The Graph Price Prediction: Will GRT Escape Consolidation?

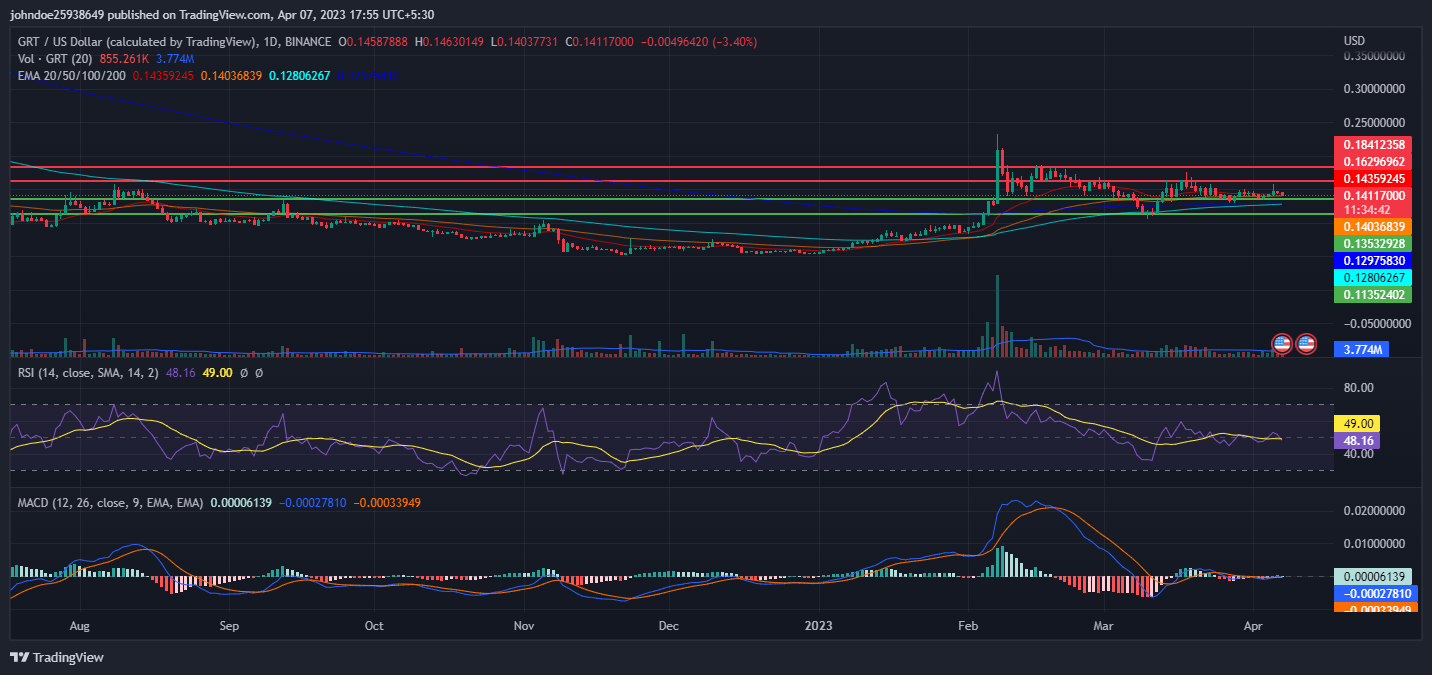

- 1 The Graph is currently trading at $0.1412 (press time) with a decrease of 3.27% intraday.

- 2 The 24-hour low for GRT was $0.1408 and the 24-hour high was $0.1478.

- 3 The current Graph price is between the 20-, and 200-Day EMAs.

The Graph Overview:

The Graph is a protocol that enables developers to build and publish open APIs, known as subgraphs, for querying blockchain data using GraphQL. It currently supports Ethereum, IPFS, and POA, with more networks to be added soon. The Graph, which has more than 3,000 subgraphs deployed by thousands of developers, has established itself as a crucial tool for DeFi and Web3 applications. By September 2020, it was being used for more than 7 billion inquiries, expanding at a rate of more than 50% MoM.

With more than 200 Indexer Nodes in the testnet and more than 2,000 Curators in the Curator Program, The Graph has a large international community. The Graph has received almost $25 million from the community, strategic VCs, and well-known figures in the blockchain world to pay for network growth.

Participants in the Graph Network use Graph Token to guarantee the security and integrity of the data being accessed (GRT). To provide indexing and curating services to the network, it is a work token that is locked up by indexers, curators, and delegators. Active members can receive compensation from the network in proportion to the effort they contribute and the value of their GRT investment.

The Graph is on a mission to bring reliable decentralized public infrastructure to the mainstream market, and its team includes professionals from leading tech companies such as Ethereum Foundation, OpenZeppelin, Decentraland, Orchid, MuleSoft, Redhat, and Barclays. The founders have worked together for 5-8 years, and Yaniv Tal, Brandon Ramirez, and Jannis Pohlmann lead the project.

The Graph Technical Analysis :

The GRT/BTC pair saw a decrease of 3.07% intraday, with a trading value of 0.000005068 BTC. However, the GRT token price suffered a significant decline of 65.77% in the previous year, indicating a substantial impact from sellers. With the market experiencing strong selling pressure, the GRT token remained below its secondary support level of $0.113 as of the end of 2022.

GRT’s volume dropped by 36.82% intraday. The volume’s continued drop shows that the short-selling pressure is increasing. The market cap-to-volume ratio is 0.0283. For investors, the fact that purchasing is growing may be comforting. Investors could choose to shift to either side. Additionally, this will present a chance for new buyers to join the market.

Price prediction for the Graph suggests that the future of GRT largely depends on the actions of buyers in the market. If the buyers are able to push the value of GRT past its primary resistance level of $0.162, the token may experience a significant upward rally over the daily time frame chart. This means that the price of GRT could potentially rise in the near future if there is enough demand from buyers to drive the price upwards.

Source: GRT/USD by Tradingview

RSI is decreasing in the overbought zone and is showing a negative crossover which indicates that the sellers are coming in the majority and pushing GRT downwards. This suggests the strength of the current bearish trend. The current value of RSI is 48.16 which is below the average RSI value of 49.00.

The MACD and the signal line are stranded near zero and are not showing a definitive crossover over the daily chart which can support the RSI claims. Investors need to watch every move over the charts during the day’s trading session.

Conclusion

The Graph protocol has established itself as a crucial tool for DeFi and Web3 applications. By September 2020, it had been utilized for more than 7 billion queries, growing at a rate of more than 50% MoM, with thousands of developers deploying more than 3,000 subgraphs. With more than 200 Indexer Nodes on the testnet and more than 2,000 Curators in the Curator Program, the protocol has a sizable international community.

The Graph has secured nearly $25 million to fund network expansion in its mission to bring dependable decentralized public infrastructure to the mass market. Future price movements of GRT could be significantly higher if it surpasses its main resistance level, which is highly dependent on market buyers’ activities. However, the current technical analysis suggests a bearish trend, with decreasing RSI in the overbought zone and a negative MACD signal. Investors must watch every move over the charts during the day’s trading session.

Technical Levels

Support Levels: $0.135 and $0.113

Resistance Levels: $0.162 and $0.184

Disclaimer

The views and opinions stated by the author, or any people named in this article, are for informational ideas only. They do not establish financial, investment, or other advice. Investing in or trading crypto assets comes with a risk of financial loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Monero

Monero  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Cosmos Hub

Cosmos Hub  Algorand

Algorand  Gate

Gate  VeChain

VeChain  Dash

Dash  Stacks

Stacks  Tezos

Tezos  TrueUSD

TrueUSD  IOTA

IOTA  Decred

Decred  Theta Network

Theta Network  Basic Attention

Basic Attention  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Zilliqa

Zilliqa  DigiByte

DigiByte  Nano

Nano  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  Hive

Hive  BUSD

BUSD  Lisk

Lisk  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  Bitcoin Gold

Bitcoin Gold  NEM

NEM  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond