Polkadot Could Present Buying Opportunity As Bullish Outlook Continues

The Polkadot price has breached the $5 resistance mark in the past trading sessions. Over the last 24 hours, DOT has appreciated by 3.8%. The price of Bitcoin has been surging, which has caused other altcoins to also move upward on their respective charts.

When Bitcoin crossed the $18,000 price mark, other altcoins broke past their immediate resistance marks. Polkadot price momentum remains bullish in the shorter time frame. The technical outlook for DOT showed that despite a price correction, accumulation on the chart increased.

Related Reading: This Metric Suggests Bitcoin Could Be In Danger Of Another Selloff

Polkadot demand also showed an increase on its chart. The asset’s price has to remain above the $5.40 support line and breach the $6.20 resistance level if the coin has to maintain a bullish stance for a longer time frame.

The daily chart of DOT also points towards an incoming fall in price, which means that traders might be presented with shorting opportunities. Currently, DOT is trading at an 89% discount from its all-time high secured in 2021.

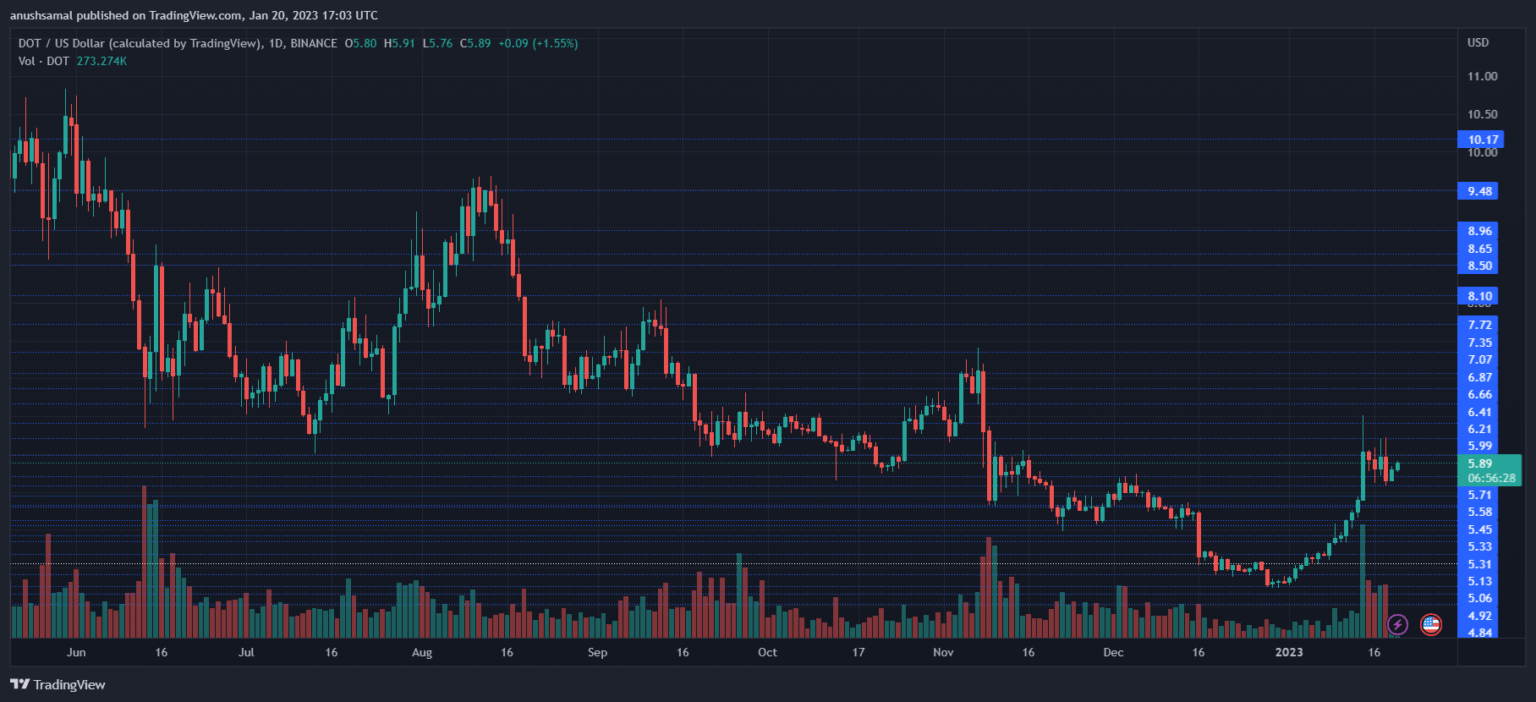

Polkadot Price Analysis: One-Day Chart

DOT was exchanging hands at $5.89 at the time of writing. Polkadot had formed a cup and handle pattern, which means that the bullish momentum can continue, which is why Polkadot resumed its northbound journey on the daily chart.

Overhead resistance for the coin stood at $6. Toppling the $6 mark can take the coin to $6.20. As Polkadot was overbought, demand for the coin could trickle down.

This can cause the price to fall for a few trading sessions before it starts to rise again. In case of a price retracement, DOT will encounter its local support at $5.40 and then at $5.33.

These two levels can be an entry point for buyers, as the altcoin will rise in value after it touches these support lines. The amount of Polkadot traded in the last session was still green, indicating that buying pressure remained.

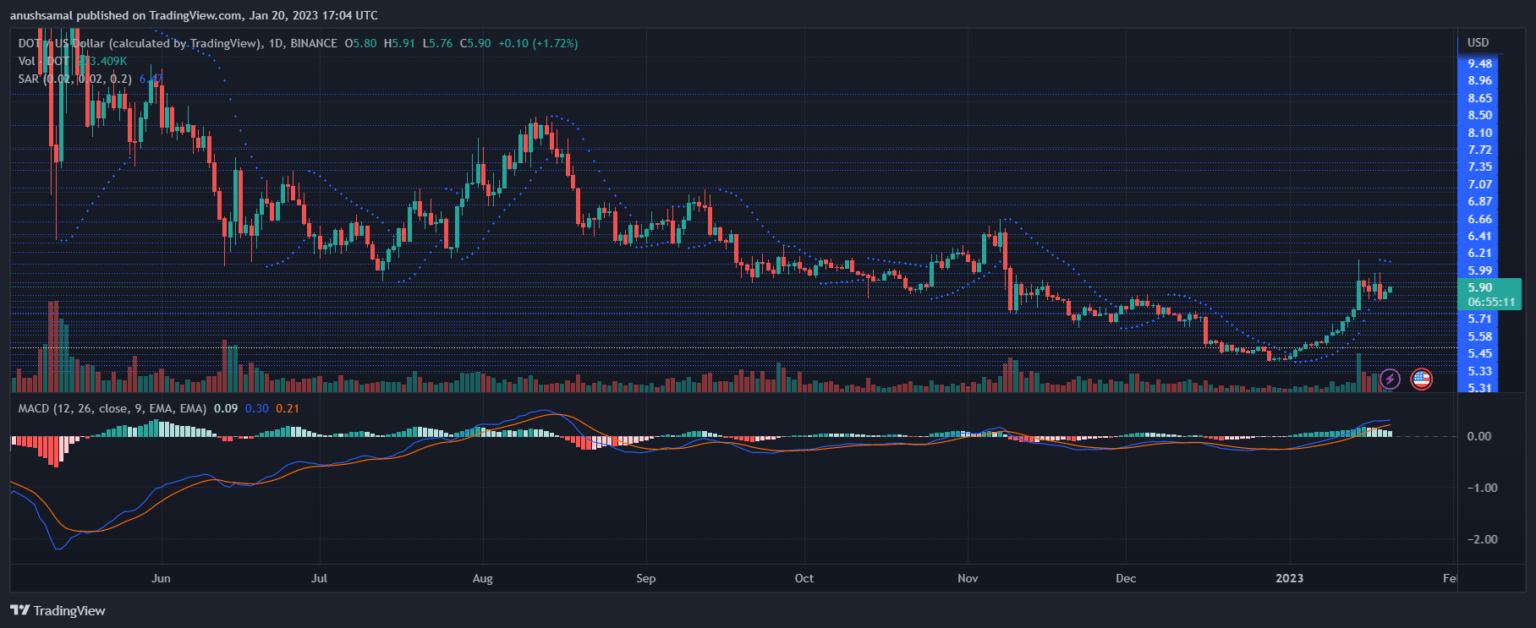

Technical Analysis

The asset had secured a multi-month high in registering demand in the past week. The coin was overvalued a week ago, and as a result, demand has retraced slightly. The Relative Strength Index fell back from the 80 mark, which was a sign of the asset being overbought.

At press time, DOT again registered an uptick, indicating that buying strength was building again. On that note, the price of DOT was above the 20-Simple Moving Average line, hinting that buyers were driving price momentum in the market.

The coin was also above the 50-SMA (yellow) line. Despite that, the 50-SMA line crossed above the 20-SMA line, which signified a death cross. A death cross means an incoming fall in value. This reading corresponds to traders finding the chance to short the asset.

The Moving Average Convergence Divergence (MACD), which depicts price momentum and reversals, showed declining buy signals. This means that the price will fall over the next trading session.

Related Reading: Shiba Inu (SHIB) Is Up 4% As Lead Dev Teases Exact Beta Launch Date

The Parabolic SAR also sides with the MACD as the dotted lines were formed above the price candlestick, indicating that the asset’s price direction was starting to become negative. Overall, the bulls could continue to dominate the price action in the shorter time frame.

Featured Image From UnSplash, Charts From TradingView.com

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur