Popular Crypto Analyst Issues Ethereum Warning, Details Catalysts That Could Trigger Massive Plunge

Widely followed cryptocurrency analyst Benjamin Cowen is warning that Ethereum (ETH) may collapse due to at least one big economic worry.

In a new strategy session, Cowen tells his 779,000 Youtube subscribers that the leading smart contract platform could decline by more than 65% from its current price of $1,174.

“I do think you’re still looking at a leg lower here on Ethereum’s valuation against the US dollar. I think around that $400-$600 range is a good spot to begin looking for that same type of value that we saw in the last cycle.”

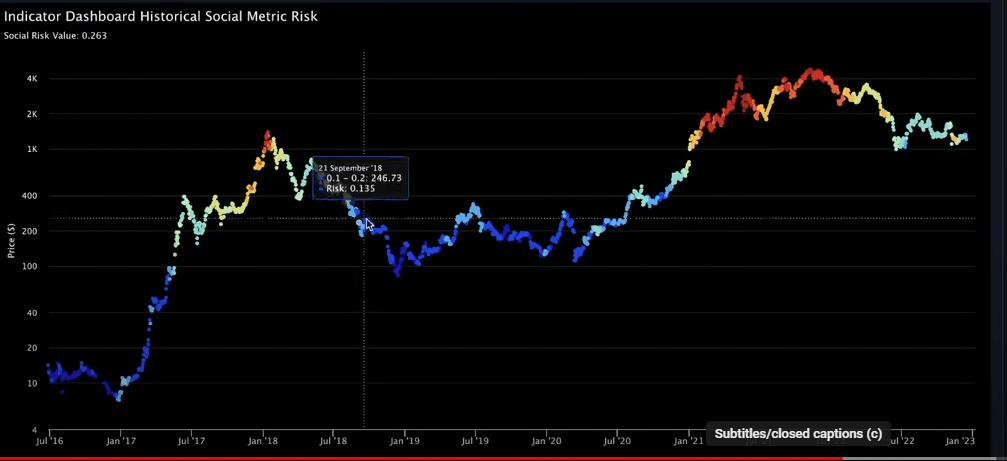

Cowen is also keeping a close watch on the social risk metric, an indicator that gauges retail interest in the space by tracking the number of people tuning in to crypto YouTube channels and following accounts on Twitter dedicated to digital assets.

According to Cowen, Ethereum’s social risk metric suggests that ETH is setting up for another sell-off event.

“I still think Ethereum is likely looking at lower prices eventually. I think this is supported by the idea of the social risk. Social risk is finally putting in new lows. When the social risk is going down typically the Bitcoin dominance goes up…

As a social risk plummets like it did back over here in 2018, that was where Ethereum took its next leg down.”

Source: Benjamin Cowen/YouTube

Cowen also says that a looming recession, likely to be triggered by the Federal Reserve’s sustained interest rate hikes, would drive Ethereum way down.

“I understand that you know a $600 Ethereum or even a $400 Ethereum is another 50% correction or more from these levels. But I do think there is reason to think that it could happen, not only from a price perspective and a technical perspective.

And I know there’s sort of the fundamental idea of all the Ethereum that’s been burned and whatnot. But the other side of it is that we are looking at a recession…

If a recession is coming, it’s likely not a good thing for risk assets like cryptocurrencies.”

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Ontology

Ontology  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Pax Dollar

Pax Dollar  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur