OP Price Analysis: OP Price may take a downward correction

- The OP price is currently trading at $2.269 while seeing a change of 44% in 24-hour trading volume.

- The OP price is observing an increase of 1.45% in the last 24 hours.

- The OP price might make a bearish correction in the upcoming days.

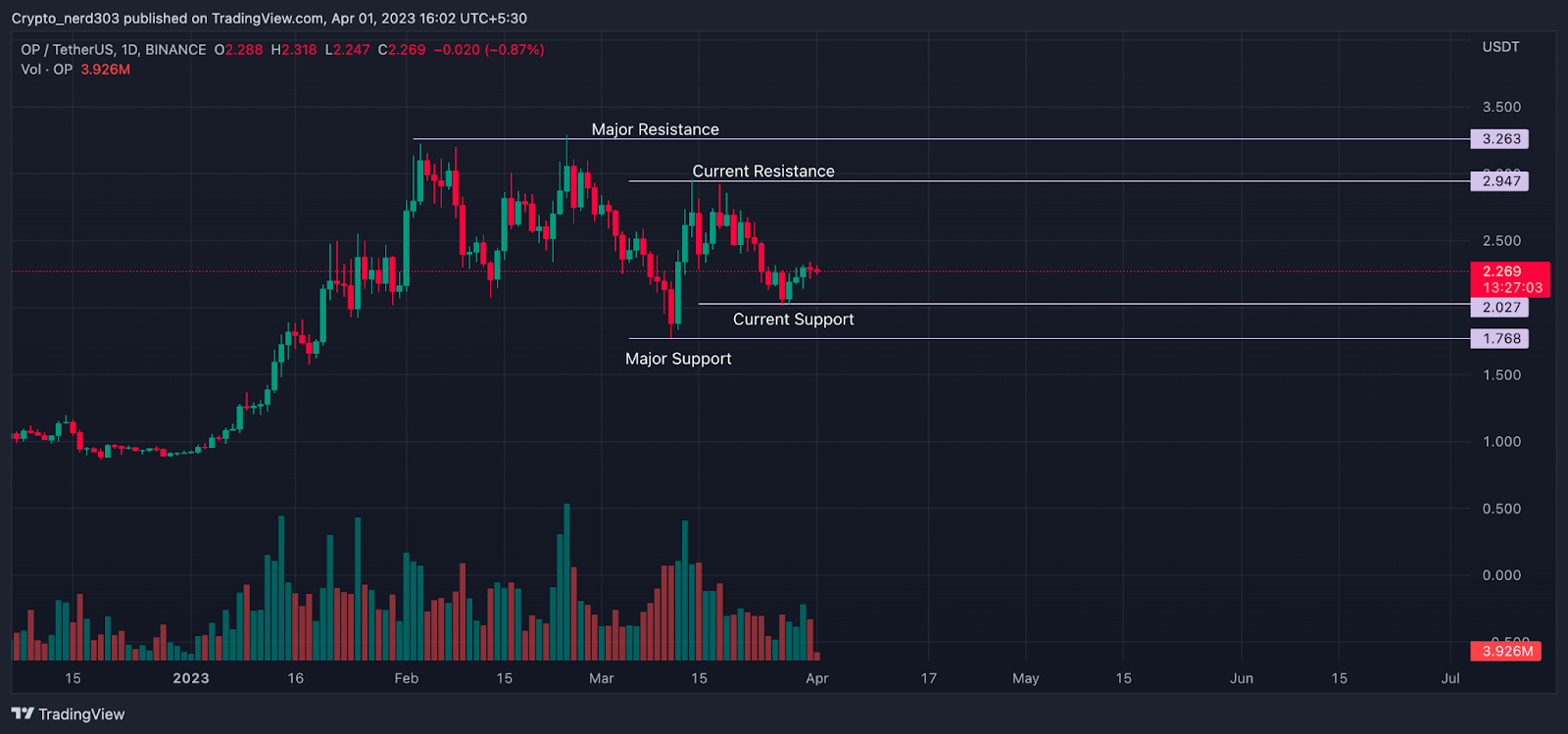

The bears are currently making a severe attempt to take control of the OP price action. After taking rejection from the price of $3.263 twice the OP price made a bearish double-top pattern followed by a lower low. The double-top is an M-shaped bearish reversal pattern that is often seen at the top of a trend.

In the double top pattern, a price after making a higher high takes rejection from the previous resistance level indicating that the buyers are refusing to support the price above the rejection point which is often followed by a sharp downfall. At this point, the sellers start taking over the price action.

OP price making a bearish reversal on the (Daily Timeframe)

Source: OP/USDT by TradingView

As illustrated in the image given above the OP price after taking support from $1.000 made a bullish rally and started trading on an uptrend. After making an extremely bullish rally the price took a rejection from $3.263 it made a bearish correction of 35 percent the OP price made another attempt to cross above the resistance level but did not succeed.

From that point, the price made a severe downfall of 45 percent, breaking the previous bull trend by making a lower low pattern. Subsequently, the OP price made a lower high which might be followed by a lower low. Although OP price has major support below the current level in the form of 200 EMA.

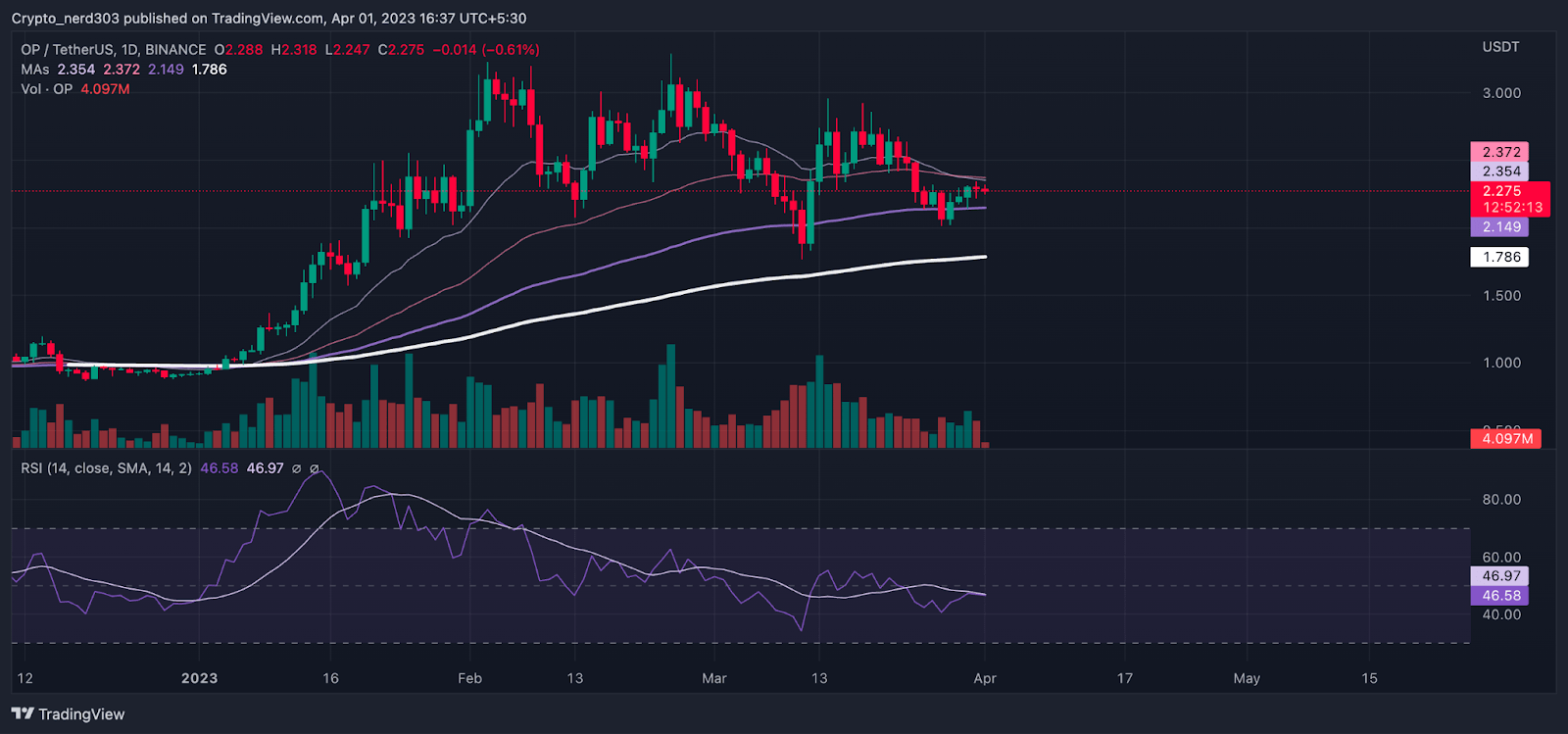

Technical Analysis ( On 1 Day Timeframe )

Source: OP/USDT by TradingView

The RSI line after reaching the overbought level in early January started making a divergence from the price action. Where the price was making a higher high and higher low RSI line was making a lower high and lower low. Which is a bearish reversal signal. After this Open Network price broke its bull trend near early march when the RSI line crossed below the median line. The current RSI value is 46.72 points which are taking resistance from the 14 SMA around 46.98 points.

Conclusion

The Open Network price is currently trading above the 200 EMA which is a critical EMA line that indicates whether the particular price action is on a bull or bear trend. According to this, the OP price is currently trading on the overall bull trend. Although the price action and indicators are suggesting that Open Network price can take a bearish correction. The 20 EMA has recently crossed below 50 EMA whereas, on the other hand, Open Network is also taking resistance from 50 EMA. From which it can make a downfall of 21 percent.

Technical levels –

Support -$2.027 and $1.768

Resistance – $3.000 and $2.600

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational purposes only, and they do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  EOS

EOS  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  0x Protocol

0x Protocol  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Siacoin

Siacoin  Ravencoin

Ravencoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Lisk

Lisk  Ontology

Ontology  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD