Uniswap Now Attempts to Breach the 200 EMA Curve!

Uniswap has taken the right advantage of the call for decentralized protocols and exchanges in the crypto-world. By solving the liquidity crisis witnessed on centralized platforms, Uniswap has created a huge upside momentum for the UNI token. The ecosystem serves the dual purpose of offering governance and rewarding staking benefits regarding the tokens. Since the decentralized space is expected to grow, the UNI token valuation will continue moving positively.

The market capitalization for the UNI token indicates $6.4 billion, with 75% of tokens existing in the circulating supply. Removing identity requirements and offering a wide range of liquidity pairs would further benefit the Uniswap ecosystem in the longer run. Focusing on developing its self-sustaining infrastructure is a major leap in the automated market-making industry.

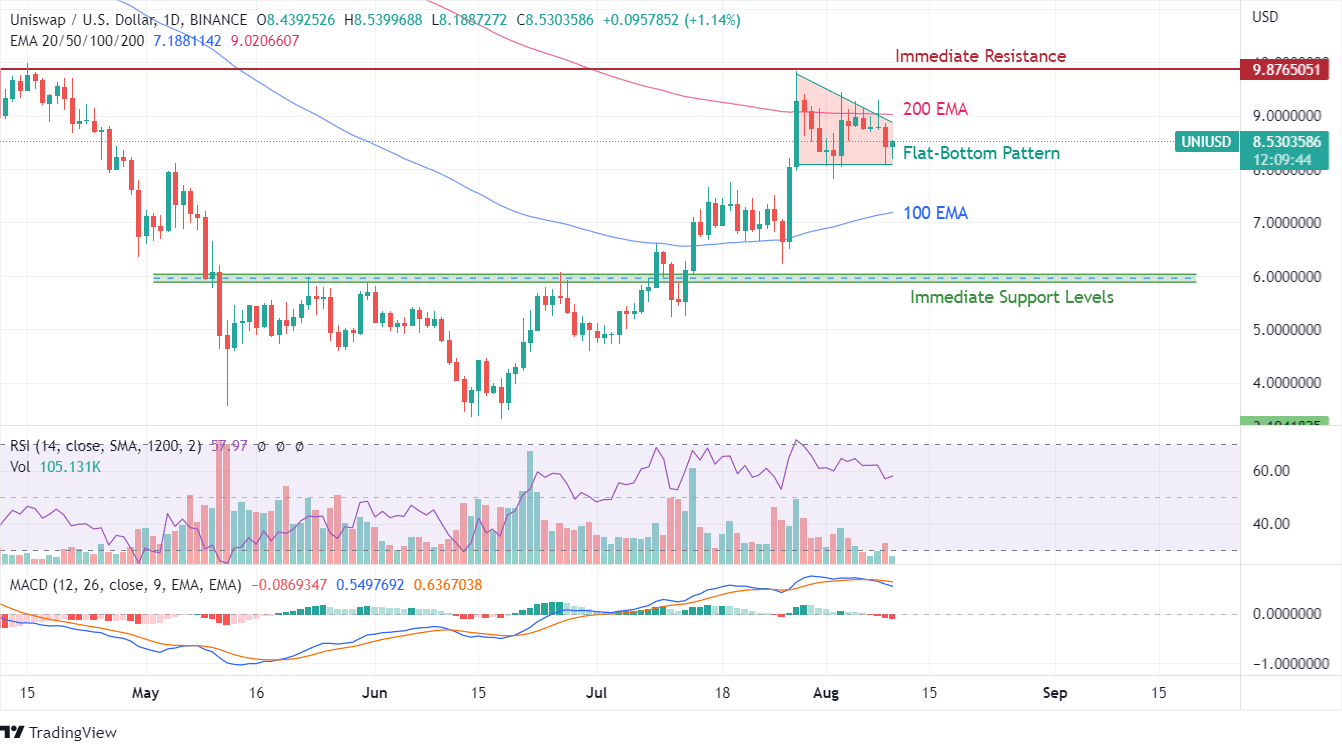

The Uniswap protocol has gained huge traction lately, creating a rising demand for the UNI token. The ongoing price action has created a positive scenario with much higher possible gains, and there could be a consolidation just as witnessed near the 100 EMA curve.

The flat bottom pattern formed near the 200 EMA curve is a result of profit booking from holders who made an entry into Uniswap before the July end breakout that saw a price hike of 51% in just two trading days. Uni token has taken a bearish crossover because of the current flat bottom pattern that indicates buyers are preparing for another take at the 200 EMA. 200 EMA has already made a straight line point that could enter its vertex if the price continues to move positively.

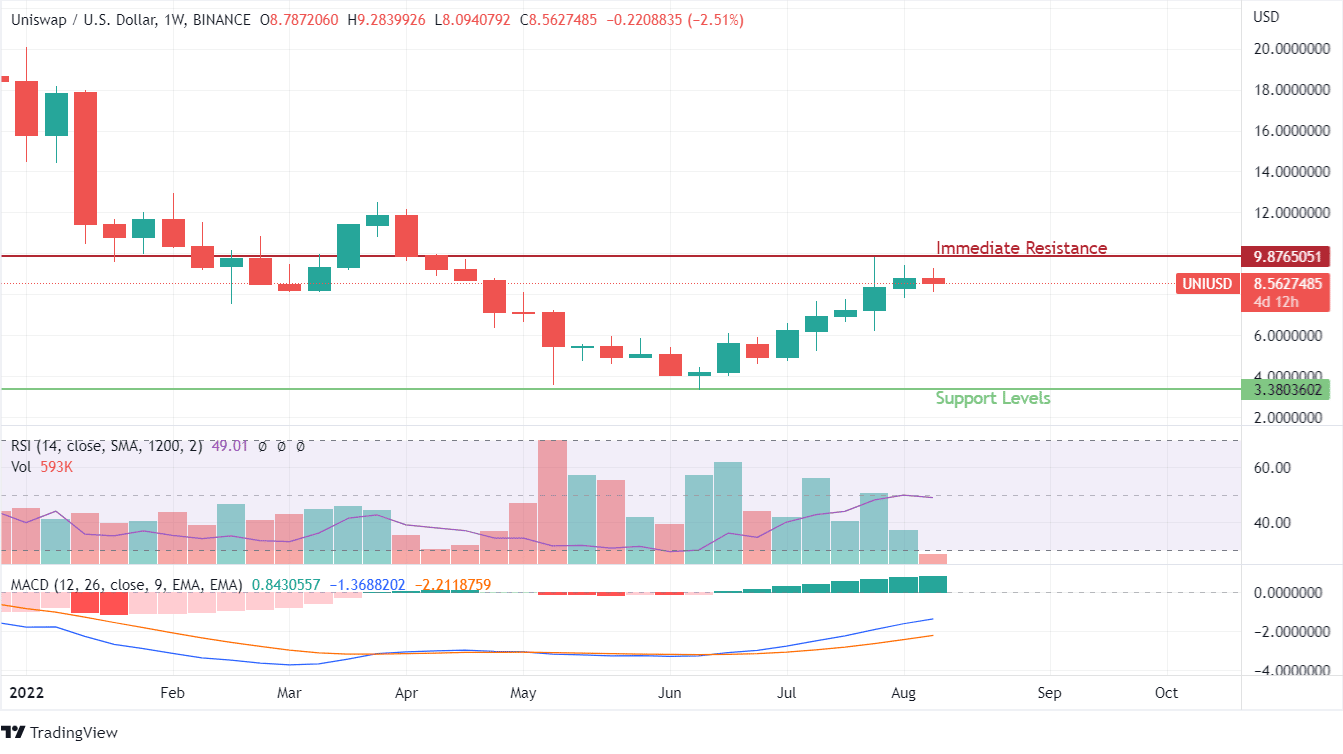

$8 has become an immediate support level, while another support is active at $6. From the lows of $3.31 in July 2022, UNI is currently trading at a premium of 155%. In other words, the Uniswap price has jumped 155% in the last two months. Despite double-digit buying and smaller profit booking volatility, RSI levels have remained short of entering the overbought zones. For the short term, buyers should take a back seat and wait for a breakout which could take a while as per the UNI crypto price prediction.

Uniswap indicates a positive breakthrough since June 2022, with consistent new highs made each week. Despite the candles carrying an upper and lower wick, the long-term momentum is positive. The current week indicates a red candle formation, but dual wicks would eventually help the UNI buyers as positive action would win out. RSI for this time frame is even more positive, while MACD has been predicting a positive rally for over a month. The resistance at $10 will weigh in heavier for the price trends, with supports readily available at $6 and $8.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Ontology

Ontology  Zcash

Zcash  NEM

NEM  Decred

Decred  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur