What Will ‘Lead the Next Bull Run in Digital Assets’, Explains CryptoCompare Research

In a newly published report researchers from leading digital asset data provider CryptoCompare have noted that while the space has undoubtedly entered a bear market there are factors they believe will trigger the next bull run in the future.

CryptoCompare’s 2022 Q3 Outlook report does into detail on the cryptocurrency space«s performance during the second quarter of the year, noting it was a “catastrophic” quarter that saw BTC lose 56.3% of its value, while ETH plunged by 67.4%.

Per the report, the collapse of the Terra ecosystem, which was a black swan event, and the subsequent contagion that “led to the bankruptcy of Three Arrows Capital and the insolvency of multiple centralized yield providers like Celsius, have undoubtedly sent the industry into a bear market.

The report adds that macroeconomic factors, including record high inflation throughout the world, have seen major asset classes tumble, with the famed 60/40 portfolio – which invests 60% of its assets in the S&P 500 Index and 40% into the Bloomberg US Aggregate Bond Index – lost 16.1% of its value year-to-date, marking its worst performance since the fixed income index was launched in 1976.

That being said, CryptoCompare found a silver lining in the bear market, which it believes may lead to the next bull run. The report reads:

We believe that this bear market will lead to the development of innovations that will lead the next bull run in digital assets, similarly to the innovations that occurred in traditional markets following the 2008 financial crisis, and in cryptocurrencies following the bubble burst in 2018.

The report notes that while stablecoins were a focus of attention after the Terra ecosystem collapsed and UST became nearly worthless, researchers believe that “collateralized stablecoins are sufficiently liquid to endure a bank run.”

CryptoCompare’s researchers note that “product innovation does not evolve simultaneously with price movements,” which means the bear market may lead to the creation of some of the cryptocurrency space’s future star protocols.

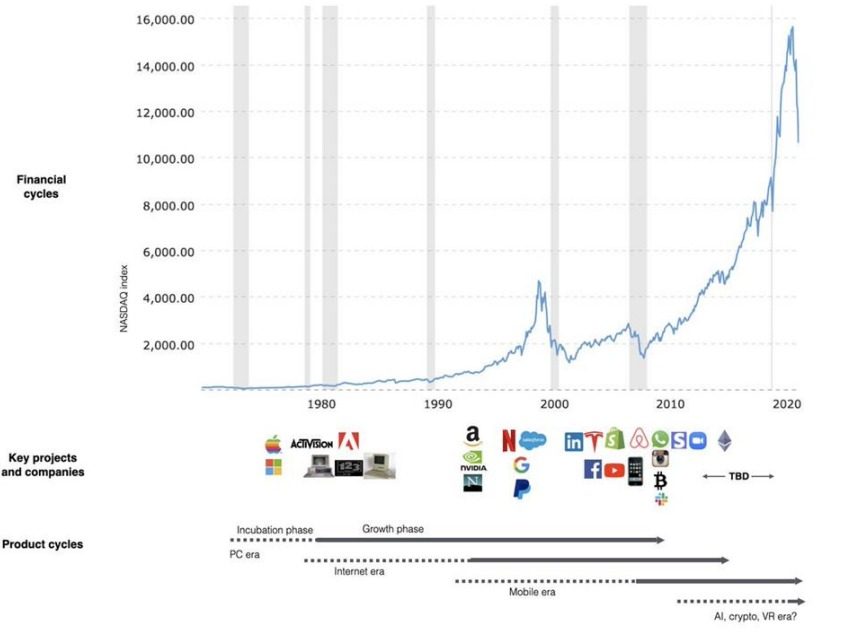

Per the researchers, developers passionate about their cause “continue t build irrespective of price movements.” The report included a chart from Chris Dixon, general partner at venture capital firm Andreessen Horowitz, showing that the three years following the 2008 financial crisis turned out to be a “golden age for startups.”

Source: CryptoCompare

The iPhone and the App Store were both launched in 2007, while Uber, Instagram, and Venmo were released after the crisis unfolded. CryptoCompare likened these developments to what was seen in crypto after the 2018 bubble burst: Compound Finance and Uniswap, a leading lending protocol and a decentralized exchange, were both launched in 2018.

CryptoCompare’s researchers noted they see crypto “at the forefront of the next technological cycle” and pointed to numerous innovations making it possible, including Solana’s work on the Saga smartphone, and the issuance of stablecoins not tied to the U.S. dollar, and the development of modular blockchains.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Stacks

Stacks  Cronos

Cronos  Stellar

Stellar  Cosmos Hub

Cosmos Hub  OKB

OKB  Maker

Maker  Theta Network

Theta Network  Monero

Monero  Algorand

Algorand  NEO

NEO  Gate

Gate  Tezos

Tezos  KuCoin

KuCoin  Synthetix Network

Synthetix Network  EOS

EOS  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Decred

Decred  Ontology

Ontology  Zcash

Zcash  NEM

NEM  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Status

Status  Nano

Nano  Hive

Hive  Pax Dollar

Pax Dollar  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  Augur

Augur