RVN Technical Analysis: Bullish Trend in Ravencoin Eyes $0.15

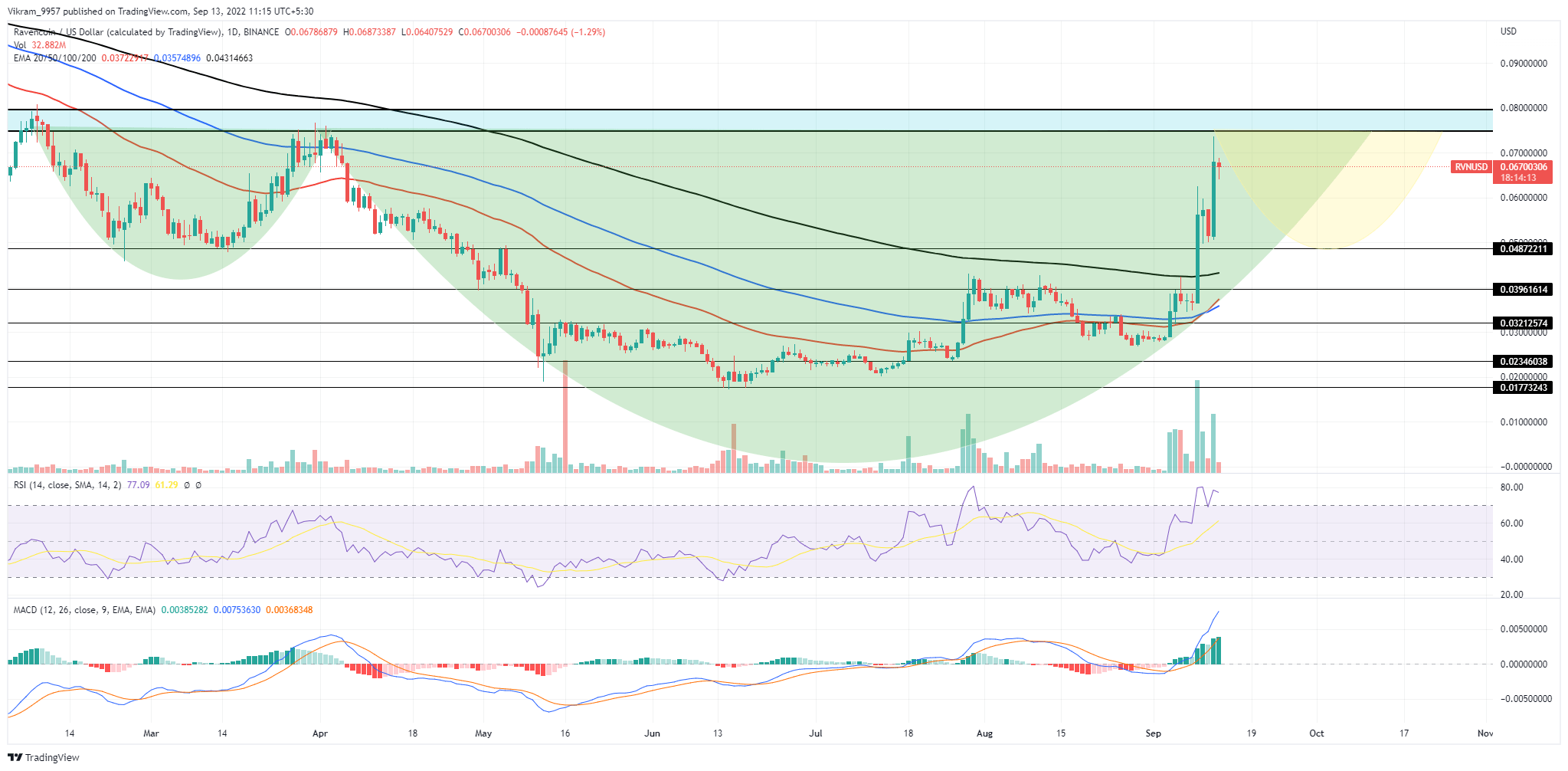

RVN price chart shows an inverted head and shoulder possibility, which may push the Ravencoin market value above the $0.1 mark. The bullish reversal rally exceeded the psychological mark of $0.050 and approached the overhead supply zone at $0.075. However, the selling pressure growing at the supply zone teases a bearish turnaround. Nonetheless, the growing underlying bullishness teases an inverted head and shoulder possibility if the reverting prices take support at the $0.050 mark.

Key Points:

- The Ravencoin price action shows an increased selling spree at $0.075.

- The bullish crossover of the 50 and 100-day EMA reflects solid underlying bullishness.

- The intraday trading volume in Ravencoin is $475 million.

Source — TradingView

RVN Technical Analysis

As mentioned in our previous article, the RVN prices reclaim the psychological mark of $0.050 and continue challenging the overhead resistance of the $0.075 supply zone. However, the increased selling pressure at the supply zone results in a higher price rejection in the bullish candle and influences bearishness on the daily candle. The daily candle shows a reduction of 9.15% in market value with 17 hours left on the clock. Hence after the phenomenal uptrend of 140% within a week, the increased selling pressure teaser returns of the $0.050 breakout. However, the bull run results in a bullish crossover of the 50 and 100 EMA, which increases the possibility of a golden crossover. Nonetheless, the increasing selling pressure warns of a retracement rally to retest $0.050. On a bullish note, if the reverting prices restart, the bullish trend from $0.050 will inchoate an inverted head and shoulder pattern with a neckline at $0.075. The breakout of this pattern will result in a rally surpassing $0.10 and reaching the $0.15 mark.

Technical Indicators

The daily-RSI slope shows the bullish reversal losing momentum as it signals bearish divergence in the overbought zone. However, the MACD indicator is yet to show any weakness, but the slight flaw in the bullish histogram forecasts a difficult time shortly. Thus, the indicators maintain a buy signal for the RVN token. Resistance Levels — $0.075 and $0.10 Support Levels — $0.050 and $0.045

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Monero

Monero  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  Tether Gold

Tether Gold  OKB

OKB  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Gate

Gate  Algorand

Algorand  Dash

Dash  VeChain

VeChain  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  Decred

Decred  IOTA

IOTA  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Enjin Coin

Enjin Coin  Ontology

Ontology  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur