Will Solana price sink to $5 as Binance looks to acquire FTX?

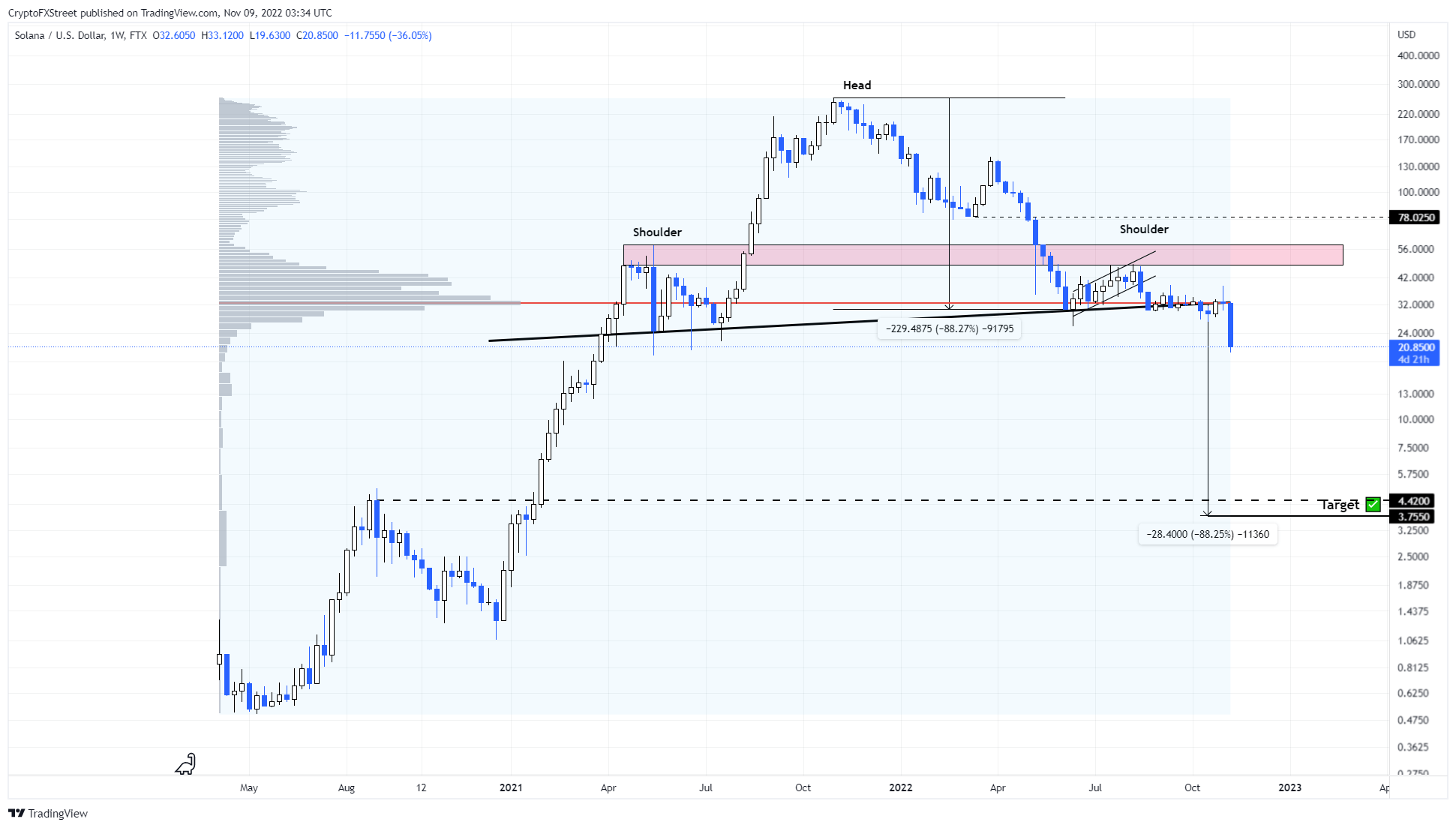

- Solana price has formed a head-and-shoulders reversal pattern on the one-week chart.

- This technical formation triggered a breakout that forecasts an 88% crash for SOL.

- Invalidation of the bearish outlook will occur if the altcoin flips the $32.91 hurdle into a support floor on theweekly time frame.

Solana price shows a steep correction that has pushed it below a few critical levels in the last 48 hours. This development has triggered a multi-year bearish outlook that could knock SOL down to single-digit levels.

The underpinning reason for this volatility and sheer bearishness is due to the recent developments between Binance and FTX CEOs, Changpeng Zhao(CZ) and Sam Bankman-Fried (SBF), respectively.

After Coindesk’s initial report and CZ’s comments, the FTX exchange faced massive withdrawals and a liquidity crunch, which eventually led to the two behemoths coming into agreement on a “strategic transaction.”

Although Binance is acquiring FTX, the details of the deals are undisclosed.

1) Hey all: I have a few announcements to make.

Things have come full circle, and https://t.co/DWPOotRHcX’s first, and last, investors are the same: we have come to an agreement on a strategic transaction with Binance for https://t.co/DWPOotRHcX (pending DD etc.).

— SBF (@SBF_FTX) November 8, 2022

Solana price at a crucial stage

Solana price set up a head-and-shoulders setup between April 2021 and August 22. This technical formation contains three peaks resembling the shape of a head and two shoulders. This development represents the end of an uptrend and the incoming of a trend reversal.

The 88% target for this setup is obtained by measuring the distance between the head’s highest point and the neckline, which connects the lowest points of the pattern. Interestingly, the volatility in the second week of Novemberpushed Solana price to break below the neckline, leading to a 36% downswing.

From a purely theoretical standpoint, adding the 88% downswing to the breakout point at $32.18 reveals a target of $3.75. However, the $4.42 support level could cut this downswing short.

Going forward, investors can expect a minor bounce that could propel Solana price to $25. This area is a good place to enter another short position with $15.9 as the target. This level is where the volume profile bulges out, suggesting that there are buyers in the area.

A breakdown of $15.9 could result in a steep correction to the final destination at $4.42,

SOLUSDT 1-week chart

While things are looking gloomy for Solana price, the bearish thesis can be invalidated if SOL bulls manage to flip $32.91. This level is the highest volume traded level since April 2020, and a weekly candlestick close above it will resolve the bearish outlook for SOL.

Such a development opens up the bullish path for Solana price to revisit the $47.45 hurdle.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Chainlink

Chainlink  Bitcoin Cash

Bitcoin Cash  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Stacks

Stacks  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Monero

Monero  OKB

OKB  Stellar

Stellar  Maker

Maker  Theta Network

Theta Network  EOS

EOS  Algorand

Algorand  Gate

Gate  NEO

NEO  KuCoin

KuCoin  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Holo

Holo  Zilliqa

Zilliqa  0x Protocol

0x Protocol  Enjin Coin

Enjin Coin  Zcash

Zcash  Ravencoin

Ravencoin  Siacoin

Siacoin  Basic Attention

Basic Attention  Qtum

Qtum  Dash

Dash  Decred

Decred  Ontology

Ontology  Lisk

Lisk  NEM

NEM  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Pax Dollar

Pax Dollar  Status

Status  Waves

Waves  Hive

Hive  Steem

Steem  Huobi

Huobi  BUSD

BUSD  Ren

Ren  OMG Network

OMG Network  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Bitcoin Diamond

Bitcoin Diamond  Energi

Energi  HUSD

HUSD  Augur

Augur