XRP Stalls at $0.37, But Is Another Crash Incoming? (Ripple Price Analysis)

Ripple has been experiencing a sideways trend below the stiff resistance for nearly three weeks and has remained range-bound between 0.36$ and $0.39 for the largest part.

Technical Analysis

By Grizzly

The Weekly Chart:

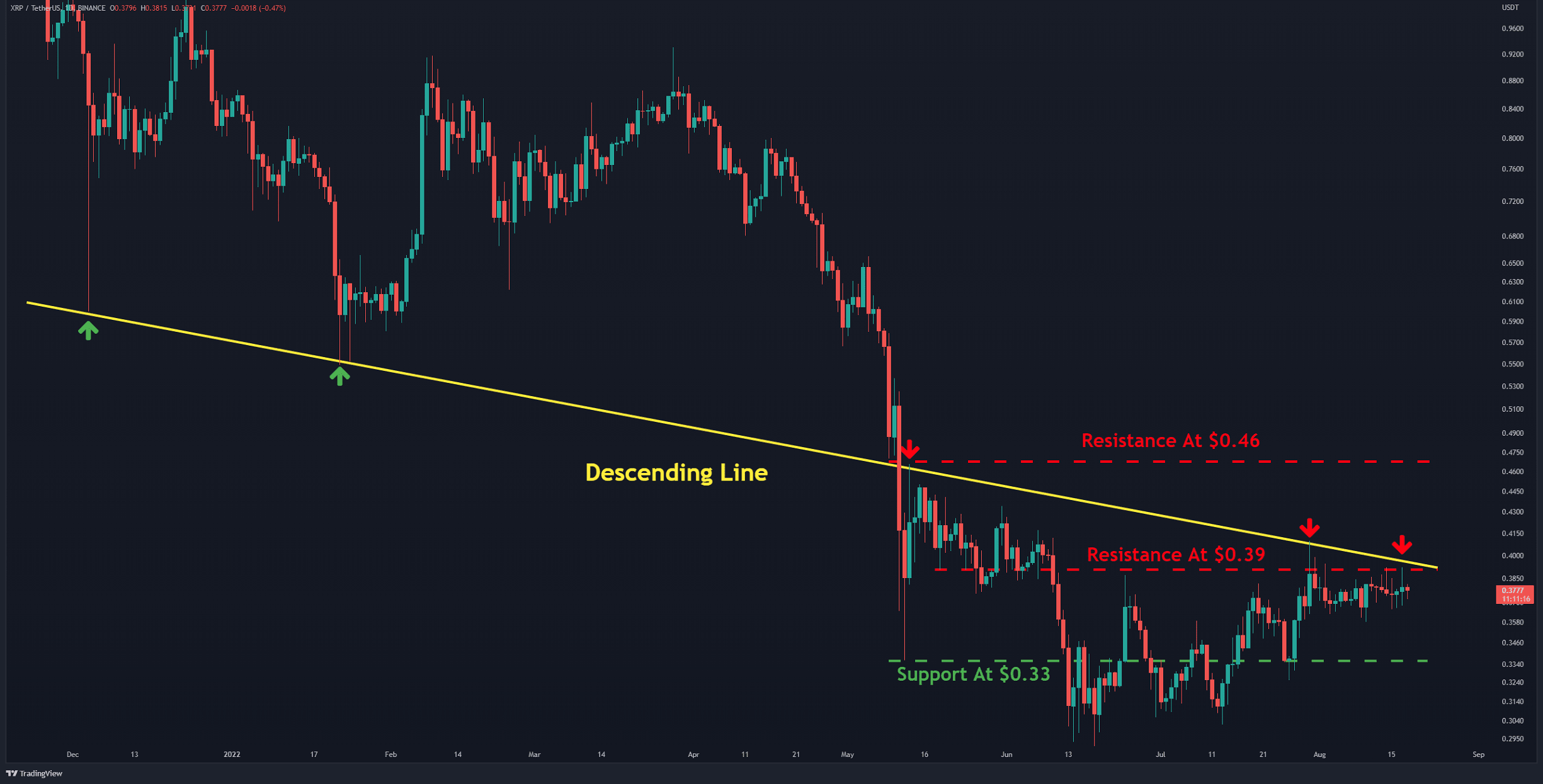

It appears that neither side is able to take assert convincing dominance in the market for XRP. The bulls need to flip the horizontal resistance at $0.39 (in red) to start a rally. The intersection of this resistance with the descending line (in yellow) has created a relatively strong barrier.

Breaking this resistance could result in XRP charging at the subsequent target, which currently lies at $0.46. This would improve the overall structure and put bulls back on track. However, if the bears get the upper hand, the cryptocurrency could revisit the support at $0.33 (in green).

Key Support Levels: $0.33 & $0.28

Key Resistance Levels: $0.39 & $0.46

Daily Moving Averages:

MA20: $0.44

MA50: $0.71

MA100: $0.69

MA200: $0.48

The XRP/BTC Chart:

Against Bitcoin, the price is struggling with descending line resistance (in red) and horizontal resistance at 1700 SATs (in yellow). From the bottom side, the 100-day moving average (in white) acts as a support line. The structure is bearish in the short term as we can see both lower highs and lower lows taking place. A close below 1500 SATs will trigger a corrective wave. On the other hand, if the bulls push XRP above 1,700 SATs, it will probably extend to the next target at 2,000 SATs.

Key Support Levels: 1500 SATs & 1370 SATs

Key Resistance Levels: 1700 SATs & 2100 SATs

Bitcoin

Bitcoin  Ethereum

Ethereum  Tether

Tether  USDC

USDC  TRON

TRON  Dogecoin

Dogecoin  Cardano

Cardano  Bitcoin Cash

Bitcoin Cash  LEO Token

LEO Token  Chainlink

Chainlink  Zcash

Zcash  Monero

Monero  Stellar

Stellar  Litecoin

Litecoin  Hedera

Hedera  Dai

Dai  Cronos

Cronos  OKB

OKB  Tether Gold

Tether Gold  Ethereum Classic

Ethereum Classic  KuCoin

KuCoin  Gate

Gate  Algorand

Algorand  Cosmos Hub

Cosmos Hub  VeChain

VeChain  Tezos

Tezos  Dash

Dash  TrueUSD

TrueUSD  Stacks

Stacks  IOTA

IOTA  Basic Attention

Basic Attention  Decred

Decred  Theta Network

Theta Network  NEO

NEO  Synthetix

Synthetix  Qtum

Qtum  0x Protocol

0x Protocol  Ravencoin

Ravencoin  DigiByte

DigiByte  Nano

Nano  Zilliqa

Zilliqa  Holo

Holo  Siacoin

Siacoin  Numeraire

Numeraire  Waves

Waves  Ontology

Ontology  BUSD

BUSD  Status

Status  Enjin Coin

Enjin Coin  Hive

Hive  Pax Dollar

Pax Dollar  Lisk

Lisk  Steem

Steem  Huobi

Huobi  OMG Network

OMG Network  NEM

NEM  Bitcoin Gold

Bitcoin Gold  Augur

Augur  Bitcoin Diamond

Bitcoin Diamond  HUSD

HUSD