Shiba Inu (SHIB) at Critical Level Following Massive Investor Outflow

Shiba Inu, the popular meme-inspired cryptocurrency, has recently faced a sudden 9% drop in its value, leaving many investors concerned about the future of the asset. The unexpected decline occurred in the aftermath of the drama involving the revelation of the identity of Shiba Inu’s creators and the situation around the Shibarium network, as well as the general derisking of the market.

Currently trading at $0.00001, Shiba Inu has failed to break through its 50- and 200-day moving averages, indicating a continuation of the downtrend that has persisted since the beginning of February. The sudden drop has left many investors wondering whether Shiba Inu will be able to recover from this setback, or if the downward trend will continue in the coming weeks.

Despite the recent dip, Shiba Inu has had a strong year so far, gaining widespread popularity and attracting a growing number of investors. However, the volatility of the cryptocurrency market has made it clear that investing in such assets comes with significant risks.

Binance Coin benefits

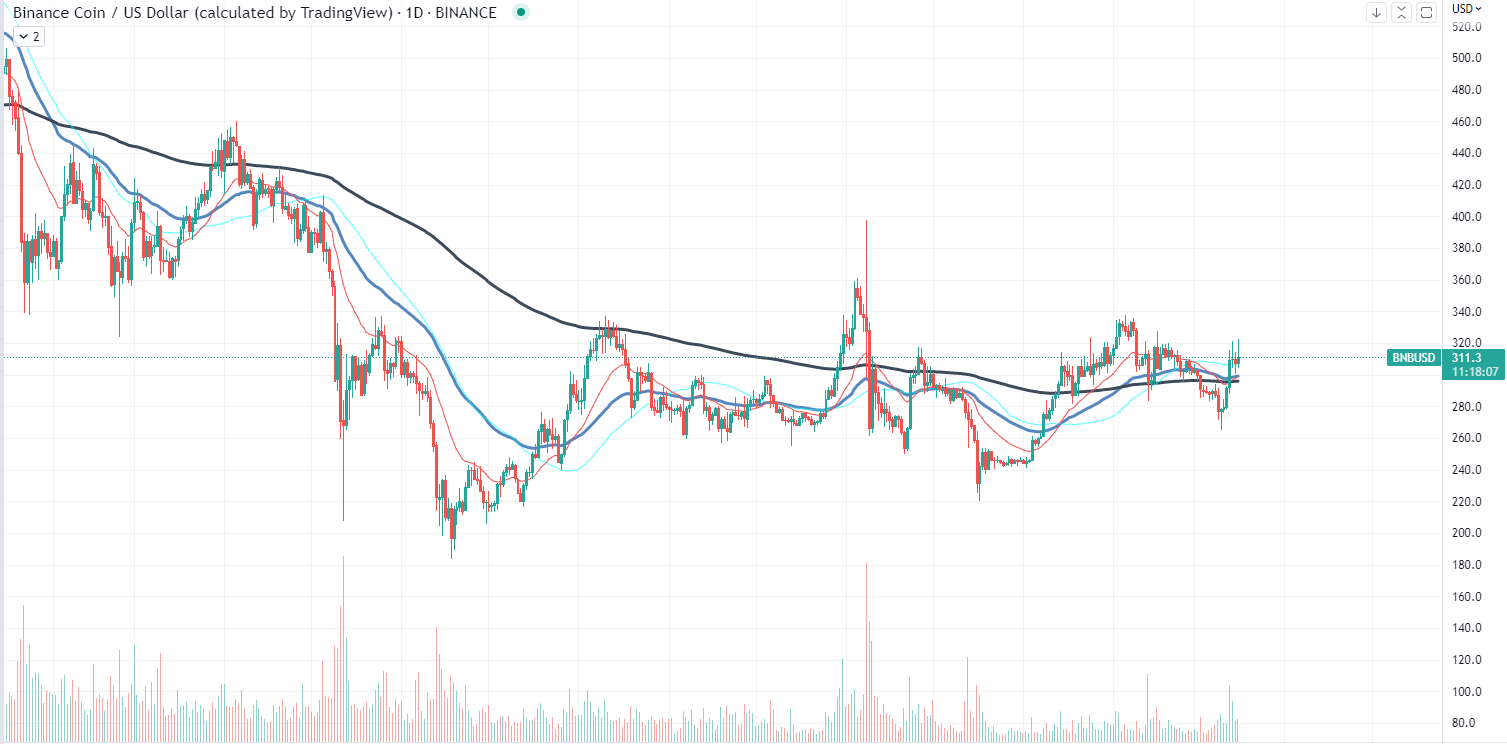

Binance Coin (BNB) has been seeing a significant uptick in value over the past few days, thanks in part to a massive $1 billion injection from the exchange’s stabilization fund. In a move aimed at stabilizing the performance of the exchange, Binance announced that it would be buying $1 billion worth of Bitcoin (BTC), Ethereum (ETH) and Binance Coin (BNB) on the market.

Since the announcement, BNB has seen a significant increase in value, gaining over 15% in just three days. This has made it one of the top-performing assets on the market, with its current trading price at $317.

This massive injection of funds has come at a crucial time for Binance, as the exchange has been facing increased scrutiny from regulators in various countries. With more and more countries imposing stricter regulations on cryptocurrency exchanges, Binance has been taking steps to ensure that it remains compliant with these regulations. The $1 billion investment is part of this effort, aimed at maintaining the stability and performance of the exchange while also helping to allay concerns from regulators.

Lido Finance loses traction

Lido Finance, a decentralized finance (DeFi) protocol providing staking services for Ethereum, has experienced a significant drop in its value. The project plummeted by over 19% in value after the creator of Maker DAO and some whales sold their LDO positions in favor of other assets.

The sudden drop in Lido Finance’s value is likely due to increased selling pressure from these high-profile individuals. The move could also indicate the decreasing popularity of Ethereum staking or Lido’s product in particular, which could lead to decreased demand for LDO tokens.

The drop in Lido Finance’s value is part of a larger trend of decreasing volatility and risk exposure on the market. After a few weeks of high volatility and market turbulence, the market appears to be consolidating, with prices stabilizing and investors becoming more risk-averse.

While this is generally a positive development for the market, it could lead to a prolonged period of consolidation, with prices remaining relatively stable for an extended period of time. This could be particularly challenging for projects like Lido Finance, which rely on high levels of volatility and market activity to drive demand for their products and services.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  Synthetix Network

Synthetix Network  KuCoin

KuCoin  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Holo

Holo  Enjin Coin

Enjin Coin  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Qtum

Qtum  Siacoin

Siacoin  Basic Attention

Basic Attention  Ontology

Ontology  Dash

Dash  NEM

NEM  Zcash

Zcash  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Status

Status  Numeraire

Numeraire  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur