XRP Price Prediction: On-Chain Metrics Flash Short-Term Recovery

XRP, the sixth-largest cryptocurrency by market cap has witnessed a sudden spike in social volumes which isn’t new for the 6th ranked token by market cap. However, can XRP chart the much-needed recovery its HODLers long for?

After charting a 55% uptick in the second half of September, XRP was one of the few assets in the top 100 cryptos by market capitalization that managed to end the month in green.

From a price perspective, at press time, XRP noted 1.8% daily losses trading at $0.45. However, on-chain metrics fueled some optimism for XRP HODLers.

Riding on the social wave

XRP’s price has been pretty sensitive to the larger narrative around the coin on social media and news, especially due to the ongoing Ripple vs SEC case which fetches XRP the occasional pump in social volumes.

This time though, XRP’s high social volumes were accompanied by considerably high social mentions as XRP appeared to be trending once more.

Source: Santiment

Apart from high social volumes, an 8.67% uptick in the coin’s trade volumes was further indicative of higher retail interest in the token. XRP’s trade volumes at press time were up to $1.6 billion.

Interestingly, the token had witnessed a sustained increase in trade volumes throughout Sept. In fact, the coin’s trade volumes peaked at $7.80 billion on 23 Sept. charting a one-year high last seen in Sept. 2021.

Old XRP getting activated

XRP’s glorious run above the $0.5 key resistance was met with significant pressure from bears as the token saw a 15% pullback from the higher level oscillating at the $0.4507 level at press time.

XRP/USD | Source: Trading View

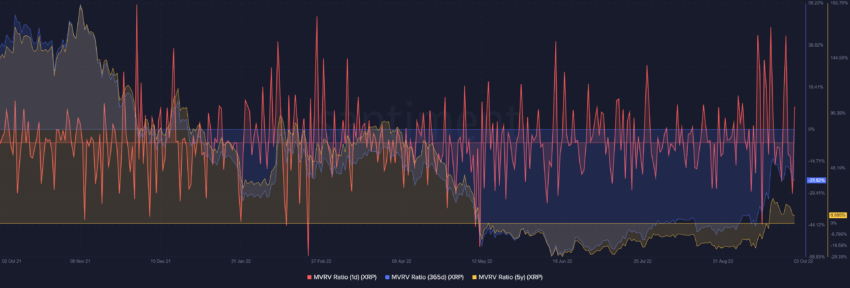

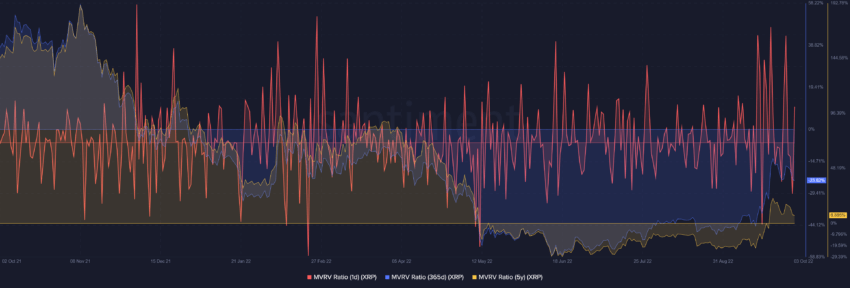

Despite the 4.37% weekly and 1.8% daily losses as well as dwindling RSI, data from Santiment presented that XRP’s long-term MVRV was noting anomalies.

Interestingly, XRP’s short-term MVRV (1-day) noted a sharp uptick while MVRV ratio (365-day) and MVRV ratio (5-year) noted a downtick.

MVRV ratio | Source: Santiment

Lower MVRV values indicate a smaller degree of unrealized profit in the system which could either point towards undervaluation, or poor demand dynamics. At press time, while short-term recovery seemed plausible, on the long-term chart XRP’s demand dynamics were still relatively poor.

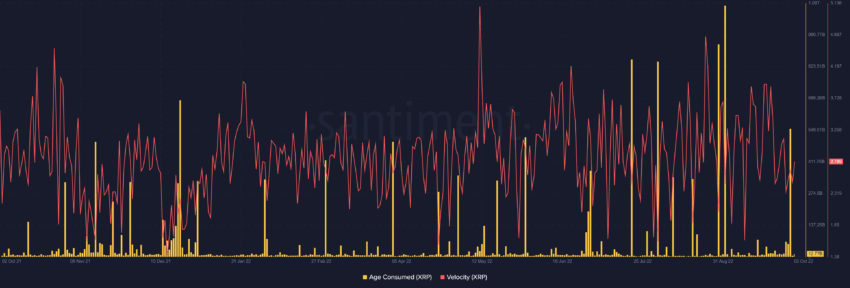

That said, a spike in Age consumed metric, which helps spot mid to long-term price direction reversals saw a major uptick on Oct. 2 highlighting that dormant tokens could be moving with the intention of pushing prices up.

Velocity and Age Consumed | Source: Santiment

Furthermore, with XRP’s velocity picking, it pointed toward a more vibrant network as transactions saw a rise.

While on-chain data for XRP presented some bullish momentum for the coin in the near term an invalidation of the thesis could lead to a pullback to the lower price level at the $0.39 mark from where XRP made a recovery on Sept 21.

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  Dogecoin

Dogecoin  Cardano

Cardano  TRON

TRON  Bitcoin Cash

Bitcoin Cash  Chainlink

Chainlink  Polygon

Polygon  Litecoin

Litecoin  LEO Token

LEO Token  Dai

Dai  Ethereum Classic

Ethereum Classic  Hedera

Hedera  Cosmos Hub

Cosmos Hub  Cronos

Cronos  Stellar

Stellar  Stacks

Stacks  OKB

OKB  Maker

Maker  Monero

Monero  Theta Network

Theta Network  Algorand

Algorand  NEO

NEO  Gate

Gate  KuCoin

KuCoin  EOS

EOS  Tezos

Tezos  Synthetix Network

Synthetix Network  IOTA

IOTA  Bitcoin Gold

Bitcoin Gold  Tether Gold

Tether Gold  TrueUSD

TrueUSD  Zilliqa

Zilliqa  Enjin Coin

Enjin Coin  Ravencoin

Ravencoin  Holo

Holo  0x Protocol

0x Protocol  Siacoin

Siacoin  Qtum

Qtum  Basic Attention

Basic Attention  Zcash

Zcash  Dash

Dash  NEM

NEM  Decred

Decred  Ontology

Ontology  Lisk

Lisk  Waves

Waves  DigiByte

DigiByte  Numeraire

Numeraire  Nano

Nano  Status

Status  Pax Dollar

Pax Dollar  Hive

Hive  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  BUSD

BUSD  Ren

Ren  Bytom

Bytom  Bitcoin Diamond

Bitcoin Diamond  Kyber Network Crystal Legacy

Kyber Network Crystal Legacy  Augur

Augur  Energi

Energi  HUSD

HUSD