Shiba Inu (SHIB) Golden Cross Provided No Value for Meme Token

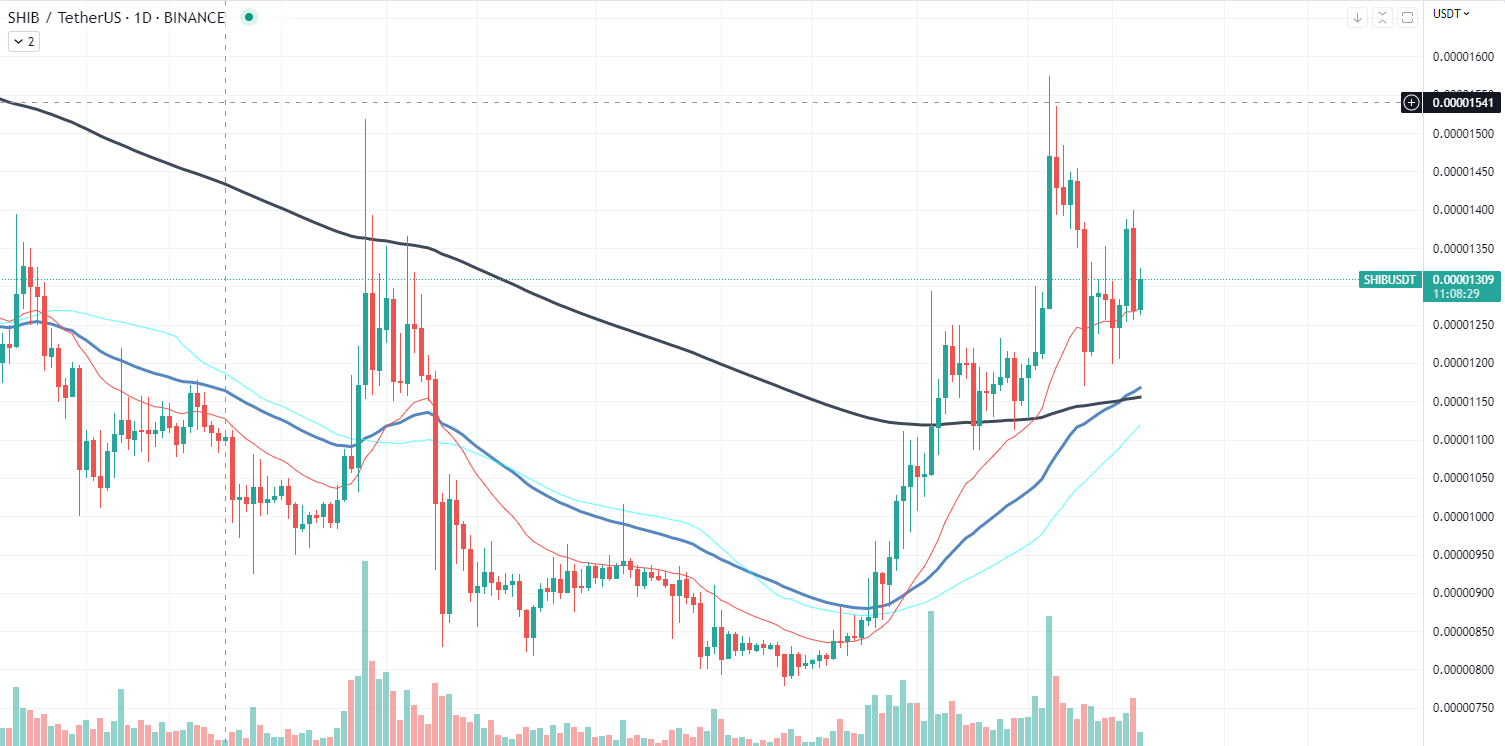

Shiba Inu (SHIB) has been facing a challenging time recently, as the asset struggles to regain the momentum it had a few months ago. Despite the recent golden cross on the daily chart, SHIB’s price remains stagnant. Recently, prominent trader Peter Brandt stated that the golden cross is a «fun talking point» that has no real market predictive utility.

The golden cross is a technical analysis indicator that occurs when the 50-day moving average crosses above the 200-day moving average. This pattern is seen as a bullish signal, indicating that a stock or asset’s price may increase. Recently, several cryptocurrencies, including Bitcoin and Shiba Inu, have experienced the golden cross pattern. However, their price performance was not significantly impacted.

SHIB’s golden cross has also not provided any support for the asset’s price. Despite the bullish signal, the token’s price remains in almost exactly the same place. The lack of price movement can be attributed to the loss of SHIB’s main source of funding on the market, retail traders.

Solana’s three important targets

Currently, Solana has three key targets to hit. The first is the previous resistance level of $26, which is an important level for the coin to break through. If SOL manages to surpass this level, it could indicate that the coin has enough strength to continue rising.

The second target is the 200-day moving average resistance, which is located at approximately $28. This level is significant, as it represents the average price of SOL over the past 200 days. If SOL breaks through this resistance, it could signify that the coin has regained its bullish momentum.

The third and final target is a point of breakdown, which is now acting as a resistance at around $33. This level has been a point of support in the past, but once it was broken, it became a point of resistance. If SOL manages to break through this level, it could indicate that the coin has regained its bullish momentum and is likely to continue rising.

It is worth noting that SOL’s technical analysis is just one aspect to consider when analyzing the coin’s potential growth. Other factors, such as news and market sentiment, can also have a significant impact on the price of SOL.

XRP’s network activity spike

XRP, the digital asset used on the Ripple network, has been seeing an increase in large transactions as whales are becoming more active and transferring millions worth of XRP coins around their wallets. This surge in activity could contribute to the volatility of XRP in the near future.

Large transactions, typically defined as any transfer of more than 10,000 XRP, have been on the rise in recent days. According to data from XRPscan, the number of daily transactions worth more than 10,000 XRP has surged from around 80 to more than 200 over the past few weeks. This trend has caught the attention of many investors, as large transactions are often a sign of increased activity and interest in a particular asset.

Despite the increase in large transactions, XRP’s recent price performance has been lackluster. The asset has lost around 10% of its value from the local high and is currently trading at around $0.85 at the time of writing. This is despite the fact that the overall cryptocurrency market has been on an uptrend, with many other assets experiencing significant gains in recent weeks.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Bitcoin Gold

Bitcoin Gold  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Pax Dollar

Pax Dollar  Status

Status  Numeraire

Numeraire  Nano

Nano  Steem

Steem  Hive

Hive  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur