Pepecoin Shakes Memecoin Market And Warning Rings

In less than a couple of weeks since it came out, the PEPE memecoin has made it to the top 100 projects list, receiving a market cap of a whopping over $1 billion dollars. However, PEPE can be the next trend or not, it is impossible to confirm because it is surrounded by many warnings despite the frenzy of investors.

PEPE’s impressive numbers

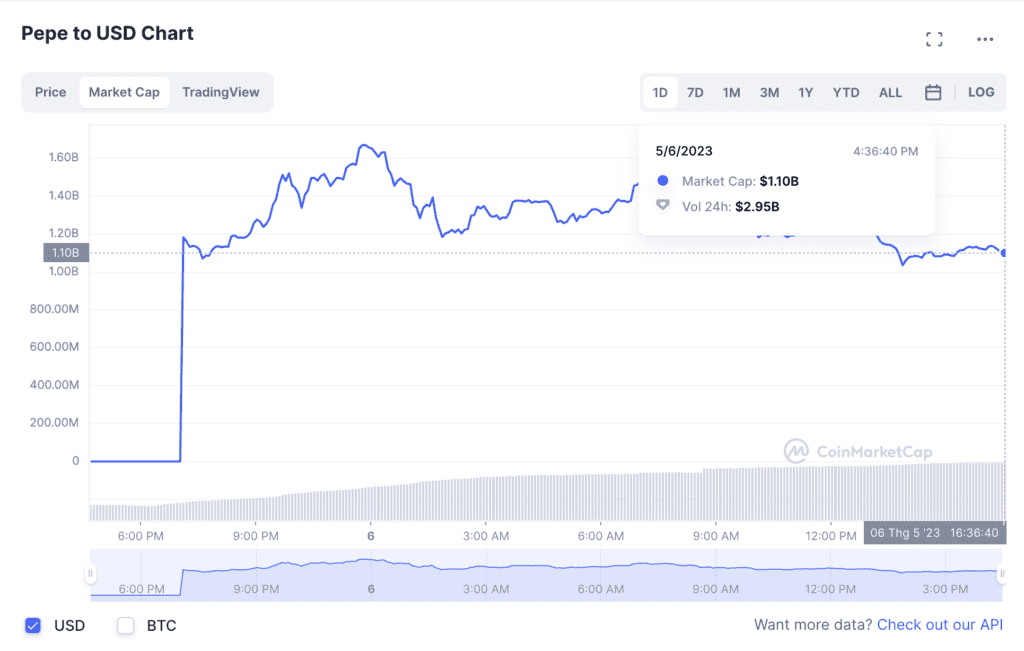

At the time of writing, despite having passed the peak, Pepecoin capitalization is still valued at more than $1.1 billion and is still increasing over time. According to data from CoinMarketCap, PEPE is currently ranked 44th in market capitalization.

Source: CoinMarketCap

And after only 4 days of launch, Pepecoin has grown more than 500 times, and there are more than 25,000 transactions taking place for this token. And the top keyword searched on Twitter also mentioned this memecoin From there, we can easily see the FOMO of the market not only with PEPE but also with memecoin.

Binance exchange on the afternoon of May 5 could not sit out of the Pepecoin fever anymore when it announced the listing of this memecoin. It was immediately followed by the listing announcement of competitor Kucoin, which further fueled the token’s heat.

It is known that with its hot growth, Pepecoin not only brings a new breeze to the market, and it also delivered record-high returns for some early investors.

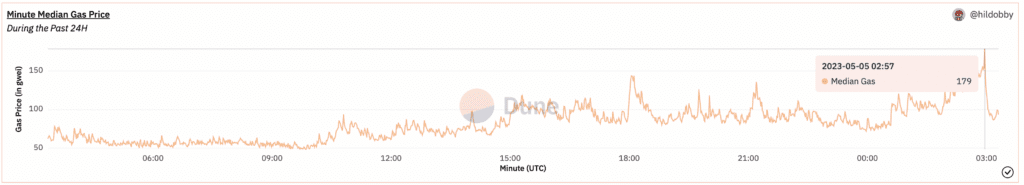

The average daily gas price, or transaction cost, hit a 12-month high of 87 gwei — one gwei equals one billionth of ether (ETH) — earlier this week. The value has increased by more than 50% since the launch of the Pepecoin on April 18, according to an analyst nicknamed @hildobby’s Ethereum Gas Tracker on Dune Analytics. On Monday, the average one-minute gas price rose beyond 150 gwei. According to analytics firm CoinMetrics, this increase represents strong demand for the Ethereum network, mainly from meme-coin traders.

Uniswap’s version(v)2 and v3 liquidity pools for PEPE-WETH are the most active liquidity pool contracts by the number of trades over the past seven days, with over 82,750 and 72,950 trades, respectively, according to Nansen data.

These two liquidity pools have collected nearly $900,000 in cumulative fees over the same period. The only two liquidity pools with more accumulated fees are the USDC-WETH and WETH-WETH liquidity pools, highlighting the recent obsession with this green frog-inspired token.

Alarm bells

Like other memecoins, although it is profitable in a short time, it comes with countless risks that investors need to be aware of.

Changpeng Zhao (CZ), CEO of the Binance exchange, as well as the Kucoin exchange, issued a note about the high volatility of PEPE and FLOKI on Twitter to warn over 8.4 million followers and worldwide crypto community kit about the plan to list PEPE and FLOKI on Binance.

The tokens have rallied from strength to strength over the past week, even as skeptics warn of an impending collapse. The biggest pepecoin holder is holding over $1 million worth of tokens as the risk of having too many coins in too few hands looms in the short-term future of the prevailing meme coin.

The largest holder is holding over $1 million worth of tokens as the risk of having too many coins in too few hands looms in the short-term future of the prevailing meme coin.

Analysts have raised concerns about the behavior of investors who purchased relatively large amounts of PEPE following its release on the Ethereum blockchain, turning around $1,200 in initial capital to over $9 million in just over $9 million in just over a year some days.

The frenzy surrounding the frog-themed token last week drove the coin’s market cap from a few thousand dollars to over $150 million and generated massive hype, attracting liquidity from investor transactions and promoting the same amount of tokens on other blockchains.

Liquidity exit is still a concern. The data shows that trading pools for pepecoin on the Uniswap decentralized exchange hold less than $4 million in available liquidity as of Tuesday. As a result, a sudden sale by a top holder has a price may increase immediately.

The wallet with the largest amount of this memecoin holds more than $1.1 million in tokens after purchasing them with several dollars’ worth of ether (ETH), data from Flipside Crypto operating under the pseudonym @deebs_defi shows to see. The same wallet also holds $1.1 million Shiba Inu (SHIB) and $1 million Floki (FLOKI), indicating that the owner is an active meme-coin trader. The investor holds $43,000 worth of ether.

Data from Lookonchain shows that five wallets connected to “pepecexwallet.eth”, which received funds from the this memecoin development contract, cumulatively purchased more than 8.87 billion PEPE after release for only $385, sold the hoard a few days later for more than $1.23 million.

1/ We found that 5 addresses related to pepecexwallet.eth bought 8.87T $PEPE at a low price, and the cost was ~0.19 $ETH ($385).

Then sold 7.76T $PEPE for $1.23M on #DEX, made nearly $1.23M (3,200x)! pic.twitter.com/hIvTJX6UTK

— Lookonchain (@lookonchain) April 24, 2023

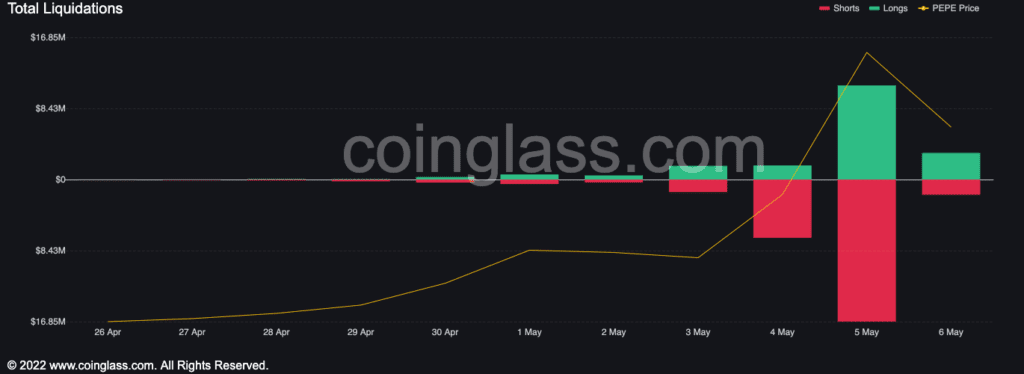

The 80% price increase in 24 hours, resulting in account errors, was too significant for these traders. CoinGlass data shows a sell order, so PEPE lost at least $11 million across several exchanges in the last 24 hours – of which traders lost $5.5 million on exchanges alone. OKX crypto exchange, the highest number among partners.

Traders lost another $2.2 million on Huobi, about $3.6 million on Bybit, and several hundred dollars on BitMEX. All of these exchanges started offering PEPE futures trading in the past week.

PEPE error accounts are only third behind liquidation accounts that merge bitcoin (BTC) and ether (ETH) futures, often causing the highest futures error accounts.

Copyright issue

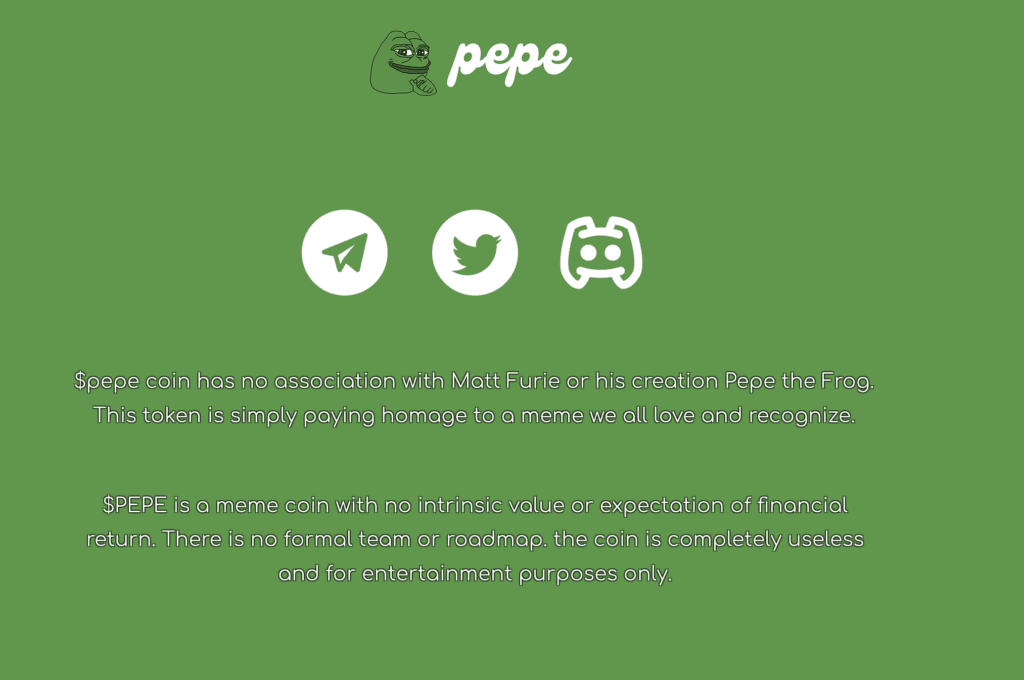

Despite this impressive growth, there is little astronomical value of Pepecoin. The token does not own the artwork on the site and its logo and has no utility or roadmap.

Worse yet, Pepe’s creator, Matt Furie, is not a fan of its use of the character in blockchain-based projects. The artist has used his copyright to work on Pepe-themed projects before.

In August 2021, Furie took down a $4 million Pepe-themed NFT collection from OpenSea. After Furie submitted a takedown request under the Digital Millennium Copyright Act (DMCA), OpenSea removed the Sad Frogs collection.

As in the previous case, Furie has several legitimate avenues to pursue this token. Artists can issue DMCA takedown requests against Pepe exchanges and websites, and they could also take legal action against this memecoin creators.

Its website acknowledges that $PEPE has no connection to the original Pepe the Frog meme or Matt Furie. The site also urges potential investors to refrain from expecting financial returns. However, possible legal action could snuff out these hopes, hurting users who have decided to invest in the token.

Conclusion

Currently, most of the memes on the market do not have a specific community service purpose, instead, they only have the effect of creating Trends for a certain period. Great investment opportunities and high returns are what Meme Coins like PEPE bring to investors. However, they also come with huge risks associated with Scams and Rug Pull tricks. In addition, the Crypto market is highly volatile and not a place for those who like stability.

DISCLAIMER: The Information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to do your own research before investing.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur