Trader Stated That XRP’s Price Will Soar to $0.53 in Coming Days

The Twitter user Cryptoes (@cryptotoes_ta) tweeted this morning that the price of the remittance token, Ripple (XRP), has recently closed above a significant price level. According to the tweet, the daily close for XRP has closed above a key price level and may continue to rise in the upcoming days.

The tweet added that XRP’s price will push right above the next resistance level around $0.53 if this level holds.

At press time, the price of XRP stands at $0.5105 according to CoinMarketCap. This comes after the altcoin’s price climbed 0.32% over the last 24 hours. This 24-hour gain has added to the crypto’s already-positive weekly performance. As a result, the weekly price gain for XRP stands at +1.12% presently.

XRP’s price did, however, weaken against the two crypto leaders, Bitcoin (BTC) and Ethereum (ETH), by 0.47% and 0.67% respectively. The daily trading volume for Ripple also dropped in the last 24 hours by around 25.04%. As a result, the daily trading volume for XRP is currently $820,345,203.

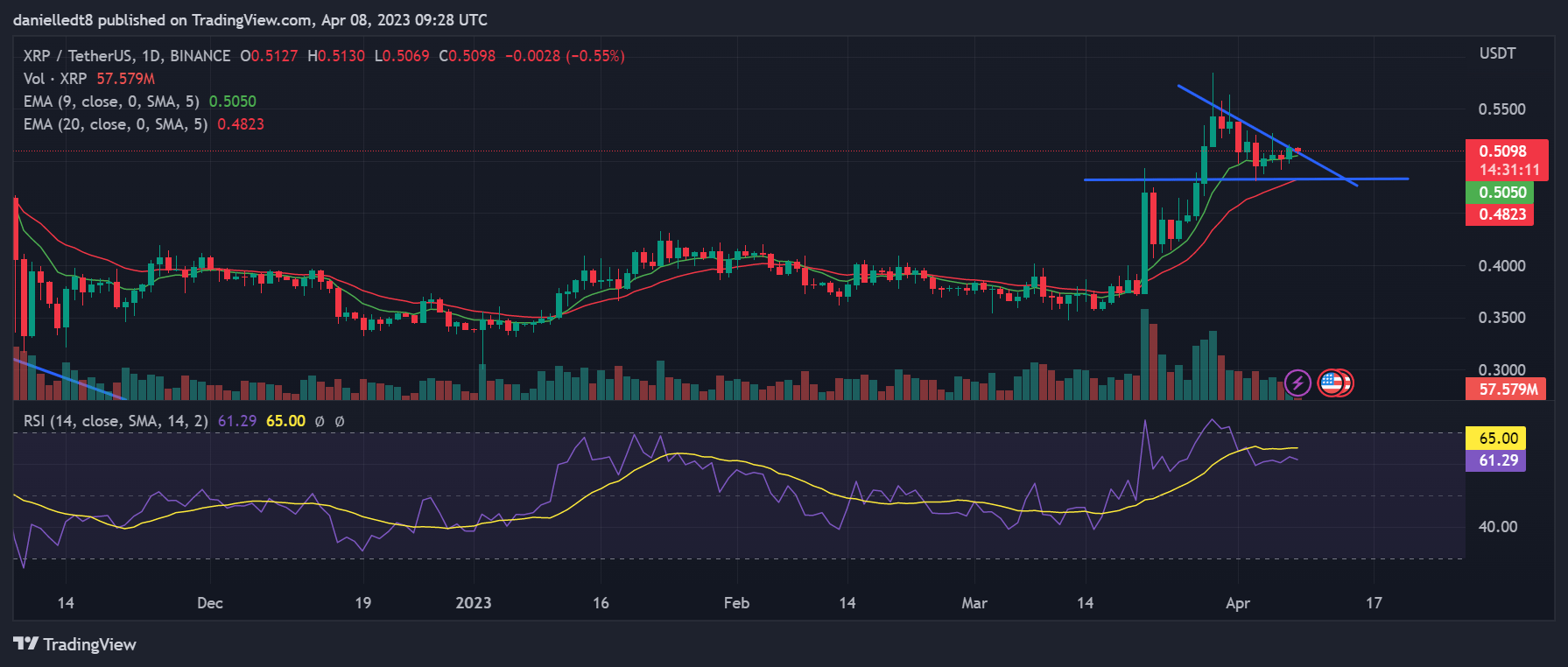

Daily chart for XRP/USDT (Source: TradingView)

There is a bearish triangle chart pattern present on XRP’s daily chart at press time after the remittance token’s price printed lower highs in the last week.

Fortunately for XRP traders and holders, the altcoin’s price has broken out of the chart pattern in today’s trading session. Should XRP’s price close today’s trading session above this pattern then the bearishness suggested by the pattern will be invalidated and XRP’s price will likely make a move towards $0.5358 in the next 24-48 hours.

The daily RSI indicator does, however, suggest that there is an overwhelming amount of sell volume present on XRP’s charts, with the daily RSI line trading below the RSI SMA line. Furthermore, the daily RSI line is sloped negatively towards oversold territory.

Traders may want to wait for a bullish cross between the daily RSI and daily RSI SMA line before entering into a long position for XRP.

Disclaimer: The views and opinions, as well as all the information shared in this price analysis, are published in good faith. Readers must do their own research and due diligence. Any action taken by the reader is strictly at their own risk. Coin Edition and its affiliates will not be held liable for any direct or indirect damage or loss.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Siacoin

Siacoin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Zcash

Zcash  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur