Will Ankr regain the previous support level of $0.03?

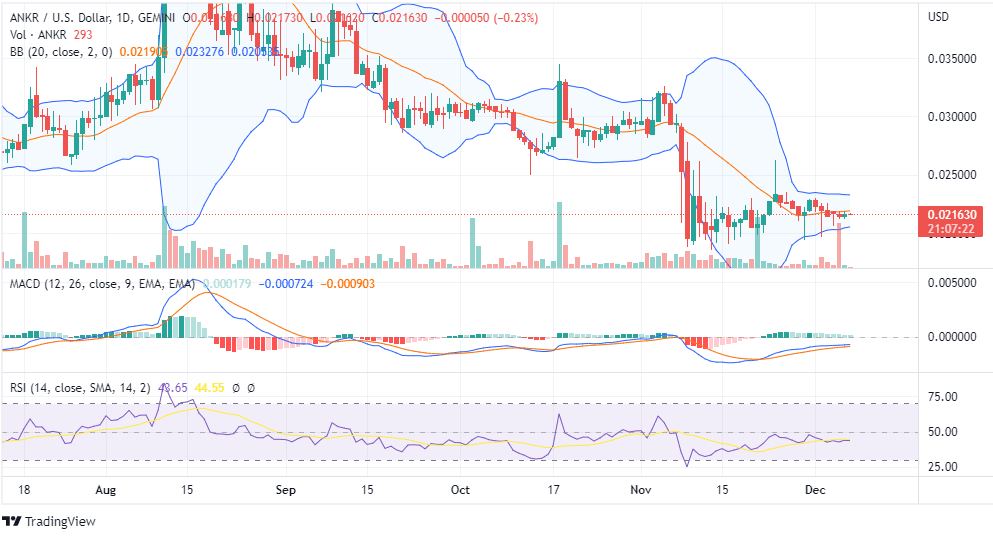

Ankr is a utility token that is used for staking, voting, or government purposes. The native token, ANKR, is also used as a payment method on the network. At the time of writing this post, Ankr trades at $0.0216, around the baseline of BB. Other popular technical indicators such as RSI and MACD are bullish, which suggests a strong uptrend, at least for the next few weeks, until the resistance level.

This year, the ANKR price chart formed a triangle pattern from June to September, but after the FTX liquidity crisis, it broke the support and formed a yearly low of around $0.019. However, it has regained momentum, but the previous support of $0.03 might be a resistance for the short term. We cannot predict long-term bullishness until it crosses that level decisively. Will it break the resistance? We have to analyze the weekly chart to get a broader view.

Overall, the weekly chart has been in a downtrend, but $0.028 is a crucial level for the long term because the ANKR price has taken support around that level throughout the year. At the end of November, it broke that level creating a bearish outlook for the long term.

The breakdown was due to the FTX liquidity crisis. It was a sudden announcement; even big investors were also selling their stakes. Retail investors were worried about the sustainability of numerous cryptocurrencies. As a result, even leading coins such as Bitcoin and Ethereum also observed an outflow.

After that, Binance launched a Recovery Fund for the fundamentally strong crypto projects that encourage investors to enter the market again. The daily trading volume is higher than average, which suggests the price will bounce back quickly.

Technically, the weekly chart is still bearish because candlesticks are forming below the baseline of Bollinger Band; MACD and RSI are neutral, which does not suggest bullish momentum. If you have already invested in ANKR, we will request you to hold for the next few years as per our Ankr coin price prediction.

For the short term, you can trade with the target of $0.03 and the stop loss around $0.018. Many enthusiasts are expecting a Santa rally during Christmas, but the market can be volatile in the next two months, so you have to keep a closer look at the price chart.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cronos

Cronos  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zilliqa

Zilliqa  Ravencoin

Ravencoin  Siacoin

Siacoin  Holo

Holo  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  HUSD

HUSD  Energi

Energi