Will Fed’s hawkish tone drive altcoin gains off a cliff?

- MAGIC, Optimism and Stargate Finance have rallied beyond 20% after the US Federal Reserve’s policy meeting on Wednesday.

- While MAGIC and Optimism are entering price discovery phases, STG has a long way to go.

- The rallies, while impressive for all three altcoins, are facing crucial hurdles and could trigger a correction.

Optimism (OP), MAGIC (MAGIC) and Stargate Finance (STG) are the top gainers in the last 24 hours. The rally of these altcoins can be attributed to the volatility generated by the interest rate decision and the Fed’s policy meeting that took place on Wednesday.

The US Federal Reserve Chairman Jerome Powell’s speech mentioned that the rates are going to stay high, and their inflation target is 2%. Despite the 25 bps rate hike, the hawkish tone from Powell is good for US Dollar and is likely to trigger a sell-off for risk-on assets like Bitcoin and stocks.

Therefore, market participants need to be cautious with this musical chair rally as it could end soon, leaving investors holding the altcoin bags or worse, getting margin called.

Can altcoins keep their gains?

MAGIC has the highest gains of 37% among the three altcoins. Stargate Finance comes in second at 34% and Optimism at 28%. While the returns on these altcoins are impressive, investors need to be cautious as Bitcoin, the largest cryptocurrency by market capitalization is showing cracks in its armor.

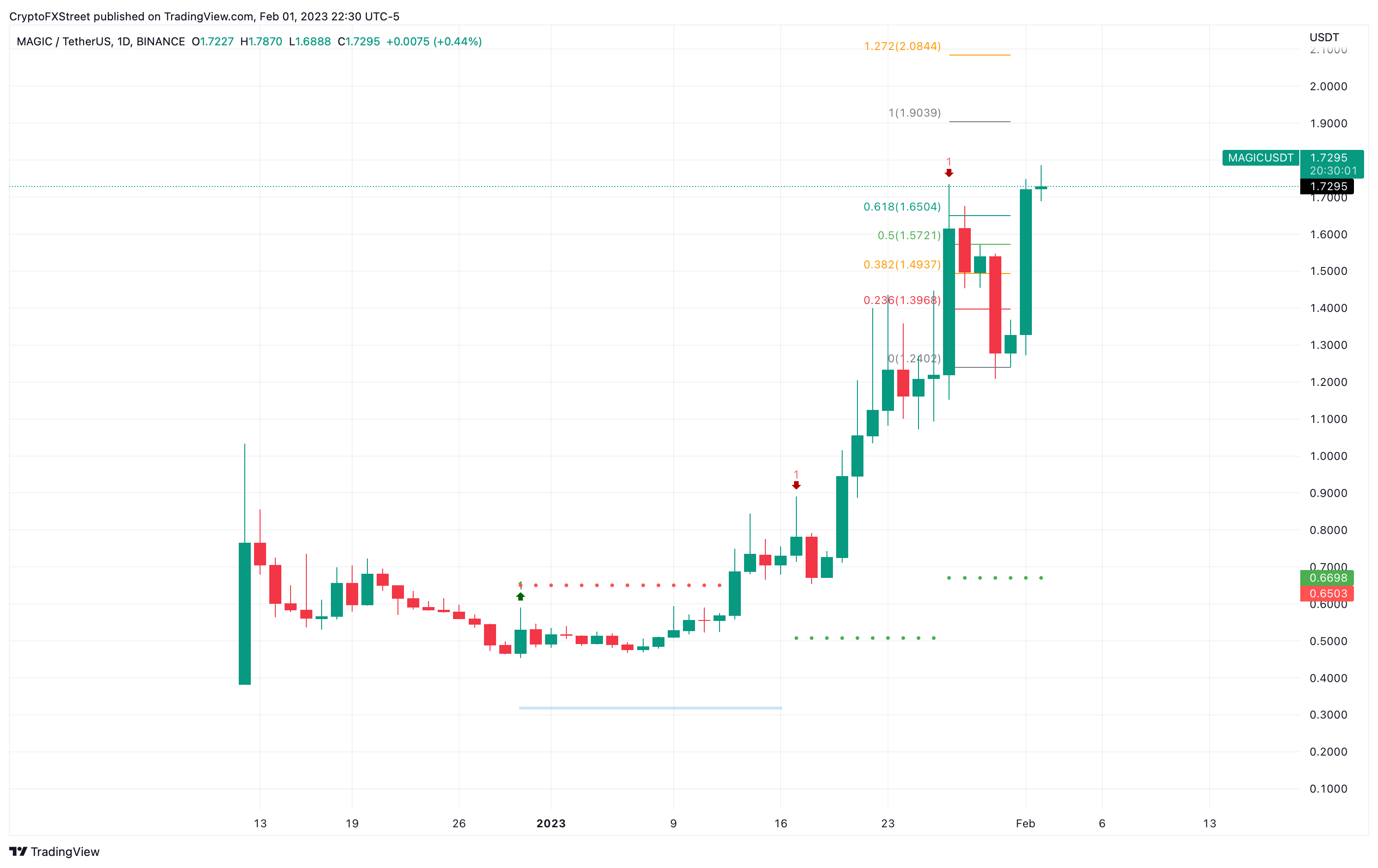

Let’s take a look at MAGIC altcoin and what to expect from its price action.

MAGIC price hit an all-time high of $1.787 as of February 2, but the 29% daily candlestick that precedes it is an impressive move. Using the trend-based Fibonacci extension tool, investors can note that the next hurdle is around $1.90, which is the 100% Fibonacci extension level.

Depending on the February 2 daily candlestick close, investors can decide if they want to hop on a long position or short.

MAGIC/USDT 1-day

If the current candlestick develops into a doji, the likelihood of a reversal becomes high. In such a case, MAGIC could retrace to the 50% Fibonacci retracement level at $1.57.

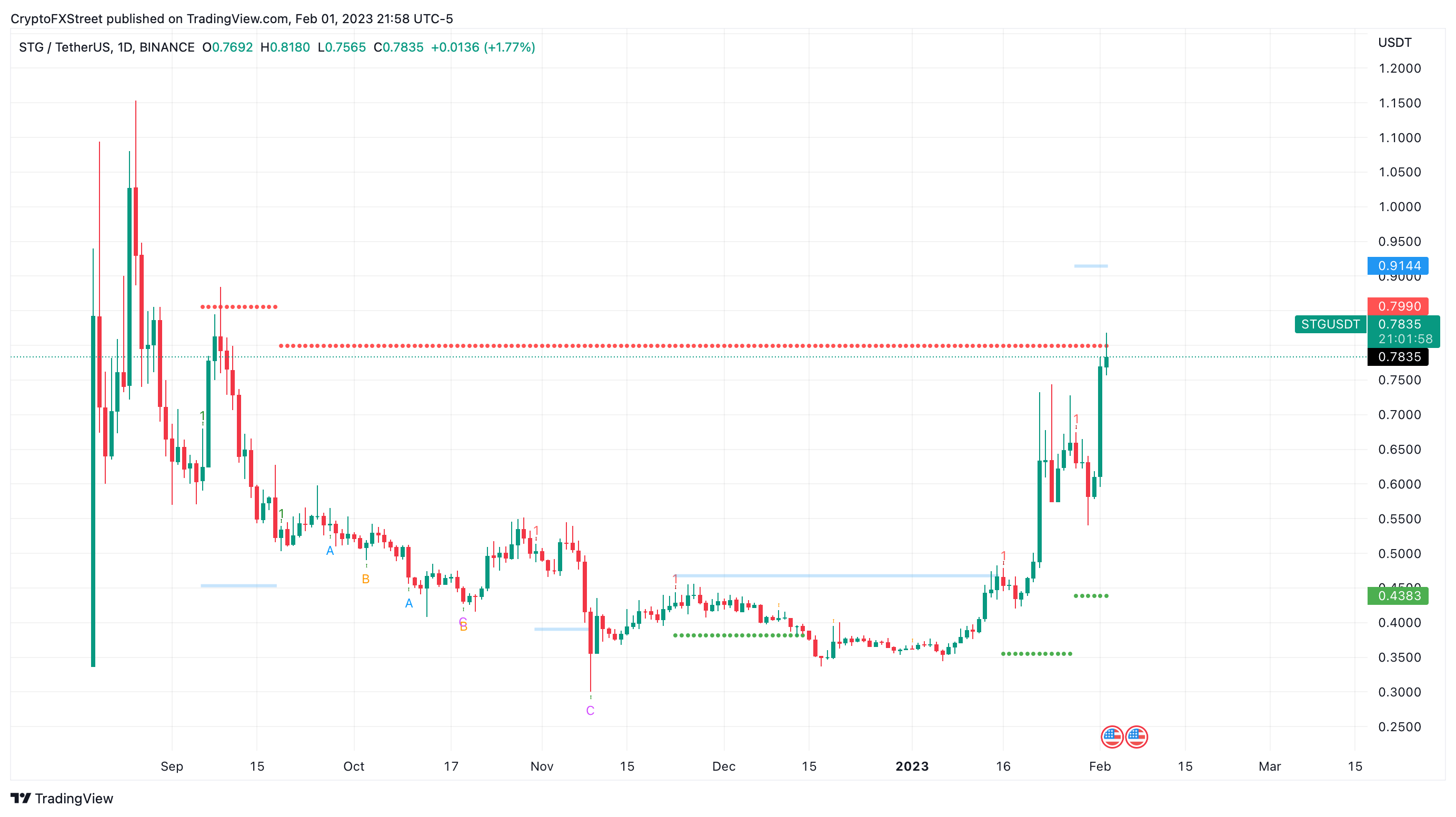

Stargate Finance price hit a peak of 34% after the FOMC meeting. In doing so, STG tagged the state trend resistance level at $0.800. If there is a massive rejection, causing a small body for a daily candlestick or if it flips into a down candlestick, it is indicative of profit-taking. In such a case, Stargate Finance could witness a 15% drawdown, pushing it down to $0.658.

STG/USDT 1-day chart

On the other hand, if $0.800 is flipped into a support floor, the next hurdle for STG is 14% away at $0.914.

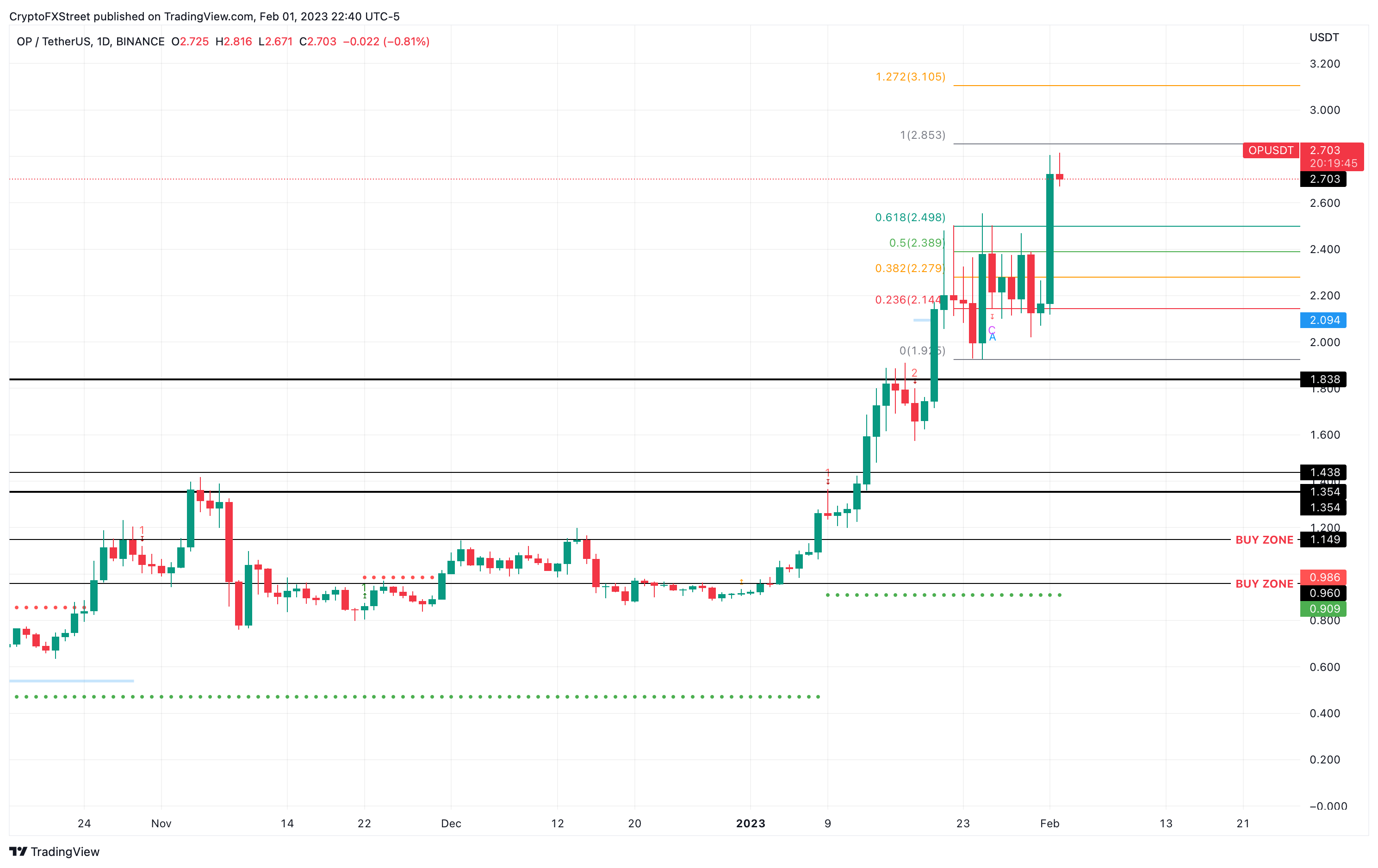

Optimism price has hit an all-time high of $2.81, but the daily candlestick has already flipped red, denoting a spike in selling pressure. Continued profit-taking will result in an 11% downswing to $2.38, which is the 50% Fibonacci retracement level.

OP/USDT 1-day chart

Although unlikely, a sustained buying pressure that flips the $2.81 hurdle into a support floor could see OP price tag the 127.2% Fibonacci extension level at $3.10, marking another all-time high.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Hedera

Hedera  Ethereum Classic

Ethereum Classic  Cronos

Cronos  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  Tezos

Tezos  EOS

EOS  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  Decred

Decred  NEM

NEM  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Nano

Nano  Numeraire

Numeraire  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  HUSD

HUSD  Energi

Energi  Augur

Augur