US Fed Set for New Rate Hike This Week, But How Aggressive Will It Be?

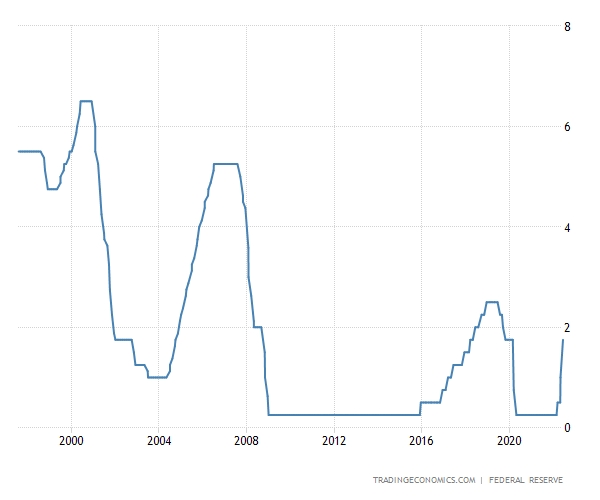

The US Federal Reserve (Fed) is set to announce another significant interest rate hike on Wednesday this week, and crypto market participants are watching closely for any clues about how aggressively the Fed will move.

Judging from the derivative exchange CME’s FedWatch Tool, traders are generally expecting the Fed to raise rates by 75 basis points, with a 77.5% probability of this outcome. However, that also means that the market prices in a 22.5% probability that the Fed will raise rates by 100 basis points – a hike described by Bloomberg as the “largest increase of the modern Fed era.”

The possibility of a 100-basis point hike has come into focus recently, given the increasingly hot inflation numbers in the US. Earlier this month, data showed that inflation reached 9.1% in June, more than analysts had expected and up from 8.6% a month earlier.

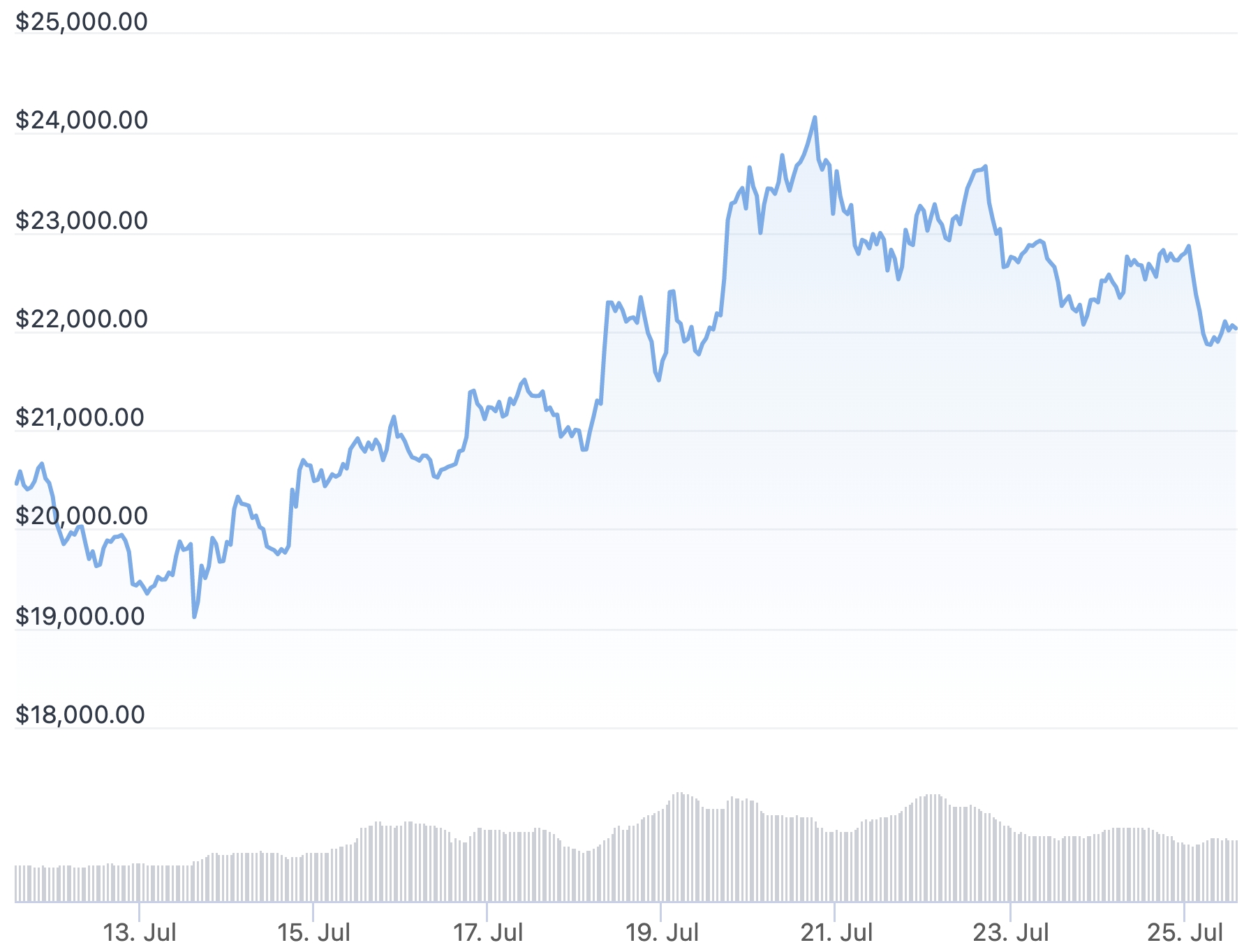

Still, the latest inflation report did lead to a relief rally of sorts for the crypto market, with bitcoin (BTC) having risen by close to 14% since the latest inflation report came out on July 13.

BTC price since the June US inflation report:

Source: CoinGecko

According to the Singapore-based crypto trading firm QCP Capital, a 100-basis point hike by the Fed is unlikely to happen given that inflation “is showing signs of peaking.” The firm also said that a mini-rally can be expected as the broader market realizes this.

“Since the high [inflation] print, the market has been decisively pricing out the probability of a 100 bps hike in the July [Fed meeting]. Currently, a 20% chance of 100 bps is still being priced in but our view is that 75 bps is the most the Fed will do. So expect another boost as 100 bps gets completely priced out,” the firm wrote in an update on Telegram before the weekend.

Meanwhile, the Wall Street Journal on Monday reported that so-called overnight index swaps now indicate an expectation in the market that the Fed will raise rates aggressively until the end of the year, before turning around next year and starting to cut them by June.

The same data also indicated that the Fed will raise rates by 75 basis points at its meeting this week, with the Federal Funds rate expected to be at around 3.3% by the end of the year.

The predicted turn-around in Fed policy has “marveled” even investors themselves, the report said. “From an expectation standpoint it’s not been at an extreme like this,” the report cited Jim Caron, a senior portfolio manager at investment bank Morgan Stanley, as saying.

At 12:18 UTC on Monday, BTC traded at USD 22,928, down 3.7% in a day and up 5.3% in a week.

____

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  LEO Token

LEO Token  Stellar

Stellar  Monero

Monero  Zcash

Zcash  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Dash

Dash  Tezos

Tezos  Stacks

Stacks  TrueUSD

TrueUSD  IOTA

IOTA  Basic Attention

Basic Attention  Theta Network

Theta Network  Decred

Decred  NEO

NEO  Qtum

Qtum  Synthetix

Synthetix  Ravencoin

Ravencoin  0x Protocol

0x Protocol  DigiByte

DigiByte  Zilliqa

Zilliqa  Nano

Nano  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  Enjin Coin

Enjin Coin  Status

Status  BUSD

BUSD  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  NEM

NEM  OMG Network

OMG Network  Augur

Augur  Bitcoin Gold

Bitcoin Gold  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond