TRON (TRX) Price Dive Could Signal the Start of Collapse

The TRON (TRX) price broke down from a long-term horizontal support area. This could be the first step of a long-term drop toward $0.36.

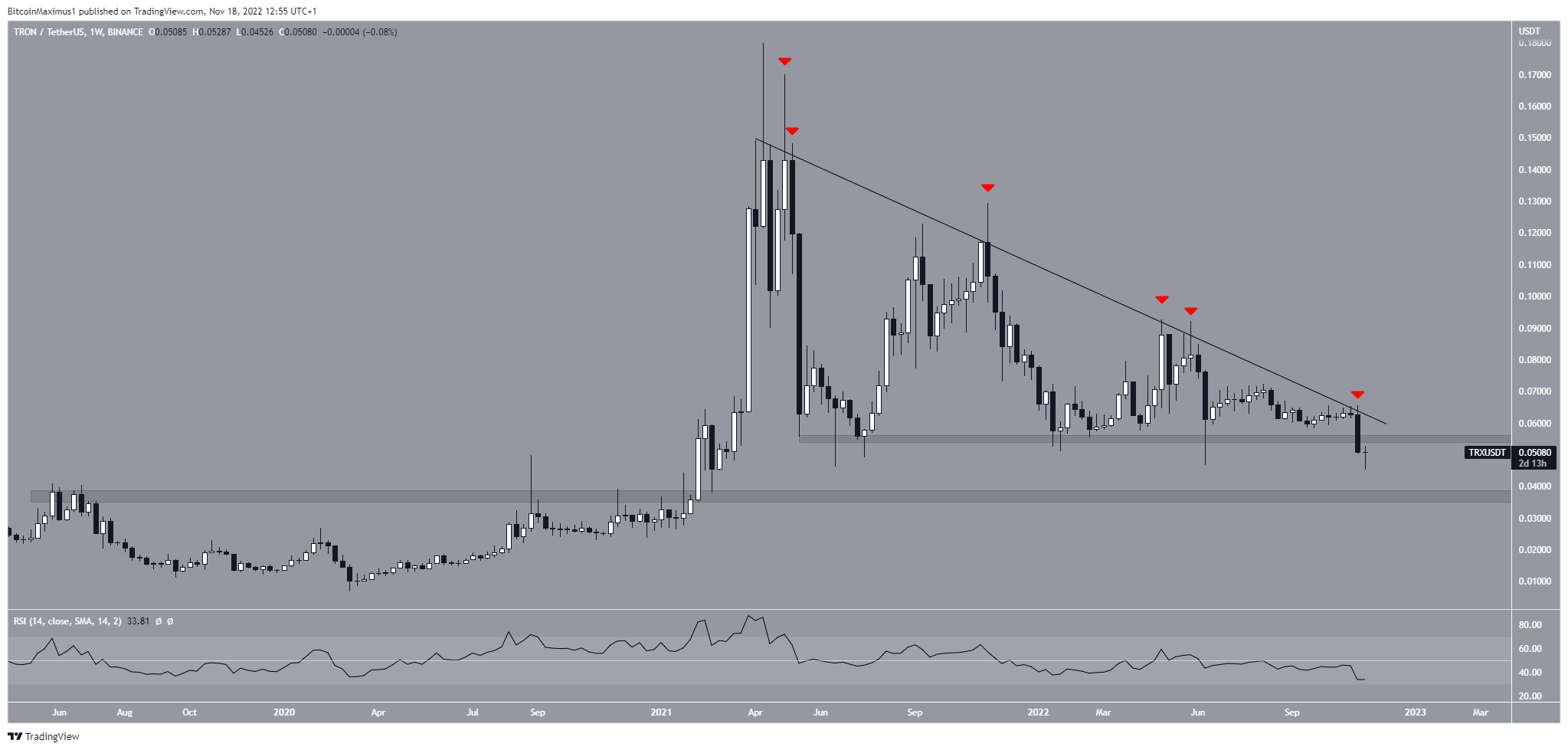

The technical analysis from the weekly time frame gives a bearish outlook. The TRX price has decreased underneath a descending resistance line since April 2021.

The line has caused numerous rejections (red icon). On Nov. 7, it catalyzed a sharp fall, breaking down below the long-term $0.055 support area. This also confirmed that the RSI is below 50, a bearish development.

There was some interesting TRON news preceding the drop, both positive and negative. The TRON-based stablecoin USDD initially de-pegged but has now nearly stabilized. Moreover, TRON founder Justin Sun announced he had plans to reimburse FTX customers that held TRX, BTT, JST, SUN, and HT.

In any case, the price forecast can only be considered bullish once the TRON price reclaims the $0.055 horizontal area. Due to the long-term breakdown and bearish RSI reading, this seems unlikely. Instead, the most likely TRX price prediction is a descent toward the next support at $0.36.

TRX/USDT Chart By TradingView

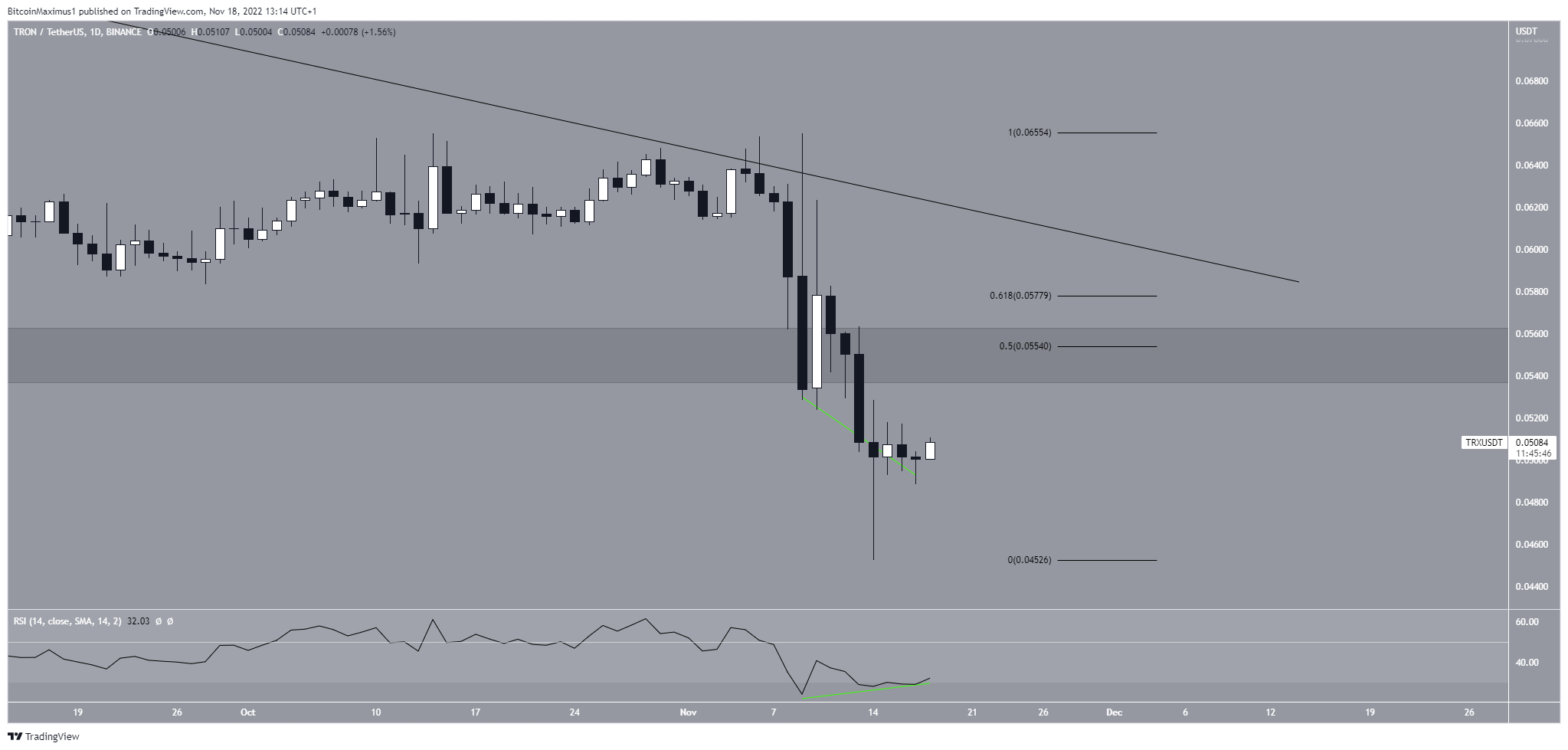

The two main reasons for this are:

- The very long lower wick on Nov. 14

- The bullish divergence in the daily RSI.

The current bounce over the past 24 hours could lead to a future price of $0.055 – $0.058.

However, there is massive resistance at these levels, created by the long-term horizontal resistance area, long-term descending resistance line and the 0.5-0.618 Fib retracement support levels.

As a result, the trend cannot be considered bullish unless TRON reclaims this level. Rather, the most likely scenario is the continuation of the downward movement towards $0.036.

TRX/USDT Chart By TradingView

Disclaimer: BeInCrypto strives to provide accurate and up-to-date information, but it will not be responsible for any missing facts or inaccurate information. You comply and understand that you should use any of this information at your own risk. Cryptocurrencies are highly volatile financial assets, so research and make your own financial decisions.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD