Price Indicators Point to a Reversal, Casting Doubt on APT Bullishness

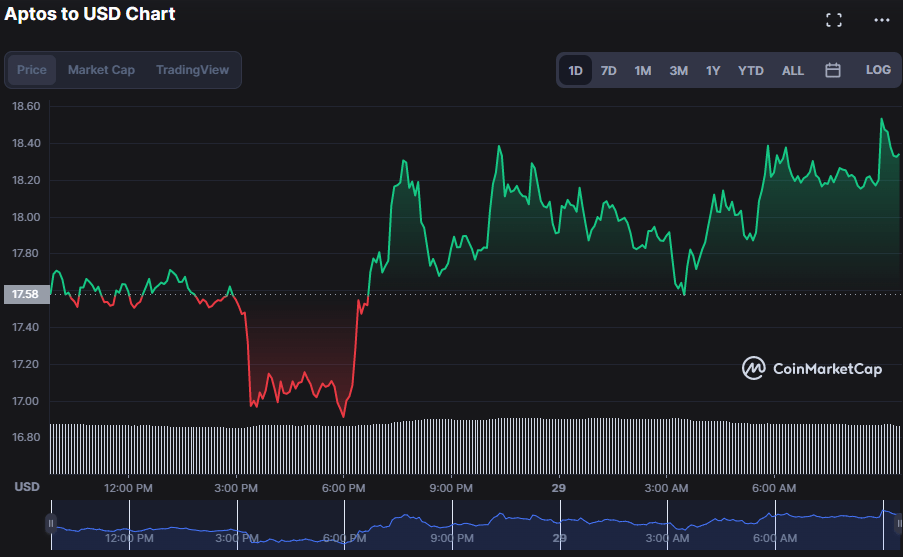

After an early-morning back-and-forth between bulls and bears in the Aptos (APT) market, bulls ultimately prevailed, driving prices up to an intraday high of $18.53 after finding support around $16.90. This bullish run continued until press time, valuing the APT price at $18.14, a 3.46% increase.

The APT market capitalization grew by 3.64% to $2,922,609,502, due to the bullish dominance; nevertheless, the 24-hour trading volume dipped by 3.83% to $1,170,725,386. Due to a drop in 24-hour trading volume and a flagging bull run, investors would be wise to tread carefully for the time being.

APT/USD 24-hour price chart (source: CoinMarketCap)

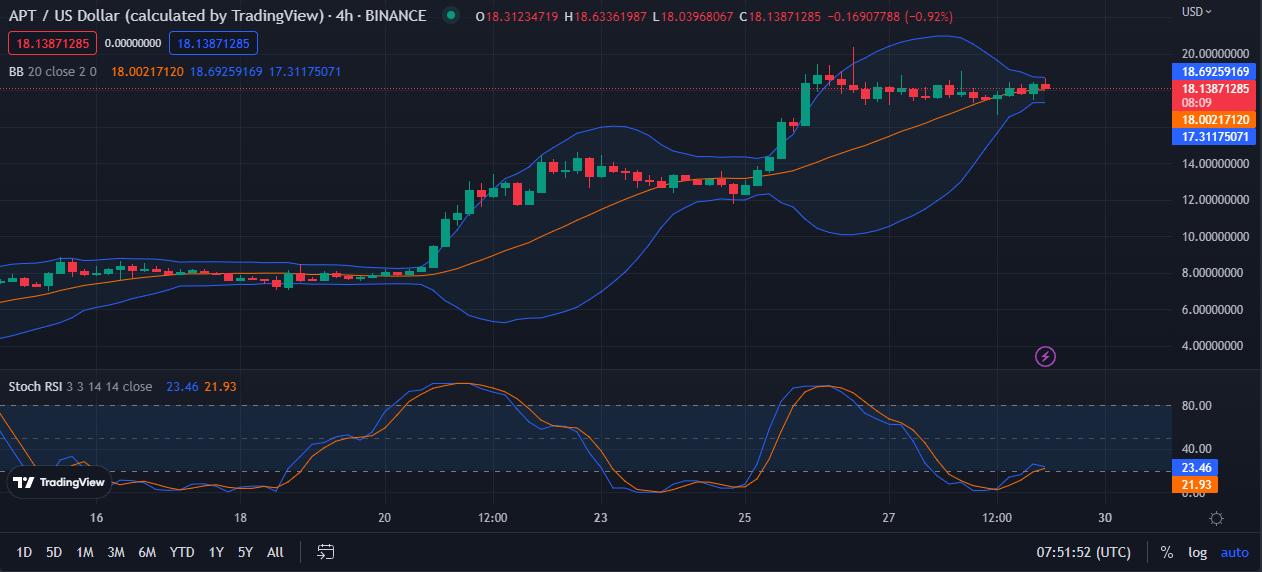

The linear movement of the Bollinger Bands, which presently lies between the upper and lower bands at $18.69379324 and $17.31183670, indicates that the APT market is stabilizing. This relatively flat trend suggests that the market may not see any significant price fluctuations in the foreseeable future, as traders and investors alike have grown more confident with present pricing.

Given that the stochastic RSI for APT’s 4-hour price chart is currently at 25.39, it appears that bullish momentum in the market is waning and that bears may soon have an opportunity to regain control of the market. The market may enter a period of negative trading as a result of the bears’ expected increase in aggression. This might be bolstered further by the decreased amount of trading activity, which suggests a lack of excitement among traders to take on long positions.

APT/USD 4-hour price chart (source: TradingView)

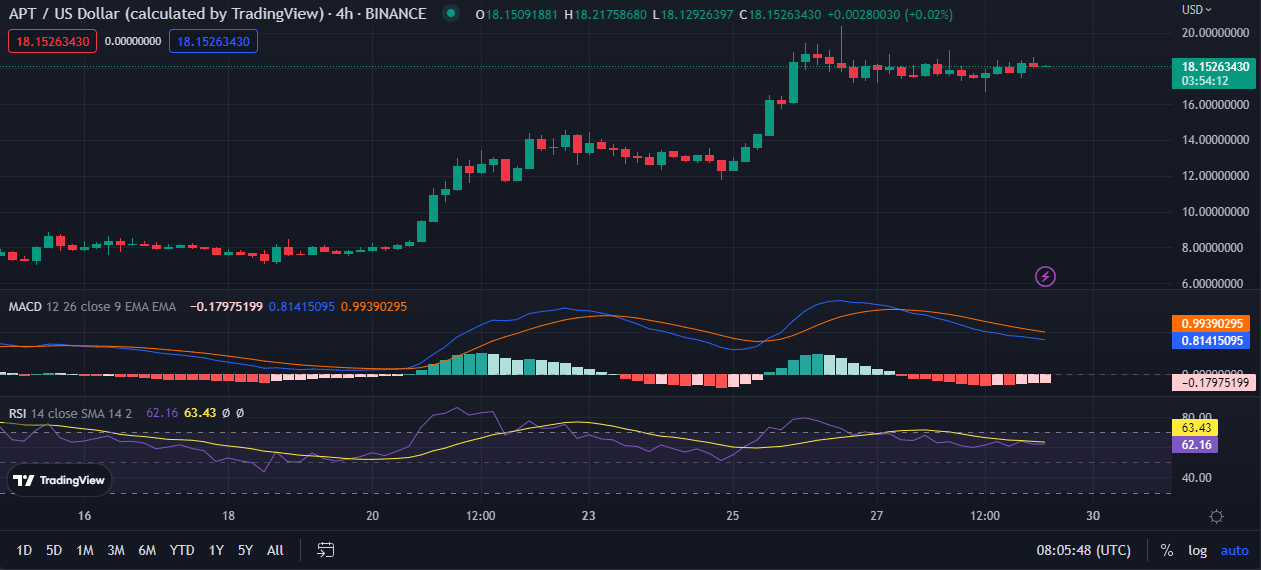

The MACD line’s recent dip (0.85140209) below its SMA line supports this bearish forecast. When the MACD line is below its SMA line, it implies that selling pressure is high and that the bears are likely to control the APT market till the MACD line crosses back above its SMA line.

Additionally, the 62.61 value for the Relative Strength Index (RSI) on the APT price chart reveals that the RSI has dropped below the signal line, signaling that the price of APT is about to collapse. This shift in the RSI is indicative of a possible reversal in the near future, as the uptrend is losing momentum.

APT/USD 4-hour price chart (source: TradingView)

Bulls must propel prices higher and maintain the present resistance level in order to wipe out the unfavorable signs on the Aptos market.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur