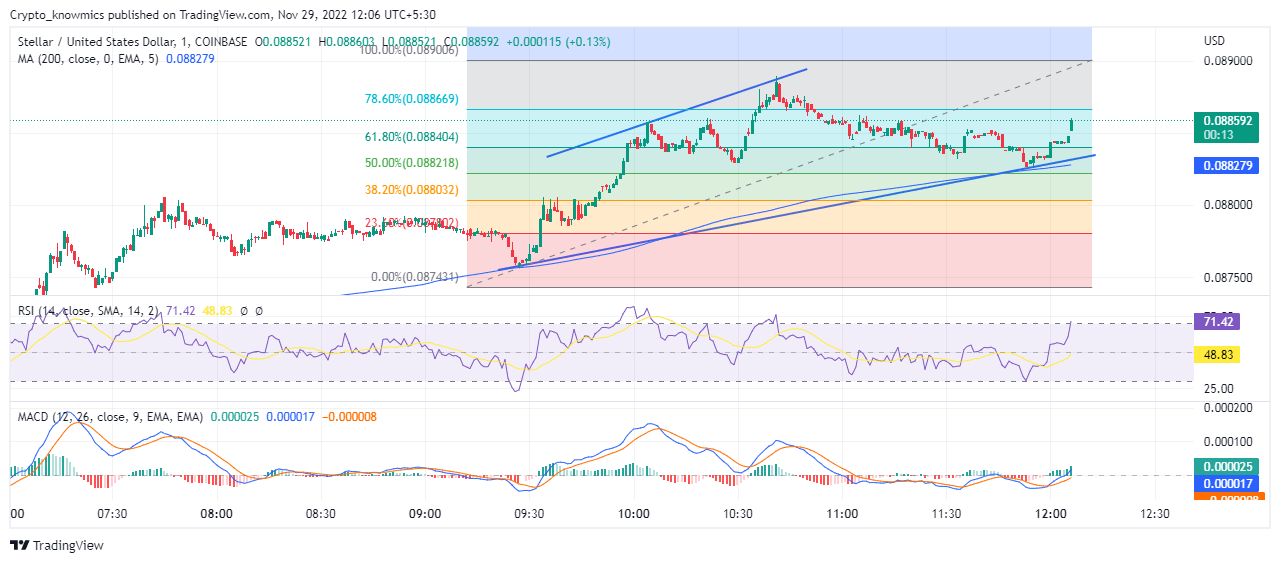

XLM Technical Analysis: Will Stellar Dive Up Back To $0.10?

The XLM technical analysis shows strong bullish momentum in the market as RSI is breaking the overbought zone with prices teasing the $.0.90 mark. Registering a remarkable recovery from a recent market crash, Stellar (XLM) delivered a growth of 4.9% in the last 7 days. A slight rise of 2.68% in the market valuation to $2.25 billion also confirms the underlying bullishness in the market. Despite a drop of 12.60% in 24-hour trading volume to $85.31 million, the token managed to rise by 2.61% over the last 24 hours, with prices recovered from $0.085 to $0.088. The token is again on the uptrend after a recent slash as buyers are finding multiple opportunities.

Key Points

- With multiple low-price rejections, XLM price action shows a bullish trend

- The 200-day EMA moving along the support line confirms the uptrend

- The intraday trading volume in XLM is $85.31 million, reflecting a drop of 12.60%

Source Tradingview

XLM Technical Analysis

As the price action shows the XLM is on an upward trend with exponential demand among buyers. The price line with several higher highs and higher lows is indicative of an upward trend in the market with multiple low-price rejections candles. After a slight recent slash, prices have again pulled back to another bull cycle after facing opposition from 200-day EMA. If the present momentum continues the token will beach above $0.090. Whereas if XLM returns to a bearish reversal falling below $0.086 could not be undermined.

Technical Indicators

Making a bullish divergence, the RSI line steeply breaching the overbought boundary with a 14-day SMA below the mean point projects strong buying pressure in the market. Moreover, the rising gap between fast and slow lines after giving a bullish crossover on an upward-moving histogram shows a bull cycle in the market. The technical indicators show bullish reversal momentum after a recent drop. However, the jump in the overbought zone may witness a slight plunge in demand with opportunities for traders.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  Dai

Dai  LEO Token

LEO Token  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stacks

Stacks  Stellar

Stellar  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  0x Protocol

0x Protocol  Ravencoin

Ravencoin  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  NEM

NEM  Decred

Decred  Zcash

Zcash  Dash

Dash  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bitcoin Diamond

Bitcoin Diamond  Bytom

Bytom  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD  Augur

Augur