of Long-Term Pattern

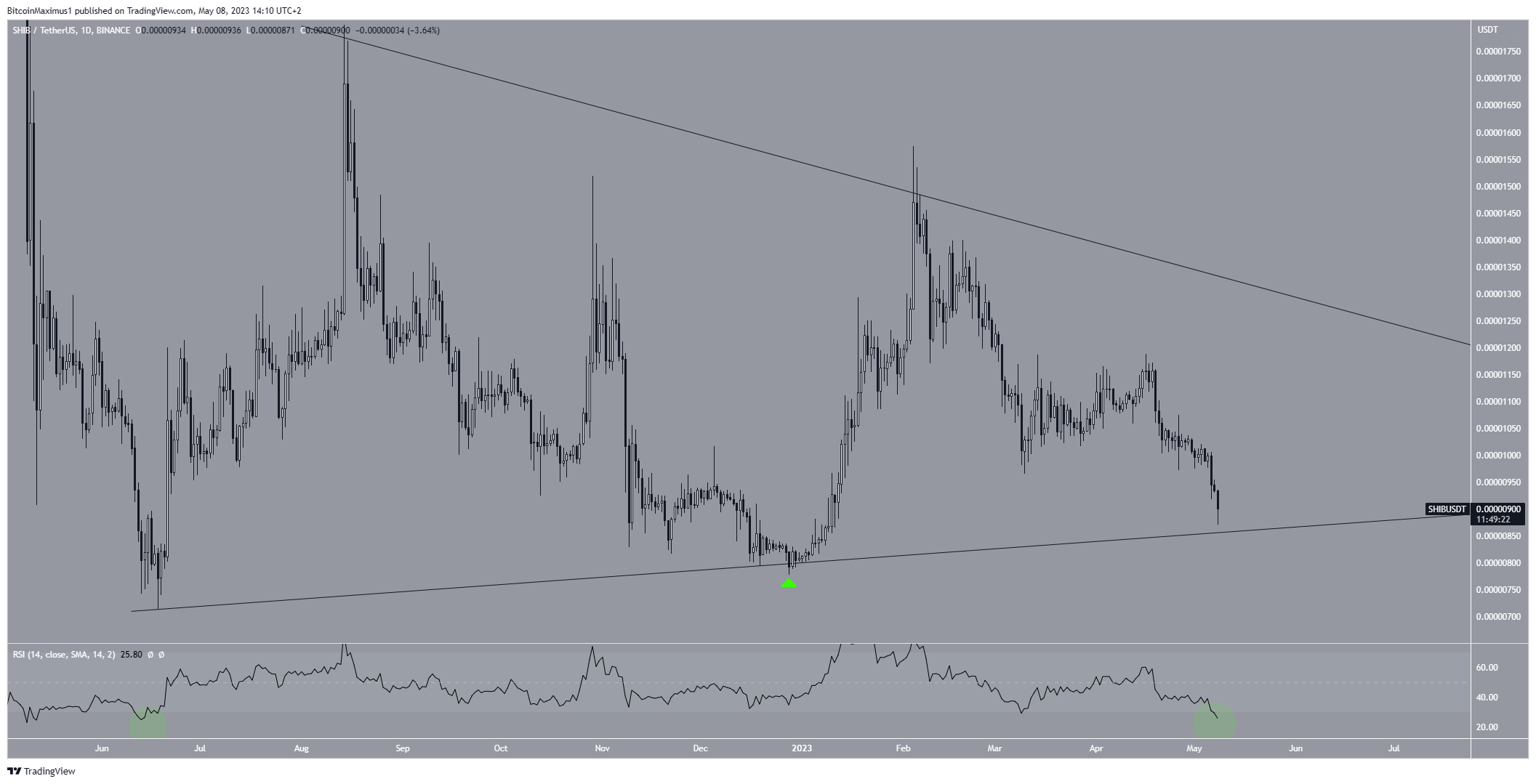

Based on the daily analysis, the price of the Shiba Inu coin has been trading within a symmetrical triangle since June 2022. This pattern is considered neutral, which means there’s an equal likelihood of an upward breakout or a downward breakdown.

Currently, the SHIB price is positioned very close to the triangle’s support line, which has not been reached since the beginning of the year (green icon).

SHIB/USDT Daily Chart. Source: TradingView

The daily Relative Strength Index (RSI) provides conflicting readings. Traders use the RSI to gauge momentum, determine if a market is overbought or oversold, and make decisions about buying or selling an asset.

If the RSI reading is above 50 and the trend is upward, bulls have an advantage. On the other hand, if the reading is below 50, the opposite is true.

The RSI is currently below 50 and decreasing. However, it has also reached oversold territory. A significant upward movement followed the last time it was this oversold (green circle).

SHIB Price Prediction: Will Price Bounce

The technical analysis from the short-term six-hour time frame shows that the meme coin price has fallen inside a descending parallel channel since April 16. These channels are considered bullish structures, meaning that they lead to breakouts most of the time.

The price of Shiba bounced at the pattern’s support line today, creating a long lower wick (green icon). However, it is still trading in its lower portion.

Similarly to the daily time frame, the six-hour RSI is extremely oversold, which could lead to an upward movement soon.

So, a bounce at the channel’s support line would also validate the support line of the long-term triangle. A breakout from the former will likely cause an upward movement toward the long-term triangle’s resistance line at an average price of $0.0000130.

SHIB/USDT Six-Hour Chart. Source: TradingView

However, a price breakdown below the triangles support line can lead to a sharp fall toward the next closest support area at $0.0000057. Which has not been reached since June 2021.

For BeInCrypto’s latest crypto market analysis, click here

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Decred

Decred  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur