XRP Forms Pattern That Once Led to 12% Spike: Crypto Market Review, Nov. 18

The gradual recovery of the cryptocurrency market after the FTX implosion has turned into a prolonged consolidation in which most assets are moving in the neutral price range. But rangebound trading often fuels the growth and appearance of various chart patterns.

Another triangle on XRP

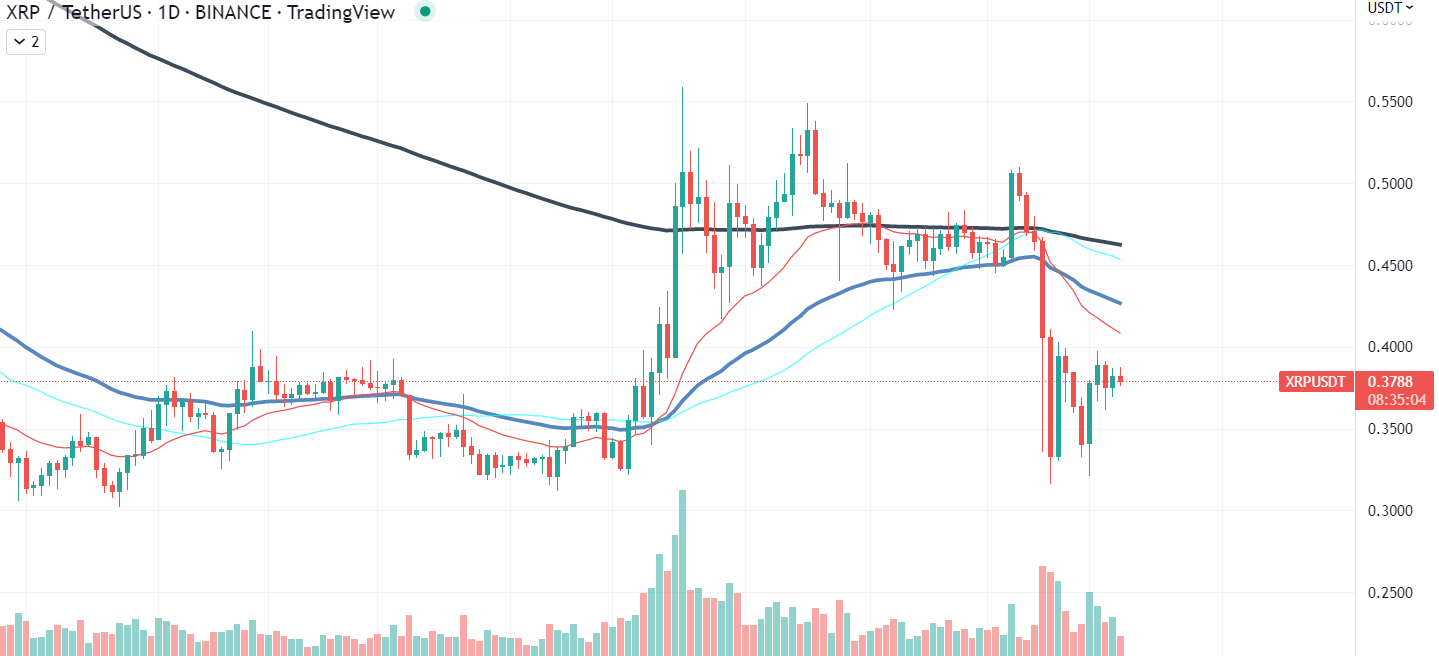

After a failed breakout back on Nov. 4, XRP dropped below the previously formed trading range, hence losing almost all the gains it had back in September and October. With the lack of new growth factors and some success in court, XRP lost most of its traction on the market and returned to the price level we saw prior to the price spike.

Luckily, XRP’s freefall stabilized after the cryptocurrency reached an adequate price level of $0.37. After that, consolidation began. The asset has gained more than 7% to its value after bottoming out at $0.33 and is now forming an ascending triangle pattern that will most likely lead to a volatility spike.

Unfortunately, the chart pattern does not necessarily suggest that XRP will move upward after volatility spikes on the market. Instead of a rally, we might see a continuation of a downtrend, especially if the market falls into an even deeper downtrend.

At the same time, we should note a slowly descending volume, which is a signal of a continuation of consolidation and ranging. If the trading volume returns to pre-pump levels and XRP does not break, movement at around the $0.34 price level would be the most likely scenario.

Ethereum shows lack of momentum

Despite showing the market a significant amount of resilience against massive stress and fear, Ether has not shown us anything exceptional after the dust settled around FTX. Some experts argue the main reason behind it could be fears of investors caused by a potential series of liquidations that will take place after the liquidation processes of numerous hedge funds and institiounal investors emerge.

Jump Crypto, FTX and other companies have been large holders of Ethereum, and they will have no other choice but to liquidate their assets in light of recent events. By dropping hundreds of millions worth of Ethereum on the market, the most likely outcome will be the poor performance of the second biggest asset in the industry.

Despite the rock-solid liquidity of the asset, the lack of inflows to the market will most likely cause a temporary drop in liquidity and local breakdowns until market makers find a way to cover the existing hole in the market.

Thankfully, the deflation of the asset and indefinitely locked Ethereum in staking contracts helps Buterin’s coin to avoid a large part of the selling pressure, and it will most likely continue to move sideways until fresh funds hit the market.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  OKB

OKB  Stacks

Stacks  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Holo

Holo  Ravencoin

Ravencoin  Siacoin

Siacoin  0x Protocol

0x Protocol  Qtum

Qtum  Basic Attention

Basic Attention  Dash

Dash  Zcash

Zcash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Augur

Augur  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Energi

Energi  HUSD

HUSD