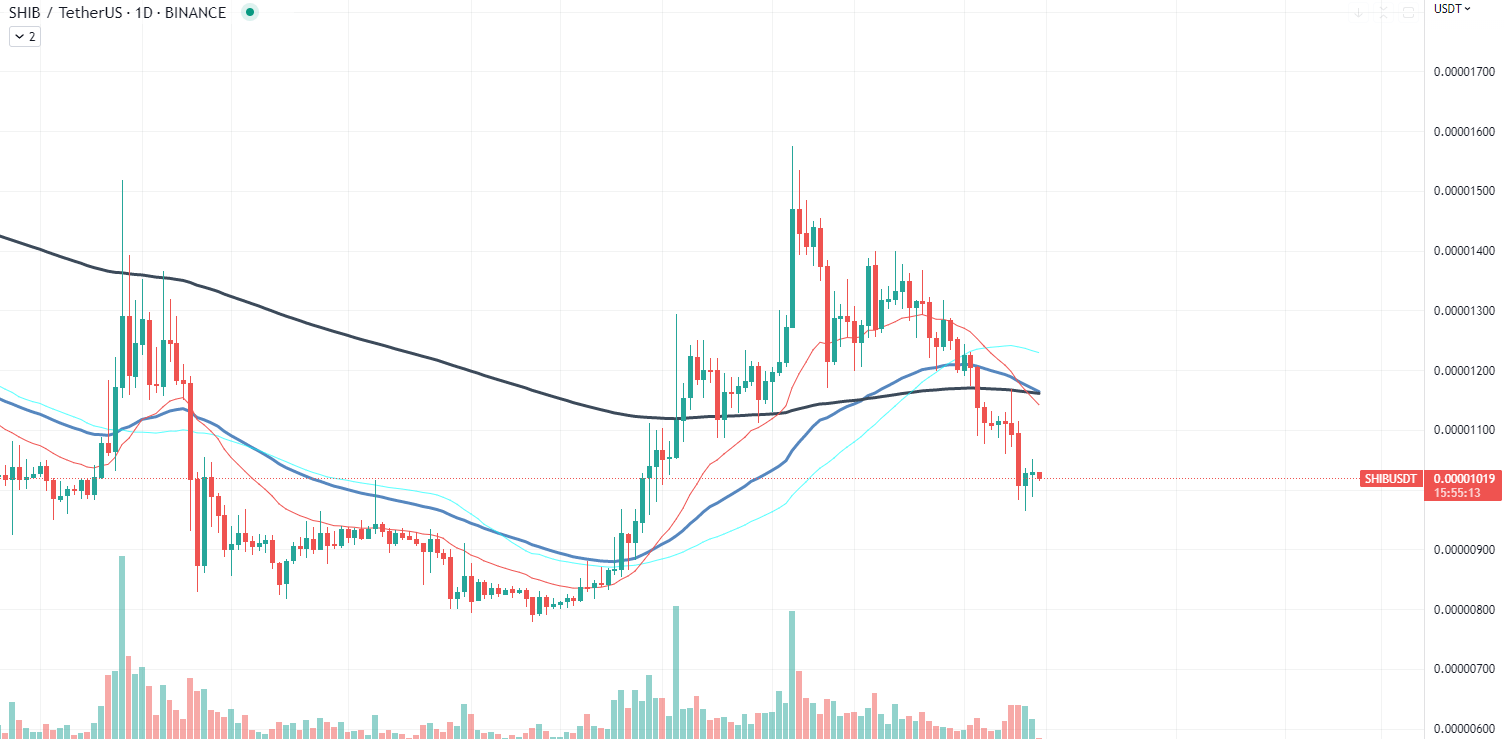

Shiba Inu Burn Machine Has No Effect on 590 Trillion SHIB Supply, Data Shows

Shiba Inu, the meme-inspired cryptocurrency, has been burning millions of its tokens since its creation. However, the burning mechanism that is supposed to reduce the circulating supply of SHIB does not seem to be very effective in terms of affecting its value on the market.

Despite daily burns of around 100 million SHIB, the token’s value remains largely driven by speculative interest rather than the amount of assets sent to burn addresses. This raises the question of why the burn rate might be ineffective.

One possible explanation is that the burning mechanism does not take into account the psychology of the market participants. The amount of tokens burned on a daily basis might seem significant on paper, but in practice, it might not be perceived as such by traders and investors.

Moreover, the burn rate might not be sufficient to offset the inflation caused by the SHIB token supply. In other words, the burning mechanism might not be able to keep up with the rate at which old tokens lose their value due to the enormous supply.

Another factor that might affect the effectiveness of the burning mechanism is the fact that most of the tokens are held by a small number of addresses, commonly referred to as whales. These large holders might not be willing to participate in the burning process, either because they do not see the benefit of reducing the supply or because they want to maintain their control over the token.

Furthermore, the speculative interest around the token might be driven by factors other than the burning mechanism. For example, the token’s popularity on social media and support of high-profile figures might create hype that fuels the demand for SHIB, regardless of the amount of tokens burned.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Siacoin

Siacoin  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Zcash

Zcash  Basic Attention

Basic Attention  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Hive

Hive  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD