What’s Ahead Of Flatlined Bitcoin Price? Will FED Chief’s Statement Crash Markets Tomorrow?

The price of Bitcoin remained pretty volatile during the previous week, but it more or less stabilized over the weekend as the price remained largely flatlined after digesting the recent Silvergate crisis. However, Bitcoin’s price is currently under pressure as traders and investors brace for a major event that is set to take place on Tuesday in the United States.

Bitcoin Price At Risk On Powell’s Speech?

The flagship cryptocurrency is coming under significant selling pressure as the crypto market awaits the testimony of the Federal Reserve Chair, Jerome Powell, at the U.S. Senate hearing scheduled tomorrow. Market participants are expected to examine his speech in search of any hints that could indicate Powell adhering to his disinflationary strategy or backtracking his views and signaling towards a revamp of policy tightening procedures.

Read More: Check Out The Top 10 DeFi Lending Platforms Of 2023

In case, Powell hints at the latter, it would come as a significant blow to risk assets like Bitcoin and usher in a complete crypto crash — wiping out all the gains in an instant. Since the markets have not heard from Chairman Powell in more than three weeks, they will be particularly eager to hear what the Fed Chief has to say and whether there is a possibility of a bigger interest rate hike for the month of March. There are already market-wide speculations on a potential 50bps rate hike, which would be significantly higher than the last hike of 25bps.

Should You Buy The Dip? Trading Data Suggests So

According to a prominent crypto trading expert, who goes by the pseudonym MacroCRG on Twitter, acknowledged the fact that the Open Interest (OI) for BTC had risen significantly with the addition of $100 million, although the price remained stagnant. For the unaware, OI is a measure of the flow of money into a futures or options market. Increasing open interest represents new money entering into the market while decreasing open interest indicates money flowing out of the market.

Moreover, he goes on to mention that holding a long position in Bitcoin would be particularly prudent in the event that Bitcoin’s price drops early in the week while all the existing long transactions are being liquidated. This scenario would make a lot of sense if in case BTC gets crushed after the Fed’s testimony as discussed earlier. As a result, if there are any price dips, it may present traders and investors with a viable buying opportunity.

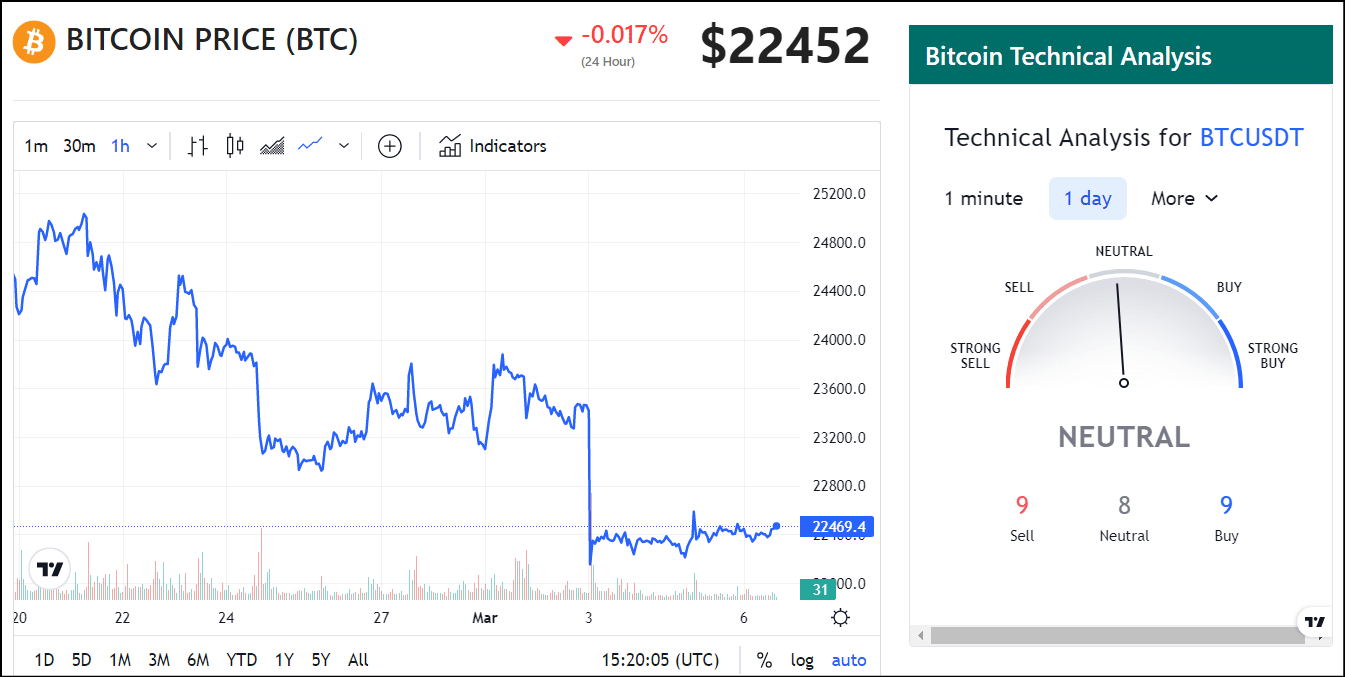

Additionally, it should be noted that BTC’s technical analysis (TA) indicators at CoinGape’s crypto market tracker recommend a “Neutral” position as summarised by moving averages that suggest a “sell” at 9 and “buy” at 9 as well. As things currently stand, the price of Bitcoin (BTC) is trading at $22,452 which represents a gain of 0.06% over the past 24 hours, in contrast to a drop of 5.75% over the last seven days.

Also Read: AI Crypto Token Fetch.AI Reveals Ambitious 2023 Roadmap; FET Price Poised For Bull Run?

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Tether Gold

Tether Gold  Bitcoin Gold

Bitcoin Gold  TrueUSD

TrueUSD  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Status

Status  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  OMG Network

OMG Network  Huobi

Huobi  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur